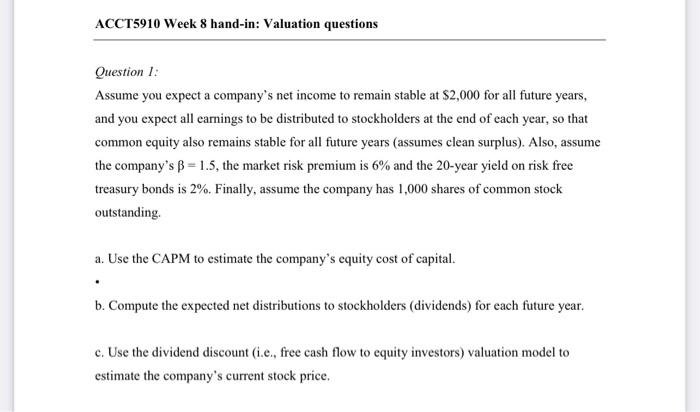

Question

Question 3. Same facts as Q2 above, except the 5% income growth rate (and beginning of year common equity to support it) are only expected

Question 3.

Same facts as Q2 above, except the 5% income growth rate (and beginning of year common equity to support it) are only expected for years 2 and 3. Then growth is expected to be zero and all income is expected to be distributed to shareholders for all future years.

a. Compute the dividend payment for the next three year, and then dividends for all future

vears.

b. Use the dividend discount (i.e., free cash flow to equity investors) valuation model to estimate the companv's current stock price

*this was Q2 "Question 2.

Use the same facts as in Q1 above, but assume you expect the company's income to be $2.000 in the coming year and to grow at the rate of 5% in every subsequent vear into infinity. Also, assume that the company's common equity as of the end of the most recent fiscal year is $12,000, and the investment needed to support the growth in net income causes shareholders' equity to increase by 5% each year. Assume the company is an all-equity firm; i.e., all financing comes from stockholders and none comes for debtholders. In this case, the company's balance sheet has net operating assets (NOA) of $12,000, shareholders' equity of $12,000, and zero net financial obligations (ie zero net debt).

- Compute dividends (or free cash flow to equityholders) for the coming year and the rate of growth in dividends for every year thereafter.

- Use the dividend discount (i.e., free cash flow to equity investors) valuation model to estimate the company's current stock price."

Question 3.

Same facts as Q2 and Q1 in the photos attached, except the 5% income growth rate (and beginning of year common equity to support it) are only expected for years 2 and 3. Then growth is expected to be zero and all income is expected to be distributed to shareholders for all future years.

a. Compute the dividend payment for the next three year, and then dividends for all future

vears.

b. Use the dividend discount (i.e., free cash flow to equity investors) valuation model to estimate the companv's current stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started