Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 On 20 December 2012 G signed a contract to lease three acres of land for 10 years from C. Brown requiring the payment

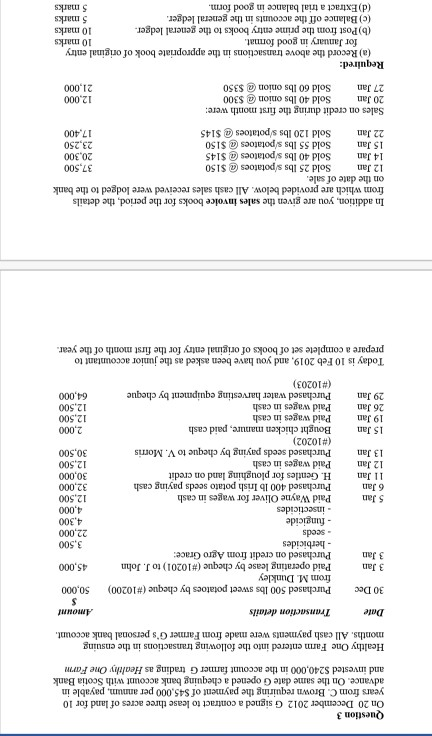

Question 3 On 20 December 2012 G signed a contract to lease three acres of land for 10 years from C. Brown requiring the payment of $45,000 per annum, payable in advance. On the same date G opened a chequing bank account with Scotia Bank and invested S240,000 in the account farmer G trading as Healthy One Farm Healthy One Farm entered into the following transactions in the ensuing months. All cash payments were made from Farmer G's personal bank account Date Transaction details Amount 30 Dec 50,000 45,000 3 Jan 3 Jan 5 Jan 6 Jan 11 Jan 12 Jan 13 Jan Purchased 500 lbs sweet potatoes by cheque (#10200) from M. Dunkley Paid operating lease by cheque (#10201) to J. John Purchased on credit from Agro Grace: - herbicides - seeds - fungicide - insecticides Paid Wayne Oliver for wages in cash Purchased 400 lb Irish potato seeds paying cash H. Gentles for ploughing land on credit Paid wages in cash Purchased seeds paying by cheque to V. Morris (#10202) Bought chicken manure, paid cash Paid wages in cash Paid wages in cash Purchased water harvesting equipment by cheque (#10203) 3,500 22,000 4,300 4,000 12,500 32,000 30,000 12,500 30,500 15 Jan 19 Jan 26 Jan 29 Jan 2,000 12,500 12,500 64,000 Today is 10 Feb 2019, and you have been asked as the junior accountant to prepare a complete set of books of original entry for the first month of the year. In addition, you are given the sales invoice books for the period, the details from which are provided below. All cash sales received were lodged to the bank on the date of sale. 12 Jan Sold 25 lbs s/potatoes @ $150 37,500 14 Jan Sold 40 lbs s/potatoes @ $145 20,300 15 Jan Sold 55 lbs s/potatoes @ $150 23,250 22 Jan Sold 120 lbs s/potatoes @ $145 17.400 Sales on credit during the first month were: 20 Jan Sold 40 lbs onion @ $300 27 Jan Sold 60 lbs onion @ $350 12,000 21,000 Required: (a) Record the above transactions in the appropriate book of original entry for January in good format. 10 marks (b) Post from the prime entry books to the general ledger. 10 marks (c) Balance off the accounts in the general ledger. 5 marks (d) Extract a trial balance in good form. 5 marks Question 3 On 20 December 2012 G signed a contract to lease three acres of land for 10 years from C. Brown requiring the payment of $45,000 per annum, payable in advance. On the same date G opened a chequing bank account with Scotia Bank and invested S240,000 in the account farmer G trading as Healthy One Farm Healthy One Farm entered into the following transactions in the ensuing months. All cash payments were made from Farmer G's personal bank account Date Transaction details Amount 30 Dec 50,000 45,000 3 Jan 3 Jan 5 Jan 6 Jan 11 Jan 12 Jan 13 Jan Purchased 500 lbs sweet potatoes by cheque (#10200) from M. Dunkley Paid operating lease by cheque (#10201) to J. John Purchased on credit from Agro Grace: - herbicides - seeds - fungicide - insecticides Paid Wayne Oliver for wages in cash Purchased 400 lb Irish potato seeds paying cash H. Gentles for ploughing land on credit Paid wages in cash Purchased seeds paying by cheque to V. Morris (#10202) Bought chicken manure, paid cash Paid wages in cash Paid wages in cash Purchased water harvesting equipment by cheque (#10203) 3,500 22,000 4,300 4,000 12,500 32,000 30,000 12,500 30,500 15 Jan 19 Jan 26 Jan 29 Jan 2,000 12,500 12,500 64,000 Today is 10 Feb 2019, and you have been asked as the junior accountant to prepare a complete set of books of original entry for the first month of the year. In addition, you are given the sales invoice books for the period, the details from which are provided below. All cash sales received were lodged to the bank on the date of sale. 12 Jan Sold 25 lbs s/potatoes @ $150 37,500 14 Jan Sold 40 lbs s/potatoes @ $145 20,300 15 Jan Sold 55 lbs s/potatoes @ $150 23,250 22 Jan Sold 120 lbs s/potatoes @ $145 17.400 Sales on credit during the first month were: 20 Jan Sold 40 lbs onion @ $300 27 Jan Sold 60 lbs onion @ $350 12,000 21,000 Required: (a) Record the above transactions in the appropriate book of original entry for January in good format. 10 marks (b) Post from the prime entry books to the general ledger. 10 marks (c) Balance off the accounts in the general ledger. 5 marks (d) Extract a trial balance in good form. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started