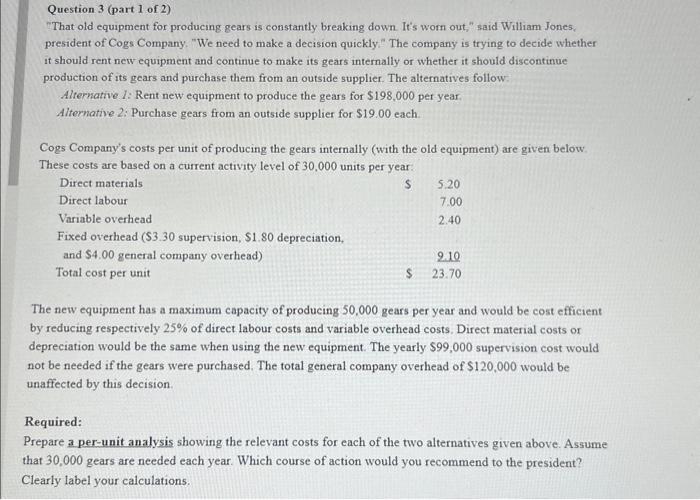

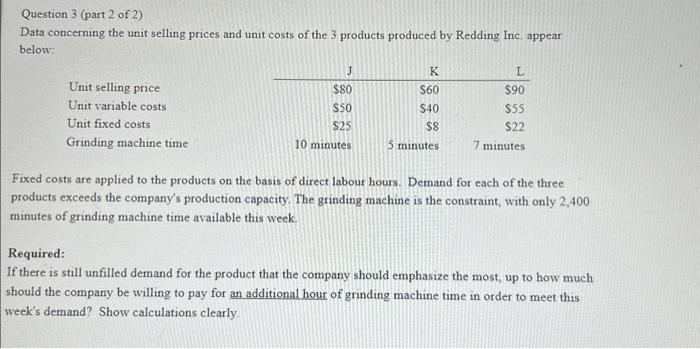

Question 3 (part 1 of 2) \"That old equipment for producing gears is constantly breaking down. It's worn out,\" said William Jones, president of Cogs Company. \"We need to make a decision quickly\" The company is trying to decide whether it should rent new equipment and continue to make its gears internally or whether it should discontinue production of its gears and purchase them from an outside supplier. The alternatives follow: Alternative I: Rent new equipment to produce the gears for \\( \\$ 198,000 \\) per year. Alternative 2: Purchase gears from an outside supplier for \\( \\$ 19.00 \\) each. Cogs Company's costs per unit of producing the gears internally (with the old equipment) are given below These costs are based on a current activity level of 30,000 units per year: The new equipment has a maximum capacity of producing 50,000 gears per year and would be cost efficient by reducing respectively \25 of direct labour costs and variable overhead costs. Direct material costs or depreciation would be the same when using the new equipment. The yearly \\( \\$ 99,000 \\) supervision cost would not be needed if the gears were purchased. The total general company overhead of \\( \\$ 120,000 \\) would be unaffected by this decision. Required: Prepare a per-unit analysis showing the relevant costs for each of the two alternatives given above. Assume that 30,000 gears are needed each year. Which course of action would you recommend to the president? Clearly label your calculations. Question 3 (part 2 of 2 ) Data concerning the unit selling prices and unit costs of the 3 products produced by Redding Inc, appear below: Fixed costs are applied to the products on the basis of direct labour hours. Demand for each of the three products exceeds the company's production capacity. The grinding machine is the constraint, with only 2,400 minutes of grinding machine time available this week. Required: If there is still unfilled demand for the product that the company should emphasize the most, up to how much should the company be willing to pay for an additional hour of grinding machine time in order to meet this week's demand? Show calculations clearly