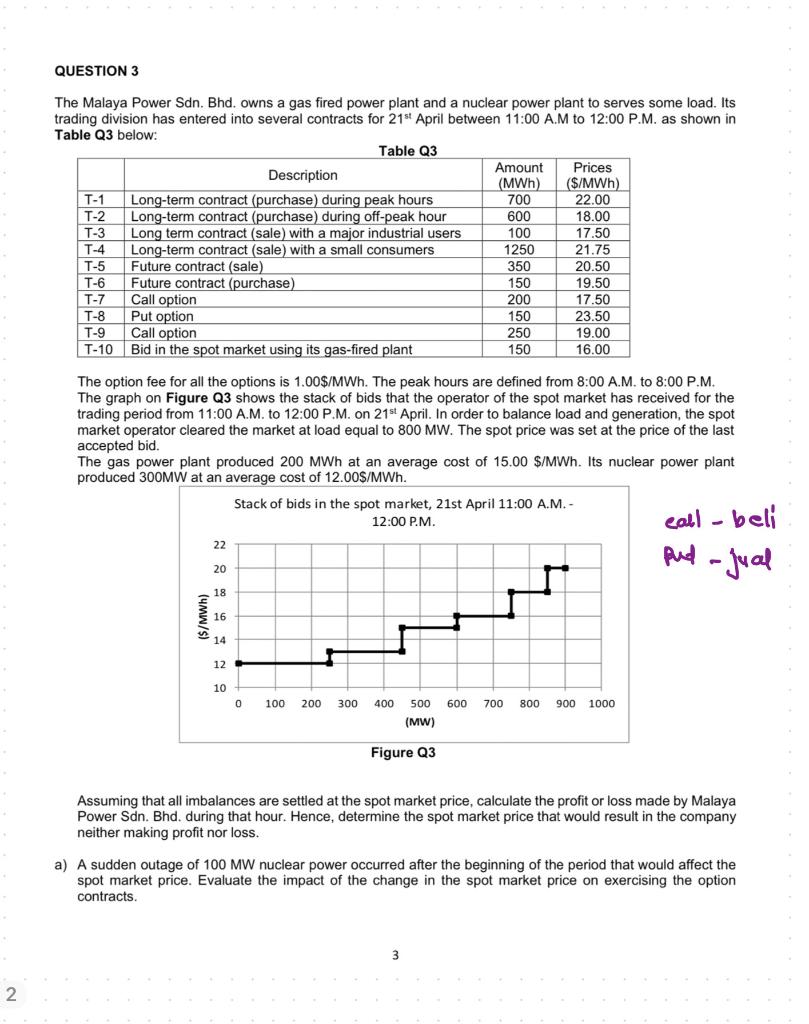

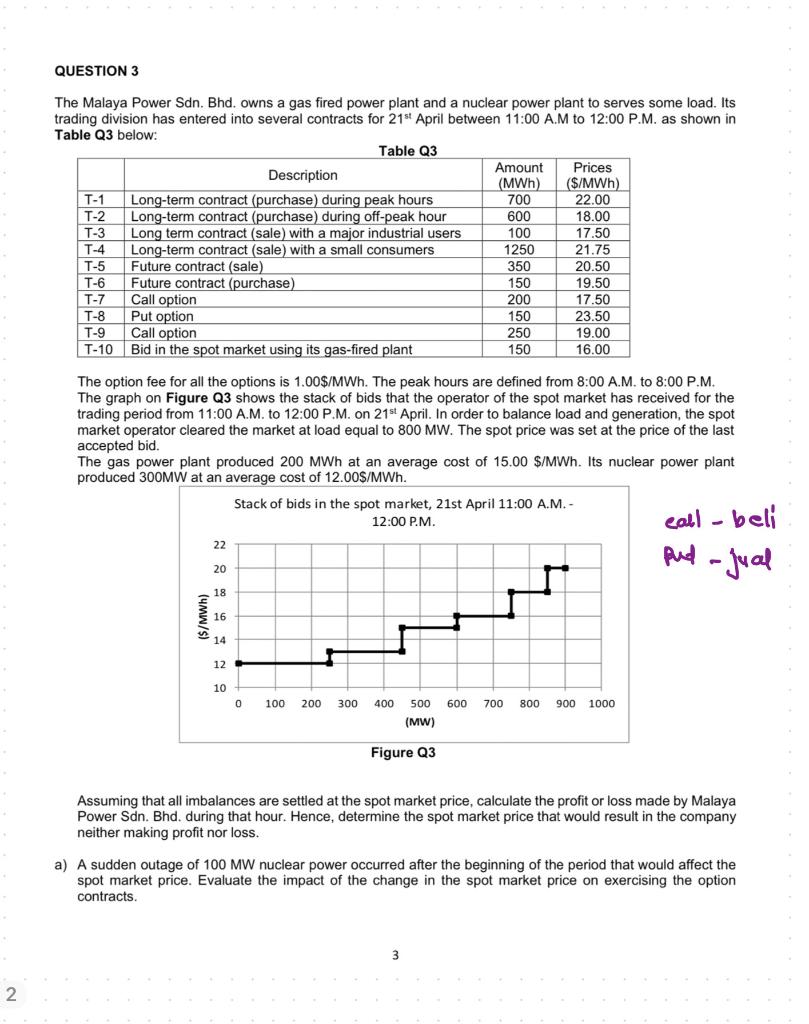

QUESTION 3 The Malaya Power Sdn. Bhd. owns a gas fired power plant and a nuclear power plant to serves some load. Its trading division has entered into several contracts for 21st April between 11:00 A.M to 12:00 P.M. as shown in Table Q3 below: Table Q3 Amount Description Prices (MWh) ($/MWh) T-1 Long-term contract (purchase) during peak hours 700 22.00 T-2 Long-term contract (purchase) during off-peak hour 600 18.00 T-3 Long term contract (sale) with a major industrial users 100 17.50 T-4 Long-term contract (sale with a small consumers 1250 21.75 T-5 Future contract (sale) 350 20.50 T-6 Future contract (purchase) 150 19.50 T-7 Call option 200 17.50 T-8 Put option 150 23.50 T-9 Call option 250 19.00 T-10 Bid in the spot market using its gas-fired plant 150 16.00 The option fee for all the options is 1.00$/MWh. The peak hours are defined from 8:00 A.M. to 8:00 P.M. The graph on Figure Q3 shows the stack of bids that the operator of the spot market has received for the trading period from 11:00 A.M. to 12:00 P.M. on 21st April. In order to balance load and generation, the spot market operator cleared the market at load equal to 800 MW. The spot price was set at the price of the last accepted bid. The gas power plant produced 200 MWh at average cost of 15.00 S/MWh. Its nuclear power plant produced 300MW at an average cost of 12.00$/MWh. Stack of bids in the spot market, 21st April 11:00 A.M. - 12:00 P.M. call- beli 22 pud-jual 20 18 (S/MWh) 16 14 12 10 0 100 200 300 600 700 800 900 1000 400 500 (MW) Figure Q3 Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by Malaya Power Sdn. Bhd. during that hour. Hence, determine the spot market price that would result in the company neither making profit nor loss. a) A sudden outage of 100 MW nuclear power occurred after the beginning of the period that would affect the spot market price. Evaluate the impact of the change in the spot market price on exercising the option contracts. 