Question

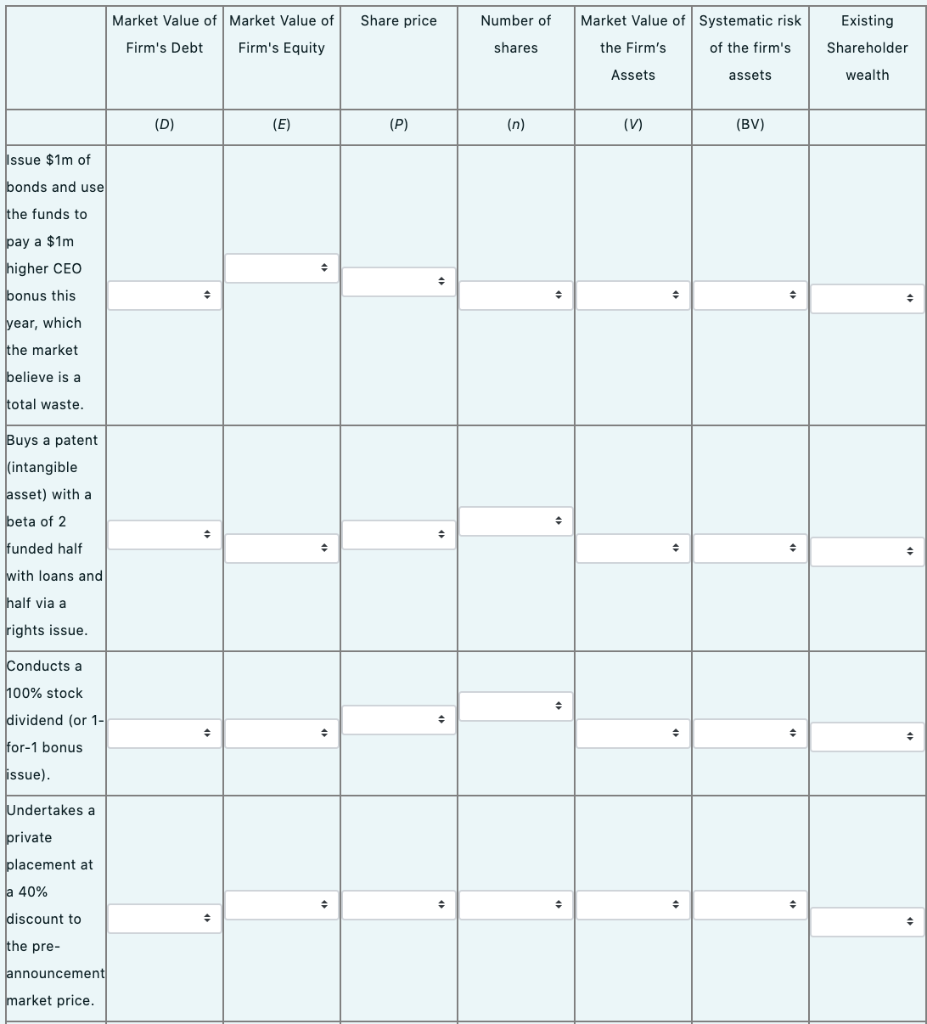

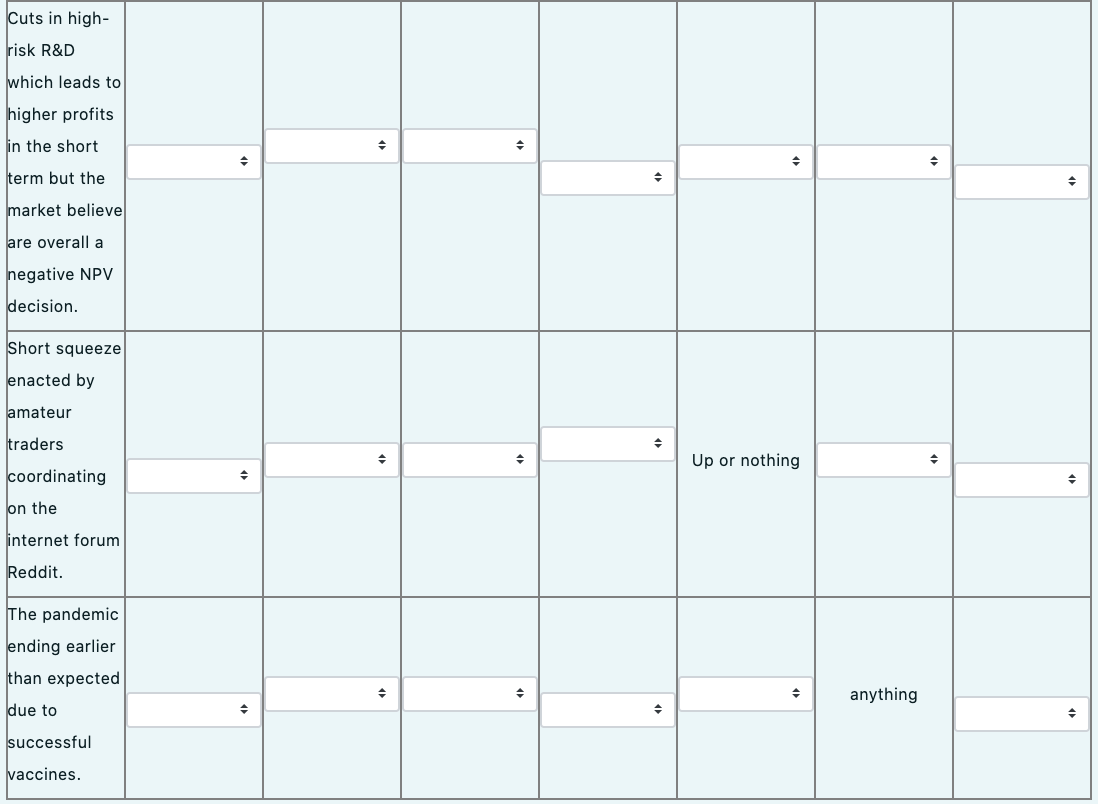

Question 3 (total of 14 marks): For each of the following events, state the effect on the firm's market value of levered equity (E), market

Question 3 (total of 14 marks): For each of the following events, state the effect on the firm's market value of levered equity (E), market value of fixed-coupon debt (D), market value of the firms levered assets (V), systematic risk of the firm's levered assets measured using beta (BV) and existing shareholder wealth.

Important assumptions: The risky firm's levered assets currently have the same systematic risk as the market portfolio, all events happen in isolation and are a surprise, all transactions are done at a fair price, that there are no transaction costs, no asymmetric information (so ignore signalling effects), no change in the credit risk of the firm's debt and no interest tax shields or depreciation tax shields due to the absence of corporate and personal taxes.

Note that there are 7 columns here to answer in this table, you may have to scroll right to see them.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started