Question

Question 3 The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200-kilometer, 300 kV

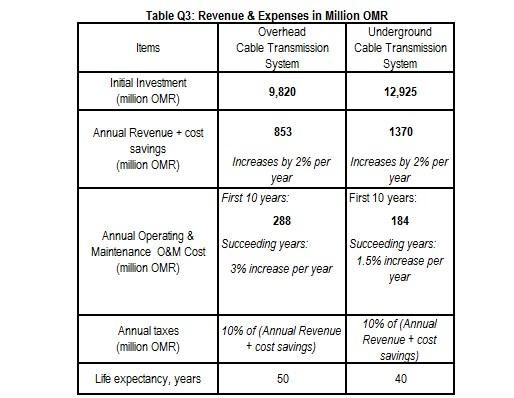

Question 3 The Muscat Electric Company ventures to a new project in the eastern part of the capital city which is a 200-kilometer, 300 kV transmission lines. The company has to choose between which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company cost of capital is 8% per year. Using the following techniques for capilal investment appraisal, perform the following:

Simple Payback Period

Average Rate of Return

Benefit Cost Ratio;

Determine which of the alterative is acceptable to the company based on the above results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started