Answered step by step

Verified Expert Solution

Question

1 Approved Answer

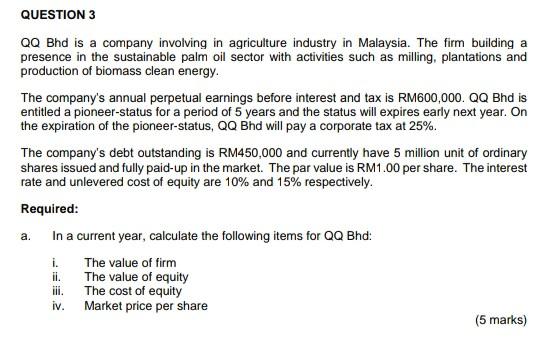

QUESTION 3 QQ Bhd is a company involving in agriculture industry in Malaysia. The firm building a presence in the sustainable palm oil sector with

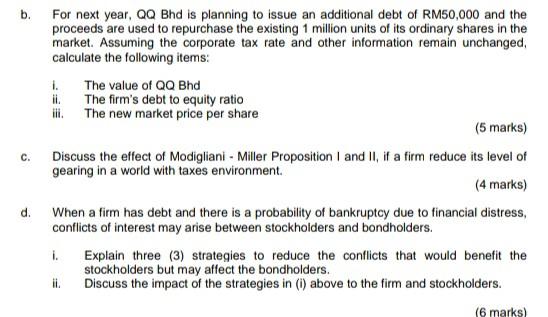

QUESTION 3 QQ Bhd is a company involving in agriculture industry in Malaysia. The firm building a presence in the sustainable palm oil sector with activities such as milling, plantations and production of biomass clean energy. The company's annual perpetual earnings before interest and tax is RM600,000. QQ Bhd is entitled a pioneer-status for a period of 5 years and the status will expires early next year. On the expiration of the pioneer-status, QQ Bhd will pay a corporate tax at 25%. The company's debt outstanding is RM450,000 and currently have 5 million unit of ordinary shares issued and fully paid-up in the market. The par value is RM1.00 per share. The interest rate and unlevered cost of equity are 10% and 15% respectively. Required: In a current year, calculate the following items for QQ Bhd: The value of firm The value of equity iii. The cost of equity Market price per share (5 marks) a. i. ii. iv. b. For next year, QQ Bhd is planning to issue an additional debt of RM50,000 and the proceeds are used to repurchase the existing 1 million units of its ordinary shares in the market. Assuming the corporate tax rate and other information remain unchanged, calculate the following items: i. The value of QQ Bhd The firm's debt to equity ratio ili. The new market price per share (5 marks) Discuss the effect of Modigliani - Miller Proposition I and II, if a firm reduce its level of gearing in a world with taxes environment. (4 marks) When a firm has debt and there is a probability of bankruptcy due to financial distress, conflicts of interest may arise between stockholders and bondholders. i. Explain three (3) strategies to reduce the conflicts that would benefit the stockholders but may affect the bondholders. Discuss the impact of the strategies in (1) above to the firm and stockholders. C. d. (6 marks) QUESTION 3 QQ Bhd is a company involving in agriculture industry in Malaysia. The firm building a presence in the sustainable palm oil sector with activities such as milling, plantations and production of biomass clean energy. The company's annual perpetual earnings before interest and tax is RM600,000. QQ Bhd is entitled a pioneer-status for a period of 5 years and the status will expires early next year. On the expiration of the pioneer-status, QQ Bhd will pay a corporate tax at 25%. The company's debt outstanding is RM450,000 and currently have 5 million unit of ordinary shares issued and fully paid-up in the market. The par value is RM1.00 per share. The interest rate and unlevered cost of equity are 10% and 15% respectively. Required: In a current year, calculate the following items for QQ Bhd: The value of firm The value of equity iii. The cost of equity Market price per share (5 marks) a. i. ii. iv. b. For next year, QQ Bhd is planning to issue an additional debt of RM50,000 and the proceeds are used to repurchase the existing 1 million units of its ordinary shares in the market. Assuming the corporate tax rate and other information remain unchanged, calculate the following items: i. The value of QQ Bhd The firm's debt to equity ratio ili. The new market price per share (5 marks) Discuss the effect of Modigliani - Miller Proposition I and II, if a firm reduce its level of gearing in a world with taxes environment. (4 marks) When a firm has debt and there is a probability of bankruptcy due to financial distress, conflicts of interest may arise between stockholders and bondholders. i. Explain three (3) strategies to reduce the conflicts that would benefit the stockholders but may affect the bondholders. Discuss the impact of the strategies in (1) above to the firm and stockholders. C. d. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started