Answered step by step

Verified Expert Solution

Question

1 Approved Answer

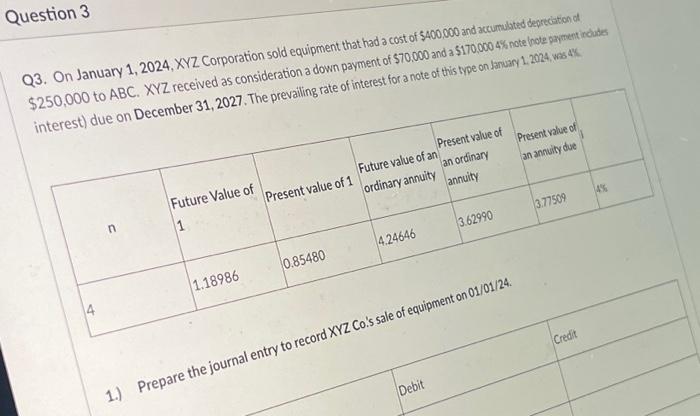

Question 3 Q3. On January 1, 2024, XYZ Corporation sold equipment that had a cost of $400,000 and accumulated depreciation of $250,000 to ABC. XYZ

Question 3 Q3. On January 1, 2024, XYZ Corporation sold equipment that had a cost of $400,000 and accumulated depreciation of $250,000 to ABC. XYZ received as consideration a down payment of $70,000 and a $170,000 4% note (note payment includes interest) due on December 31, 2027. The prevailing rate of interest for a note of this type on January 1, 2024, was 4%. n Future Value of 1 1.18986 Present value of 1 0.85480 Future value of an ordinary annuity 4.24646 Present value of an ordinary annuity Debit 3.62990 Present value of an annuity due 1.) Prepare the journal entry to record XYZ Co.'s sale of equipment on 01/01/24. 3.77509 Credit 4%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started