Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 The principal consultant of Madeolo Consult, Vera Fiador, has requested your assistance in executing an investment appraisal for a firm that has engaged

QUESTION

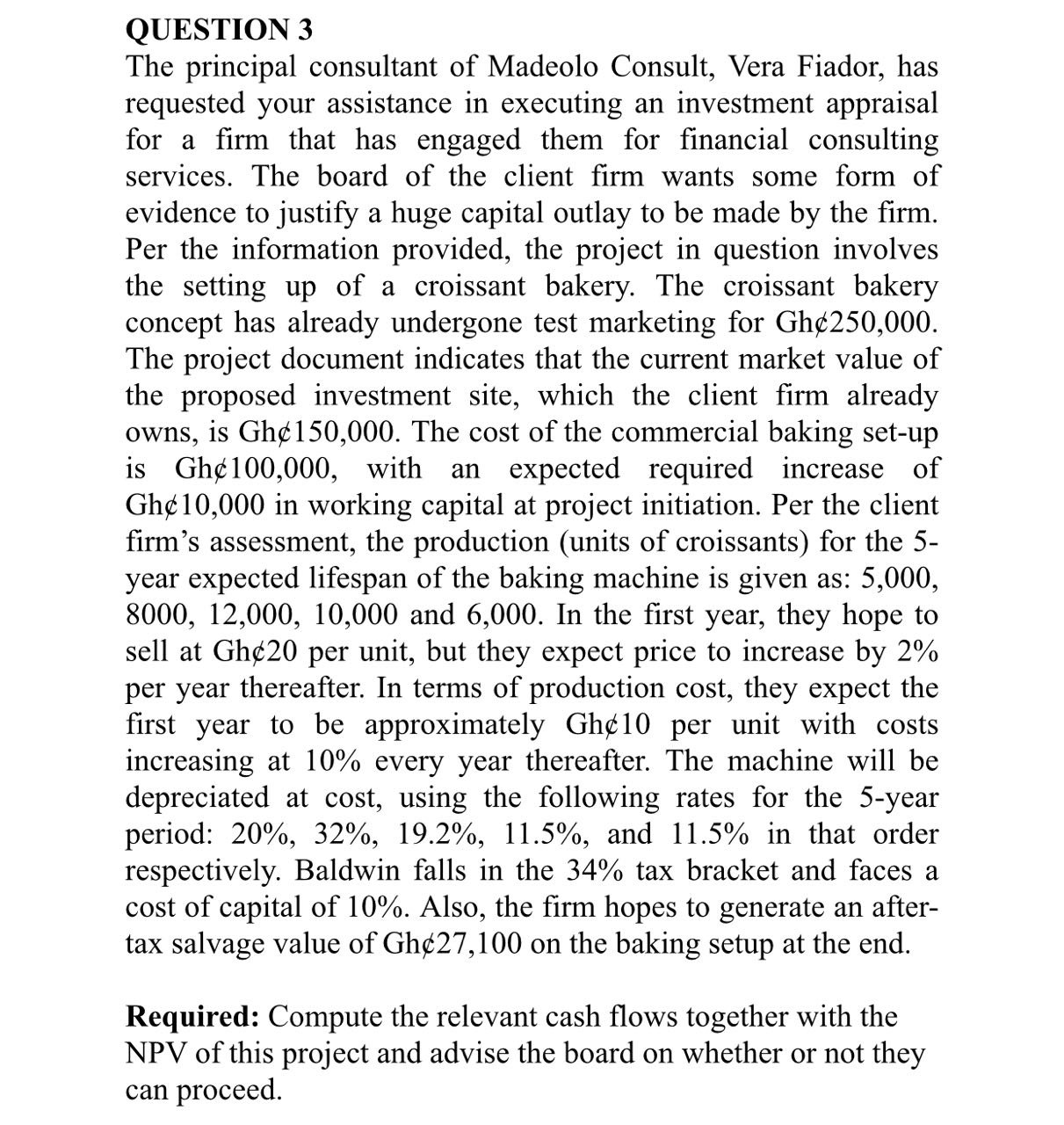

The principal consultant of Madeolo Consult, Vera Fiador, has

requested your assistance in executing an investment appraisal

for a firm that has engaged them for financial consulting

services. The board of the client firm wants some form of

evidence to justify a huge capital outlay to be made by the firm.

Per the information provided, the project in question involves

the setting up of a croissant bakery. The croissant bakery

concept has already undergone test marketing for Gh&

The project document indicates that the current market value of

the proposed investment site, which the client firm already

owns, is Gh The cost of the commercial baking setup

is Ghc with an expected required increase of

Gh& in working capital at project initiation. Per the client

firm's assessment, the production units of croissants for the

year expected lifespan of the baking machine is given as:

and In the first year, they hope to

sell at Gh& per unit, but they expect price to increase by

per year thereafter. In terms of production cost, they expect the

first year to be approximately Gh per unit with costs

increasing at every year thereafter. The machine will be

depreciated at cost using the following rates for the year

period: and in that order

respectively. Baldwin falls in the tax bracket and faces a

cost of capital of Also, the firm hopes to generate an after

tax salvage value of Gh& on the baking setup at the end.

Required: Compute the relevant cash flows together with the

NPV of this project and advise the board on whether or not they

can proceed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started