Answered step by step

Verified Expert Solution

Question

1 Approved Answer

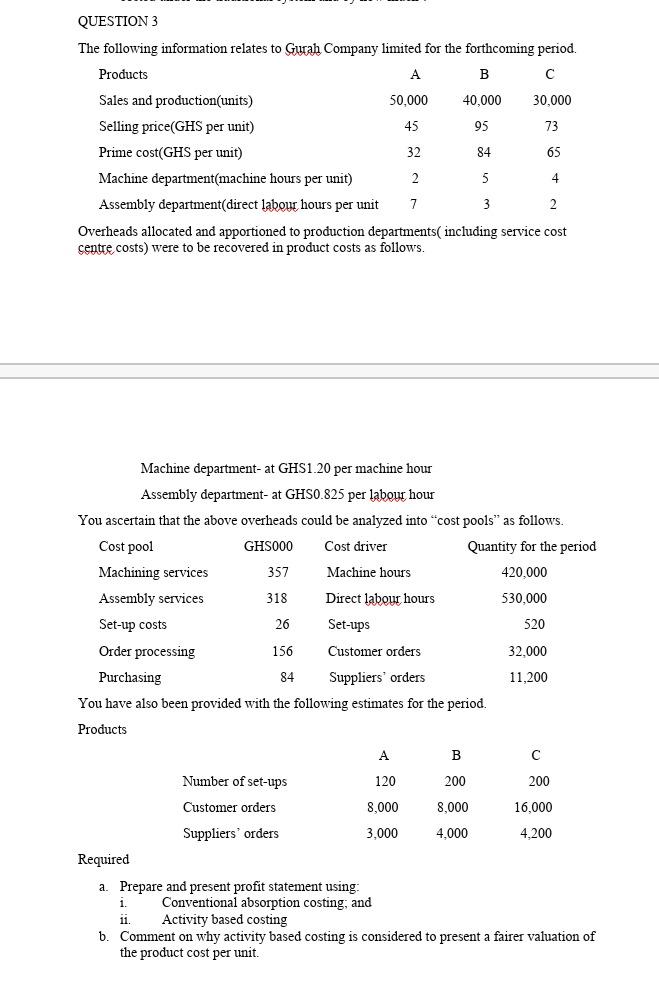

QUESTION 3 The following information relates to Gurah Company limited for the forthcoming period. Products A B Sales and production(units) 50,000 40,000 30,000 Selling price(GHS

QUESTION 3 The following information relates to Gurah Company limited for the forthcoming period. Products A B Sales and production(units) 50,000 40,000 30,000 Selling price(GHS per unit) 45 95 73 Prime cost(GHS per unit) 32 84 65 Machine department(machine hours per unit) 2 5 Assembly department direct labour hours per unit 7 3 2 Overheads allocated and apportioned to production departments including service cost centre costs) were to be recovered in product costs as follows. 4 Machine department at GHS1.20 per machine hour Assembly department- at GHS0.825 per labour hour You ascertain that the above overheads could be analyzed into "cost pools" as follows Cost pool GHS000 Cost driver Quantity for the period Machining services 357 Machine hours 420,000 Assembly services 318 Direct labour hours 530,000 Set-up costs 26 Set-ups 520 Order processing 156 Customer orders 32,000 Purchasing 84 Suppliers' orders 11,200 You have also been provided with the following estimates for the period. Products A B Number of set-ups 120 200 200 Customer orders 8,000 8,000 16,000 Suppliers' orders 3,000 4,000 4,200 Required a. Prepare and present profit statement using 1. Conventional absorption costing; and 11. Activity based costing b. Comment on why activity based costing is considered to present a fairer valuation of the product cost per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started