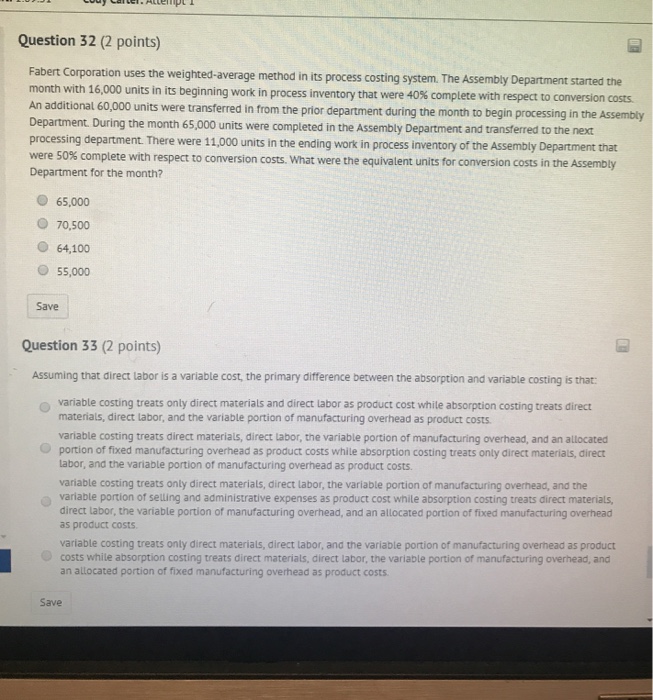

Question 32 (2 points) Fabert Corporation uses the weighted-average method in its process costing system. The Assembly Department started the month with 16,000 units in its beginning work in process inventory that were 40% complete with respect to conversion costs An additional 60,000 units were transferred in from the prior department during the month to begin processing in the Assembly Department. During the month 65,000 units were completed in the Assembly Department and transferred to the next processing department. There were 11,000 units in the ending work in process inventory of the Assembly Department that were 50% complete with respect to conversion costs. What were the equivalent units for conversion costs in the Assembly Department for the month? O 65,000 O 70,500 O 64,100 55,000 Save Question 33 (2 points) Assuming that direct labor is a variable cost, the primary difference between the absorption and variable costing is that: variable costing treats only direct materials and direct labor as product cost while absorption costing treats direct materials, direct labor, and the variable portion of manufacturing overhead as product costs variable costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs while absorption costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs. O variable costing treats only direct materials, direct labor, the variable portion of manufacturing overhead, and the variable portion of selling and administrative expenses as product cost while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costS o variable costing treats only direct materials, direct labor, and the variable portion of manufacturing overhead as product costs while absorption costing treats direct materials, direct labor, the variable portion of manufacturing overhead, and an allocated portion of fixed manufacturing overhead as product costs Save