Question

QUESTION 3 The following information has been extracted from the financial records of Blue Ltd: 31/3/202 2 31/3/202 1 Current assets: Cash $500 $275 Accounts

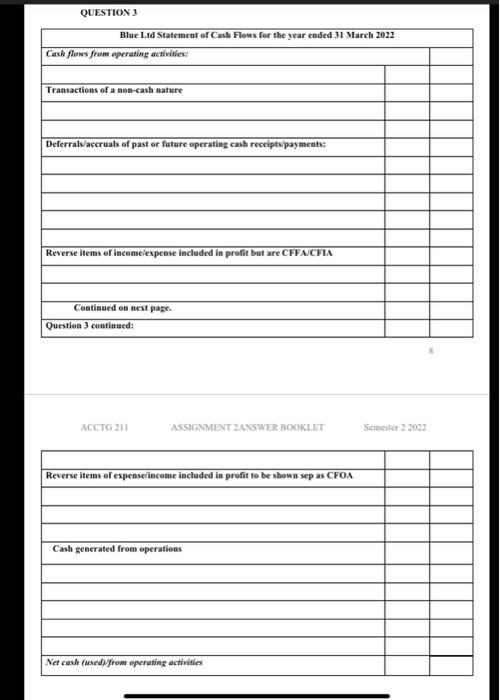

QUESTION 3

The following information has been extracted from the financial records of Blue Ltd:

31/3/2022 | 31/3/2021 | |

Current assets: |

|

|

Cash | $500 | $275 |

Accounts receivable | 5 241 | 5 452 |

Allowance for DD | 250 | 300 |

Inventory | 7 000 | 7 240 |

Current liabilities: |

|

|

Bank overdraft | 110 | 200 |

Accounts payable | 6 342 | 7 992 |

GST payable | 50 | 381 |

Interest expense payable | 10 | 15 |

Dividends payable | 150 | - |

Income tax payable | 40 | 30 |

|

|

|

Retained earnings | 18 950 | 21 750 |

|

|

|

Sales | 69 918 |

|

Cost of goods sold | 40 000 |

|

Operating expenses | 14 591 |

|

Bad debt expense | 150 |

|

Doubtful debt expense | 239 |

|

Interest expense | 206 |

|

Depreciation expense | 3 300 |

|

Loss on sale of plant and equipment | 500 |

|

Interest income | 50 |

|

Dividend income | 32 |

|

Tax expense | 4 000 |

|

Additional information:

1. Blue Ltd uses the indirect method to report cash flows from operating activities.

2. The entity classifies dividend income, interest income, dividends paid and interest paid as operating cash flows.

3. The GST rate is 15%.

Required:

Prepare the Cash flows from operating activities section of the Statement of Cash Flows for Blue Ltd, in accordance with NZ IAS 7 Statement of Cash Flows, for the year ended 31 March 2022.

Answer in this format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started