Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 33 (1 point) John purchased a permanent life insurance policy for his grandson, Richard, when Richard was born 28 years ago. This policy has

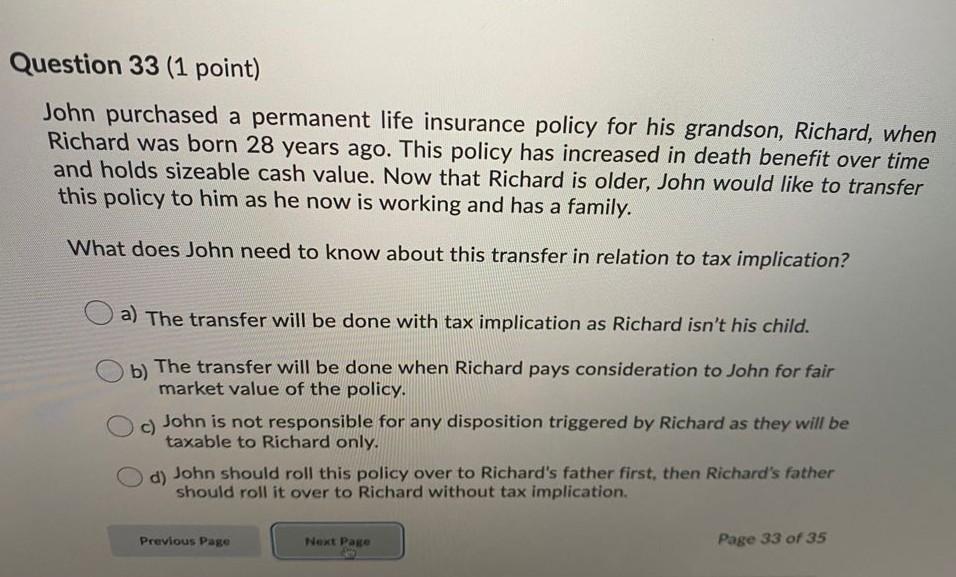

Question 33 (1 point) John purchased a permanent life insurance policy for his grandson, Richard, when Richard was born 28 years ago. This policy has increased in death benefit over time and holds sizeable cash value. Now that Richard is older, John would like to transfer this policy to him as he now is working and has a family. What does John need to know about this transfer in relation to tax implication? a) The transfer will be done with tax implication as Richard isn't his child. b) The transfer will be done when Richard pays consideration to John for fair market value of the policy. John is not responsible for any disposition triggered by Richard as they will be taxable to Richard only. d) John should roll this policy over to Richard's father first, then Richard's father should roll it over to Richard without tax implication. Previous Page Next Page Page 33 of 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started