2. QUESTION 3 The Malaya Power Sdn. Bhd. owns a gas fired power plant and a nuclear power plant to serves some load. Its trading division has entered into several contracts for 21st April between 11:00 A.M to 12:00 P.M. as shown in Table Q3 below: Table Q3 Amount Description Prices (MWh) ($/MWh) T-1 Long-term contract (purchase) during peak hours 700 22.00 T-2 Long-term contract (purchase) during off-peak hour 600 18.00 T-3 Long term contract (sale) with a major industrial users 100 17.50 T-4 Long-term contract (sale with a small consumers 1250 21.75 T-5 Future contract (sale) 350 20.50 T-6 Future contract (purchase) 150 19.50 T-7 Call option 200 17.50 T-8 Put option 150 23.50 T-9 Call option 250 19.00 T-10 Bid in the spot market using its gas-fired plant 150 16.00 The option fee for all the options is 1.00$/MWh. The peak hours are defined from 8:00 A.M. to 8:00 P.M. The graph on Figure Q3 shows the stack of bids that the operator of the spot market has received for the trading period from 11:00 A.M. to 12:00 P.M. on 21st April. In order to balance load and generation, the spot market operator cleared the market at load equal to 800 MW. The spot price was set at the price of the last accepted bid. The gas power plant produced 200 MWh at average cost of 15.00 S/MWh. Its nuclear power plant produced 300MW at an average cost of 12.00$/MWh. Stack of bids in the spot market, 21st April 11:00 A.M. - 12:00 P.M. call- beli 22 pud-jual 20 18 (S/MWh) 16 14 12 10 0 100 200 300 600 700 800 900 1000 400 500 (MW) Figure Q3 Assuming that all imbalances are settled at the spot market price, calculate the profit or loss made by Malaya Power Sdn. Bhd. during that hour. Hence, determine the spot market price that would result in the company neither making profit nor loss. a) A sudden outage of 100 MW nuclear power occurred after the beginning of the period that would affect the spot market price. Evaluate the impact of the change in the spot market price on exercising the option contracts. 2