Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there is nothing to be added this is the question as i have got it in my last class as it is i have post

there is nothing to be added this is the question as i have got it in my last class as it is i have post it as it is so i had no more details these informations are enough i think

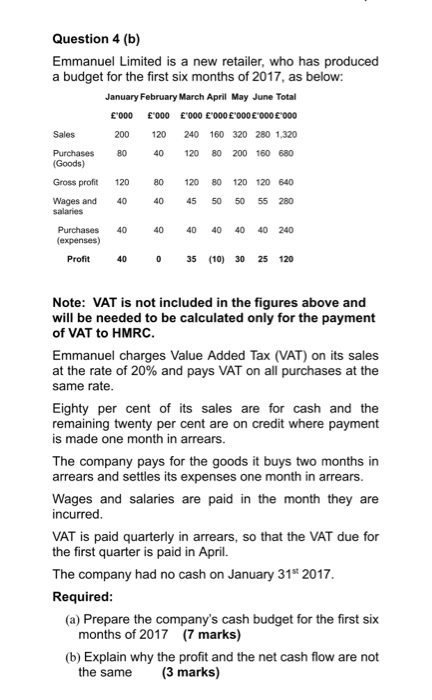

Question 4 (b) Emmanuel Limited is a new retailer, who has produced a budget for the first six months of 2017, as below: January February March April May June Total '000 '000 '000 '000 E'000 E'000 000 Sales 200 120 240 160 320 280 1.320 Purchases 80 680 (Goods) oss profit 120 80 120 80 120 120 540 Wages and 40 40 45 50 50 55 280 40 120 80 200 salaries Purchases (expenses) 40 4 0 40 40 40 40 240 Profit 400 35 (10) 30 25 120 Note: VAT is not included in the figures above and will be needed to be calculated only for the payment of VAT to HMRC. Emmanuel charges Value Added Tax (VAT) on its sales at the rate of 20% and pays VAT on all purchases at the same rate. Eighty per cent of its sales are for cash and the remaining twenty per cent are on credit where payment is made one month in arrears. The company pays for the goods it buys two months in arrears and settles its expenses one month in arrears. Wages and salaries are paid in the month they are incurred. VAT is paid quarterly in arrears, so that the VAT due for the first quarter is paid in April. The company had no cash on January 31 2017. Required: (a) Prepare the company's cash budget for the first six months of 2017 (7 marks) (b) Explain why the profit and the net cash flow are not the same Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started