Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 please the average mark-up percentage on purchases? What is the capital yield to the owner expressed as a percentage? (d) (e) Would the

Question 3 please

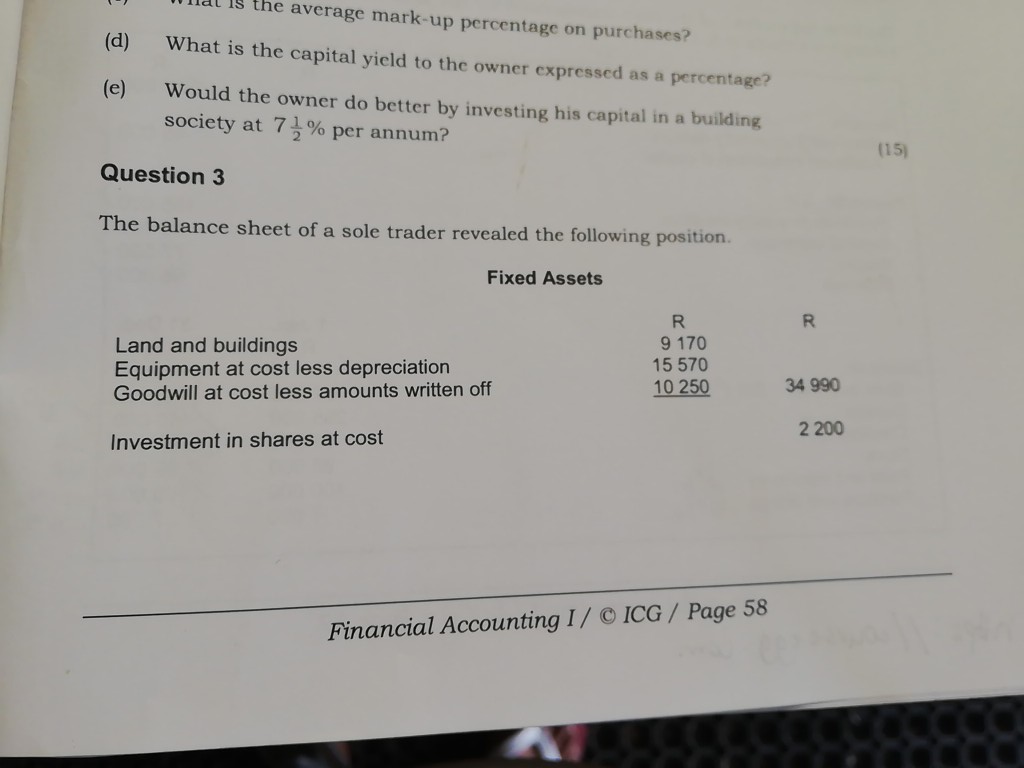

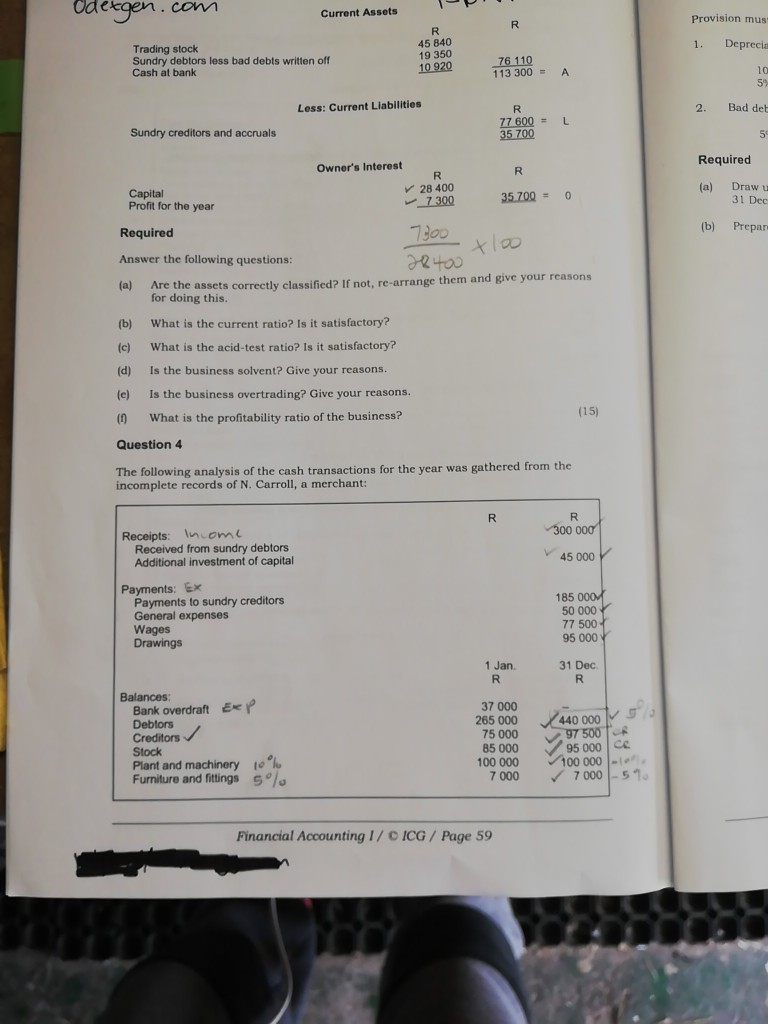

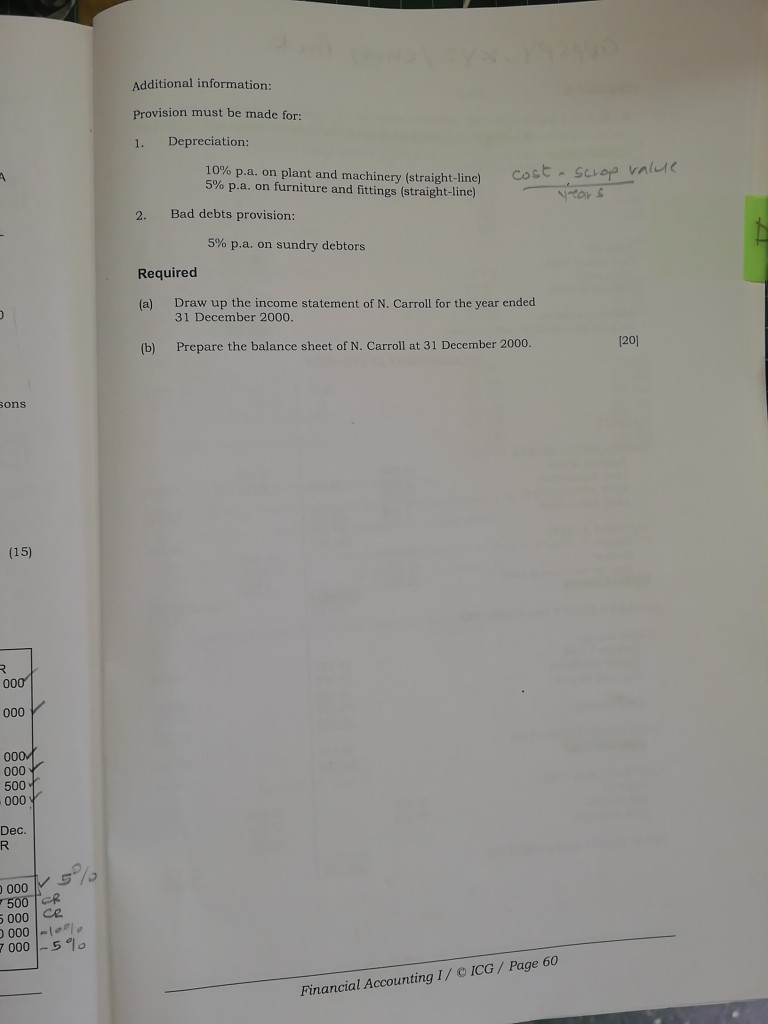

the average mark-up percentage on purchases? What is the capital yield to the owner expressed as a percentage? (d) (e) Would the owner do better by investing his capital in a building society at 72% per annum? (15) Question 3 The balance sheet of a sole trader revealed the following position. Fixed Assets R Land and buildings Equipment at cost less depreciation Goodwill at cost less amounts written off R. 9 170 15 570 10 250 34 990 2 200 Investment in shares at cost Financial Accounting I/ ICG / Page 58 Odexgen.com Current Assets R Provision mus 1. R 45 840 19 350 10.920 Trading stock Sundry debtors less bad debts written off Cash at bank Deprecia 76 110 113 300= A 10 59 Less: Current Liabilities 2. Bad del R 77 600 = 35 700 L Sundry creditors and accruals 5 Required Owner's Interest R R 28 400 7300 (a) Capital 35 700 = 0 Drawu 31 Dec Profit for the year (b) Prepar Required 7300 Answer the following questions: (a) Are the assets correctly classified? If not, re-arrange them and give your reasons for doing this (b) What is the current ratio? Is