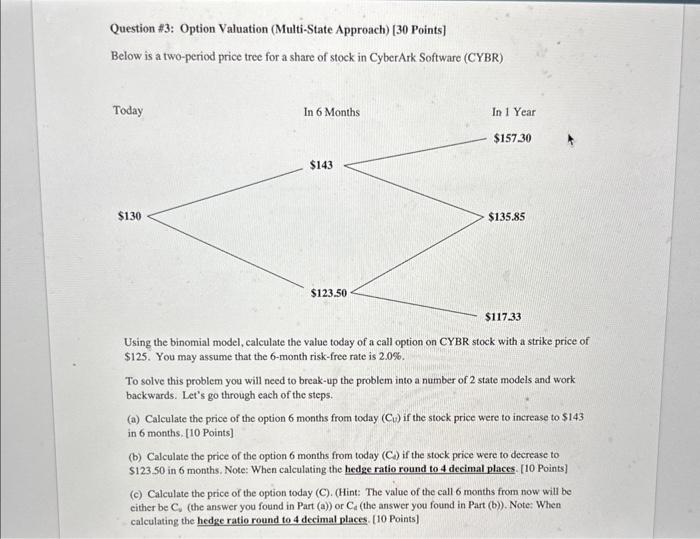

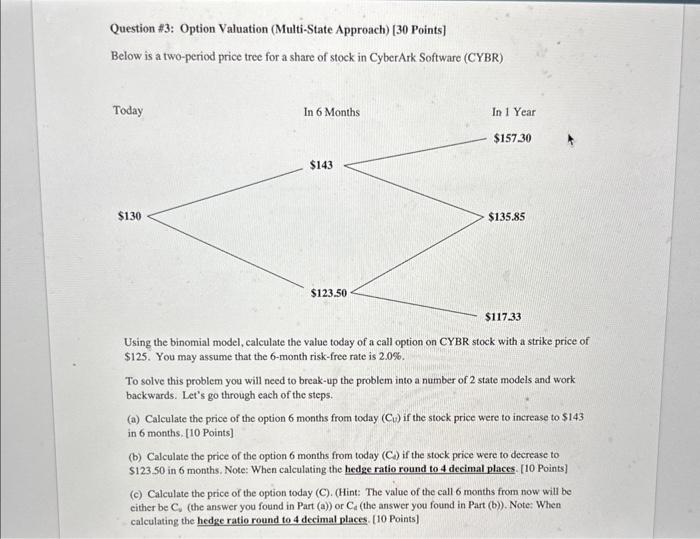

Question \#3: Option Valuation (Multi-State Approach) [30 Points] Below is a two-period price tree for a share of stock in CyberArk Software (CYBR) Using the binomial model, calculate the value today of a call option on CYBR stock with a strike price of $125. You may assume that the 6-month risk-free rate is 2.0%. To solve this problem you will need to break-up the problem into a number of 2 state models and work backwards. Let's go through each of the steps. (a) Calculate the price of the option 6 months from today (Cv) if the stock price were to increase to $143 in 6 months. [10 Points] (b) Calculate the price of the option 6 months from today (C) if the stock price were to decrease to $123.50 in 6 months. Note: When calculating the hedge ratio round to 4 decimal places. [10 Points] (c) Calculate the price of the option today (C). (Hint: The value of the call 6 months from now will be either be C2 (the answer you found in Part (a)) or Ca (the answer you found in Part (b)). Note: When calculating the hedge ratio round to 4 decimal places. [10 Points] Question \#3: Option Valuation (Multi-State Approach) [30 Points] Below is a two-period price tree for a share of stock in CyberArk Software (CYBR) Using the binomial model, calculate the value today of a call option on CYBR stock with a strike price of $125. You may assume that the 6-month risk-free rate is 2.0%. To solve this problem you will need to break-up the problem into a number of 2 state models and work backwards. Let's go through each of the steps. (a) Calculate the price of the option 6 months from today (Cv) if the stock price were to increase to $143 in 6 months. [10 Points] (b) Calculate the price of the option 6 months from today (C) if the stock price were to decrease to $123.50 in 6 months. Note: When calculating the hedge ratio round to 4 decimal places. [10 Points] (c) Calculate the price of the option today (C). (Hint: The value of the call 6 months from now will be either be C2 (the answer you found in Part (a)) or Ca (the answer you found in Part (b)). Note: When calculating the hedge ratio round to 4 decimal places. [10 Points]