Answered step by step

Verified Expert Solution

Question

1 Approved Answer

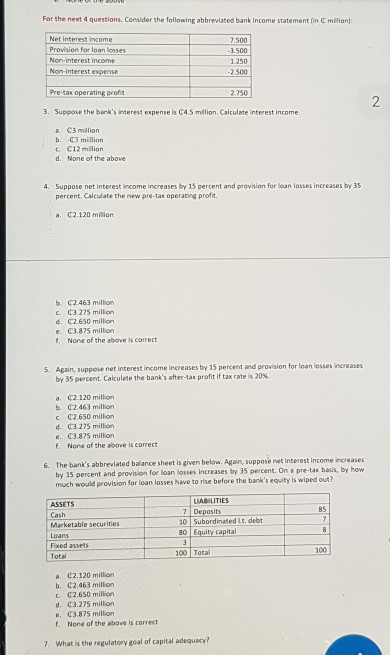

question 3 to 6 For the next questions. Consider the following abbreviated bank income statement in milioni Net interest income Provision for loan losses Non

question 3 to 6

For the next questions. Consider the following abbreviated bank income statement in milioni Net interest income Provision for loan losses Non interest income Non interest experte 7.500 -3.500 1250 -2500 Pre tax operating profit 2.750 2 3. Suppose the bank's interest expense is 04.5 milion Calculate interest income a C3 million b. 3 million 6. C12 milion d. None of the above 4. Suppose net interest income increases by 15 percent and provision for loan losses increases by 35 percent. Calculate the new pre-tax operating profit a 02.120 million b. 02.463 million C 03.275 million d. C2 650 million e. C3.875 million 1. None of the above is correct 5. Again, suppose net interest income increases by 15 percent and provision for loan losses increases by 35 percent. Calculate the bank's after-tax profit if tax rates 20% a. 02. 120 million b. 02.463 million CC2.650 million d. 3.275 million e. (3.875 million f. None of the above is correct 6. The bank's abbreviated balance sheet is given below. Again, suppose net interest income increases by 15 percent and provision for loan losses increases by 35 percent. On a pre-tax basis, by how much would provision for loan losses have to rise before the bank's equity is wiped out? ASSETS Cash Marketable securities Loans Fixed assets Total LIABILITIES 7 Deposits 10 Subordinated Lt. debt 80 Equity capital 3 100Total BS 7 B 100 #. 02.120 million b. C2.463 million c02.650 million d. 13.275 million e 3.875 million f. None of the above is correct 7. What is the regulatory goal of capital adequacyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started