Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (Soalan 31 Assume that Tasmir Corporation is considering the establishment of a subsidiary in Norway. The initial investment required by the parent company

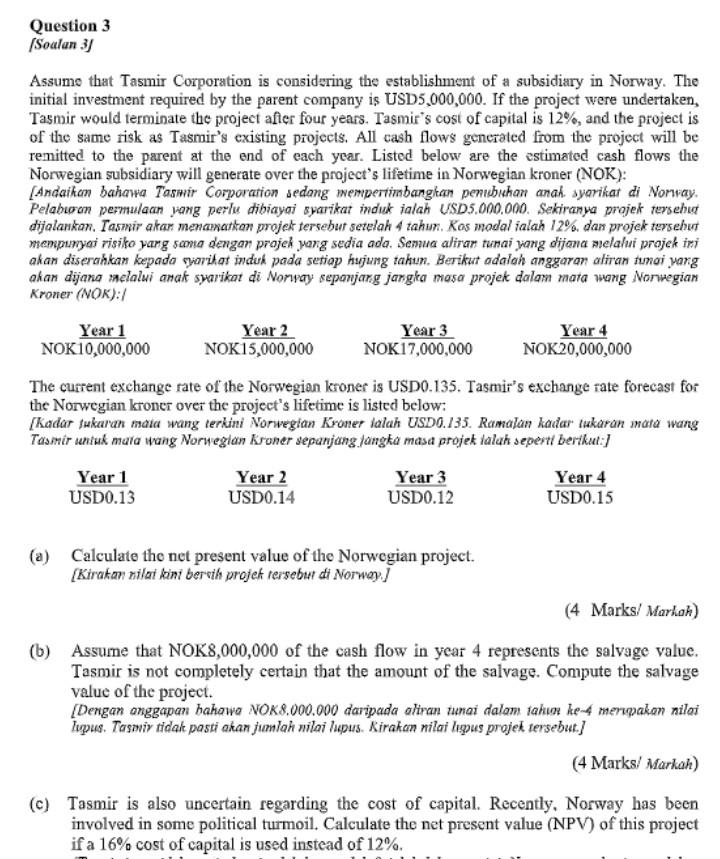

Question 3 (Soalan 31 Assume that Tasmir Corporation is considering the establishment of a subsidiary in Norway. The initial investment required by the parent company is USD5,000,000. If the project were undertaken, Tasmir would terminate the project after four years. Tasmir's cost of capital is 12%, and the project is of the same risk as Tasmir's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK): [Andaikan bahawa Tasmir Corporation sedang mempertimbangkan penubuhan anah syarikat di Norway, Pelaboon permulaan yang perlu dibiayai syarikat induk ialah USD5.000.000. Sekiranya projek tersebut dijalankan. Tas ir akan menamatkan projek tersebut setelah 4 tahun. Kas modal ialah 12% dan projek tersebut mempunyai risiko varg sama dengan projek yang sedia ada. Semua alirar tunai yang dijana melalui projek ini akan diserahkan kepada syarikat induk pada setiap hujung tahun. Berikut adalah anggaran aliran tungi yang akan dijana melalui anak syarikat di Norvay sepanjang jangka masa projek dalam mata wang Norwegian Kroner (NOK): Year 1 Year 2 Year 3 Year 4 NOK10,000,000 NOK15,000,000 NOK17,000,000 NOK20,000,000 The current exchange rate of the Norwegian kroner is USDO.135. Tasmir's exchange rate forecast for the Norwegian kroner over the project's lifetime is listed below: [Kadar fukaran mata wang terkini Norwegian Kroner ialah USDO.135. Ramalan kadar tukaran mata wang Tasmir untuk mata wang Norwegian kroner sepanjang langka masa projek ialah seperti berikut: Year 1 Year 2 Year 3 Year 4 USD0.13 USD0.14 USD0.12 USD0.15 (a) Calculate the net present value of the Norwegian project. {Kirakan nilai kini bersih projek tersebur di Norway) (4 Marks/ Markah) (6) Assume that NOK 8,000,000 of the cash flow in year 4 represents the salvage value. Tasmir is not completely certain that the amount of the salvage. Compute the salvage value of the project. [Dengan anggapan bahawa NOK 8.000.000 daripada aliran tunai dalam tahun ke-4 merupakan nilai lupus. Tasmiy tidak pasti akan jumlah nilai lupus. Kirakan nilai ligus projek tersebut.] (4 Marks/ Markah) c) Tasmir is also uncertain regarding the cost of capital. Recently, Norway has been involved in some political turmoil. Calculate the net present value (NPV) of this project ifa 16% cost of capital is used instead of 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started