Question

Question 31 Bonds for which the owners names are NOT registered with the issuing corporation are called a. Irredeemable bonds b. bearer bonds. c. term

Question 31

Bonds for which the owners names are NOT registered with the issuing corporation are called

a. Irredeemable bonds

b. bearer bonds.

c. term bonds.

d. secured bonds.

Question 32

Hugo Co. issued 100,000 of ten-year, 10% bonds that pay interest semiannually. The bonds are sold to yield 8%. One step in calculating the issue price of the bonds is to multiply the principal by the table value for

a. 20 periods and 4% from the present value of an ordinary annuity of 1 table.

b.20 periods and 5% from the present value of 1 table.

c. 20 periods and 4% from the present value of 1 table.

d. 20 periods and 5% from the present value of an annuity due of 1 table.

Question 33

Under the effective-interest method of bond discount or premium amortization, the periodic interest expense is equal to

A. the coupon rate multiplied by the beginning-of-period carrying amount of the bonds.

b.the market rate multiplied by the beginning-of-period carrying amount of the bonds.

c. the coupon (nominal) rate of interest multiplied by the face value of the bonds.

D. the market rate of interest multiplied by the face value of the bonds.

Question 34

In a debt extinguishment in which the debt is settled by a transfer of assets with a fair value more than the carrying amount of the debt, the debtor would recognize

A. no gain or loss on the settlement.

b. a gain on the settlement.

c. a loss on the settlement.

D. None of these answer choices are correct.

Question 35

If bonds are issued between interest dates, the entry on the books of the issuing corporation could include a

a. credit to Interest Payable.

b. debit to Interest Receivable.

c.debit to Interest Expenses.

d. credit to Interest Expense.

Question 36

Many companies believe that off-balance-sheet financing

a.is attempting to conceal the debt from shareholders by having no information about the debt included in the statement of financial position.

b.wishes to confine all information related to the debt to the income statement and the statement of cash flows.

c.is acceptable under current IFRS.

d.can enhance the quality of its financial position and perhaps permit credit to be obtained more readily and at less cost.

Question 37

Lawman Company issues 10,000,000 of 10-year, 9% bonds on March 1, 2021 at 97 plus accrued interest. The bonds are dated January 1, 2021, and pay interest on June 30 and December 31. What is the total cash received on the issue date?

A. 9,700,000 B. 9,850,000 C. 10,225,000 D. 9,550,000

Question 38

Edith Corporation retires its 100,000 face value of loan notes (bonds) at 106 on January 1, following the payment of interest. The carrying value of the bonds at the redemption date is 102,658. The entry to record the redemption will include a

a. credit of 2,658 to Loss on Extinguishment of Debt.

b.credit of 3,342 to Gain on Extinguishment of Debt.

c.debit of 2,658 to Bonds Payable.

d.debit of 102,658 to Bonds Payable.

Question 39

A. $3,730,000. B. $3,700,000. C. $3,900,000. D. $3,930,000.

Question 40

A company issues 20,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2020. Interest is paid on June 30 and December 31. The proceeds from the bonds are 19,604,145. Using effective-interest amortization, what will the carrying value of the bonds be on the December 31, 2020 statement of financial position?

A. 20,000,000 B. 19,625,125 C. 19,608,310 D. 19,612,643

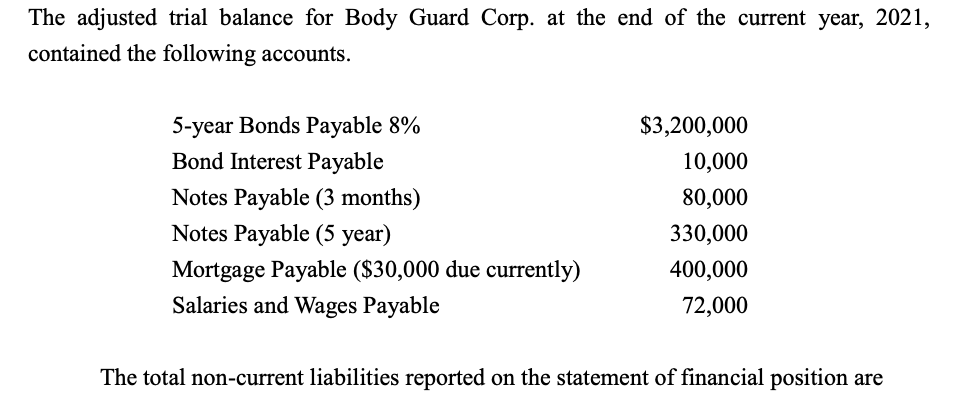

The adjusted trial balance for Body Guard Corp. at the end of the current year, 2021, contained the following accounts. 5-year Bonds Payable 8% Bond Interest Payable Notes Payable (3 months) Notes Payable (5 year) Mortgage Payable ($30,000 due currently) Salaries and Wages Payable $3,200,000 10,000 80,000 330,000 400,000 72,000 The total non-current liabilities reported on the statement of financial position areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started