Answered step by step

Verified Expert Solution

Question

1 Approved Answer

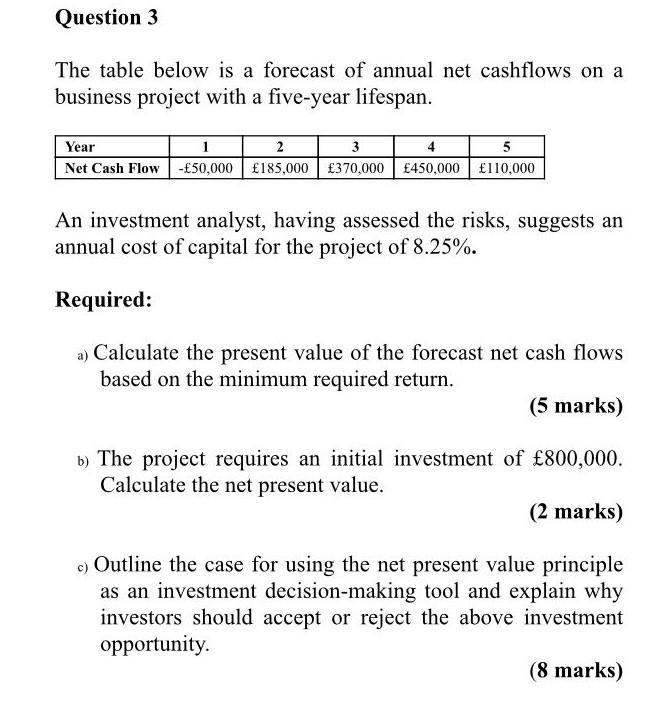

Question 3 The table below is a forecast of annual net cashflows on a business project with a five-year lifespan. Year 2 3 4 5

Question 3 The table below is a forecast of annual net cashflows on a business project with a five-year lifespan. Year 2 3 4 5 Net Cash Flow -50,000 185,000 370,000 450,000 110,000 An investment analyst, having assessed the risks, suggests an annual cost of capital for the project of 8.25%. Required: a) Calculate the present value of the forecast net cash flows based on the minimum required return. (5 marks) b) The project requires an initial investment of 800,000. Calculate the net present value. (2 marks) c) Outline the case for using the net present value principle as an investment decision-making tool and explain why investors should accept or reject the above investment opportunity. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started