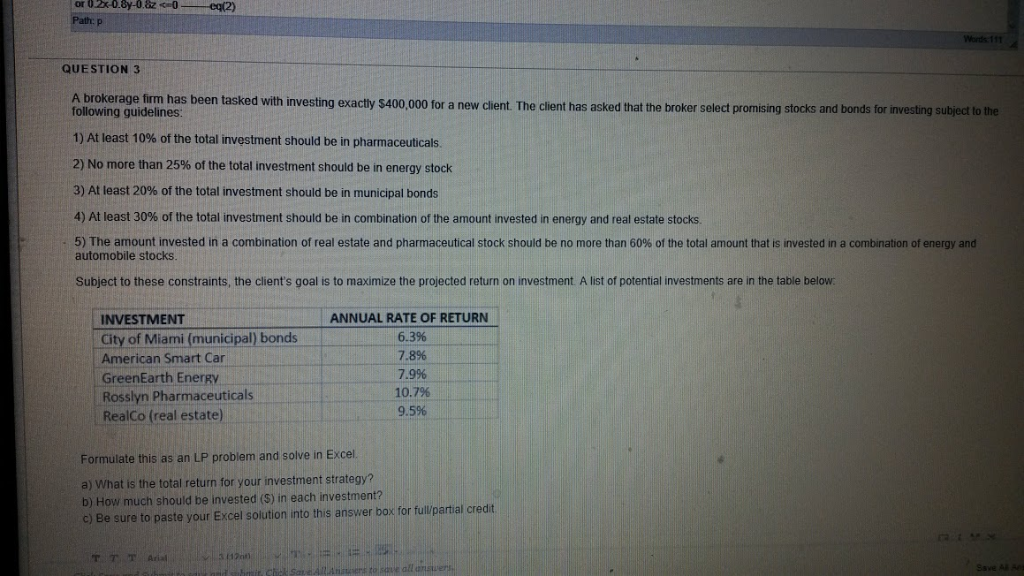

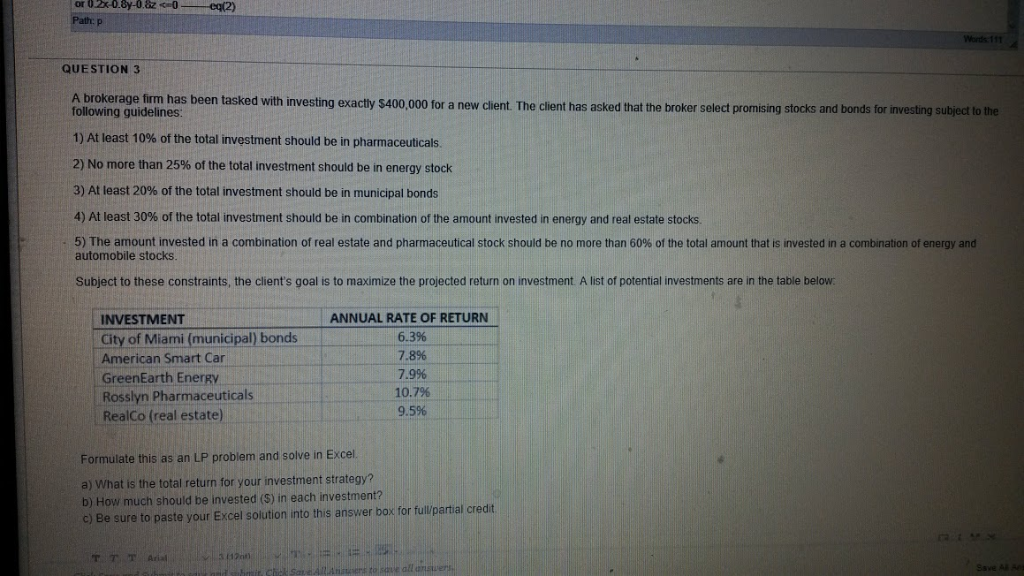

QUESTION 3 okerage firm has been tasked with investing exactly $400,000 for a new client. The client has asked that the broker select promising stocks and bonds for investing subject to the following guidelines: 1) At least 10% of the total investment should be in pharmaceuticals. 2) No more than 25% of the total investment should be in energy stock 3) At least 20% of the total investment should be in municipal bonds 4) At least 30% of the total investment should be in combination of the amount invested in energy and real estate stocks. 5 The amount invested in a combination o real estate and pharmaceutical stock should be no more than 60% o ne total amount that s n este n a combination energy and automobile stocks. Subject to these constraints, the client's goal is to maximize the projected return on investment A list of potential investments are in the table below INVESTMENT City of Miami (municipal) bonds American Smart Car GreenEarth Energy Rosslyn Pharmaceuticals ANNUAL RATE OF RETURN 6.3% 7.8% 7.9% 10.7% 9.5% RealCo (real estate) Formulate this as an LP problem and solve in Excel a) What is the total return for your investment strategy? b) How much should be invested (S) in each investment? c) Be sure to paste your Excel solution into this answer box for full/partial credit QUESTION 3 okerage firm has been tasked with investing exactly $400,000 for a new client. The client has asked that the broker select promising stocks and bonds for investing subject to the following guidelines: 1) At least 10% of the total investment should be in pharmaceuticals. 2) No more than 25% of the total investment should be in energy stock 3) At least 20% of the total investment should be in municipal bonds 4) At least 30% of the total investment should be in combination of the amount invested in energy and real estate stocks. 5 The amount invested in a combination o real estate and pharmaceutical stock should be no more than 60% o ne total amount that s n este n a combination energy and automobile stocks. Subject to these constraints, the client's goal is to maximize the projected return on investment A list of potential investments are in the table below INVESTMENT City of Miami (municipal) bonds American Smart Car GreenEarth Energy Rosslyn Pharmaceuticals ANNUAL RATE OF RETURN 6.3% 7.8% 7.9% 10.7% 9.5% RealCo (real estate) Formulate this as an LP problem and solve in Excel a) What is the total return for your investment strategy? b) How much should be invested (S) in each investment? c) Be sure to paste your Excel solution into this answer box for full/partial credit