it satisfactory? (c) What is the acid-test ratio? Is it satisfactory? (d) Is the business solvent? Give your reasons. (e) Is the business overtrading? Give your reasons. (0) What is the profitability ratio of the business? (15) Question 4 The following analysis of the cash transactions for the year was gathered from the incomplete records of N. Carroll, a merchant: R R 300 000 Receipts: income Received from sundry debtors Additional investment of capital 45 000 Payments: Ex Payments to sundry creditors General expenses Wages Drawings 185 0007 50 000 77 500 95 000 1 Jan. R 31 Dec R Balances: Bank overdraft Exp Debtors Creditors Stock Plant and machinery 10% Furniture and fittings sl 37 000 265 000 75 000 85 000 100 000 7 000 440 000 97 500 TL 95 000 e 100 000 - 7000-57 Financial Accounting 1/ CICG/ Page 59 Additional information: Provision must be made for: 1. Depreciation: 10% p.a. on plant and machinery (straight-line) 5% p.a. on furniture and fittings (straight-line) cost scrop value years 2. Bad debts provision: 5% p.a. on sundry debtors Required (a) Draw up the income statement of N. Carroll for the year ended 31 December 2000. (b) [20] Prepare the balance sheet of N. Carroll at 31 December 2000. sons (15) 000 000 000/ 000 500 000 Dec. R . 000 500R 5 000 ce 000 - 7000-50 Financial Accounting / CICG/ Page 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started