Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 37 30 marks Jess Hnat, aged 51, lived in Szczecin, Poland. She arrived in Melbourne with her family on the 1 July 2021

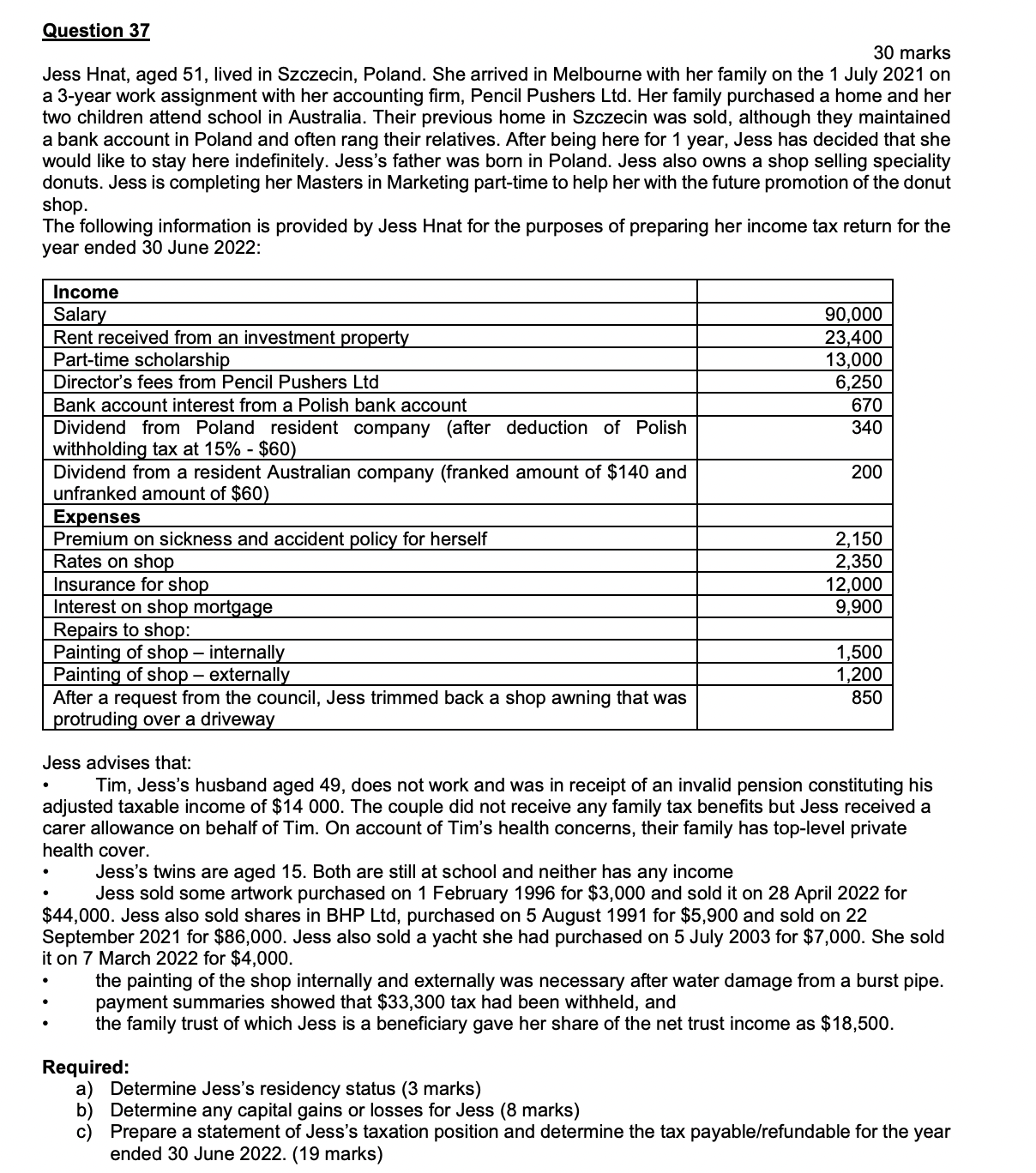

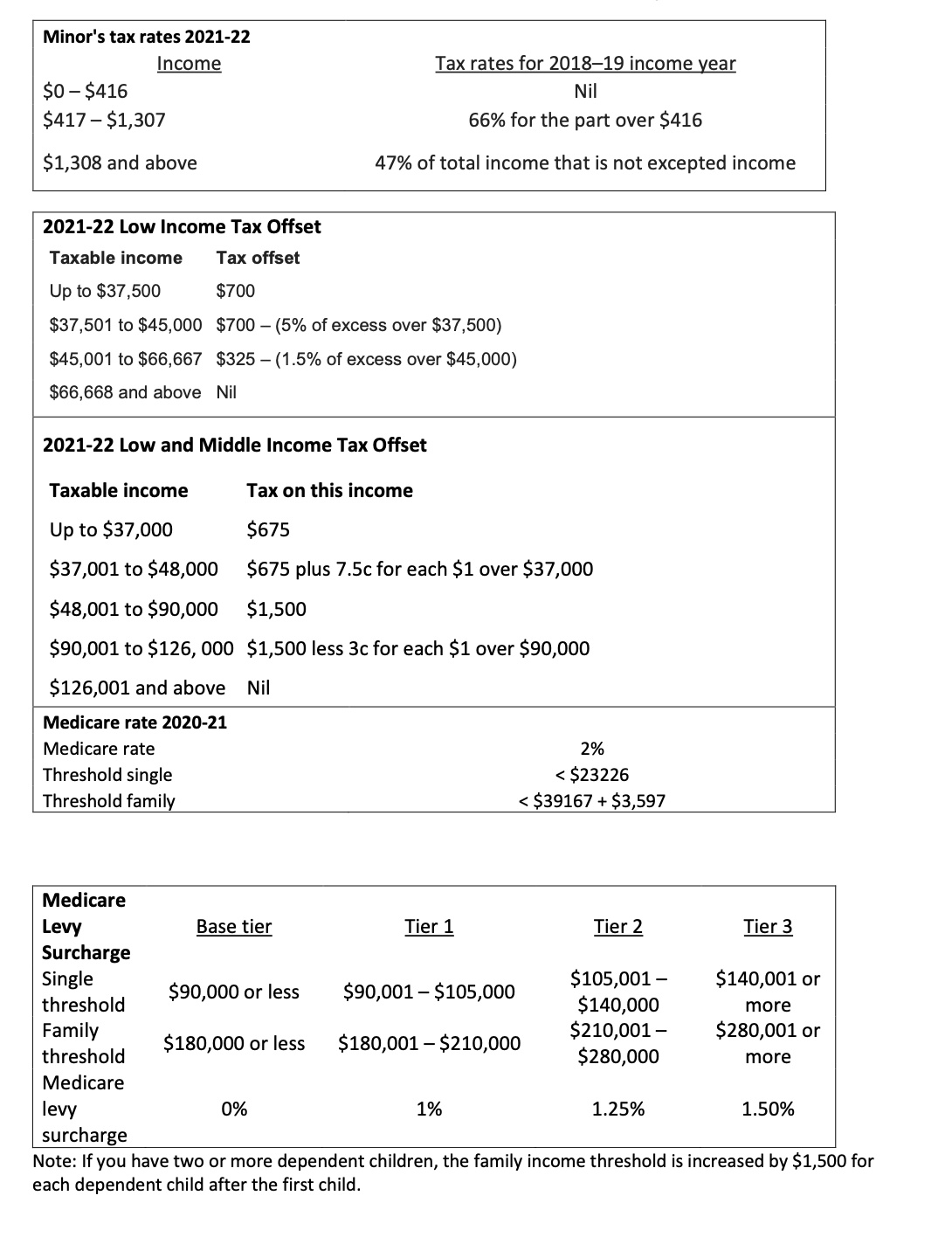

Question 37 30 marks Jess Hnat, aged 51, lived in Szczecin, Poland. She arrived in Melbourne with her family on the 1 July 2021 on a 3-year work assignment with her accounting firm, Pencil Pushers Ltd. Her family purchased a home and her two children attend school in Australia. Their previous home in Szczecin was sold, although they maintained a bank account in Poland and often rang their relatives. After being here for 1 year, Jess has decided that she would like to stay here indefinitely. Jess's father was born in Poland. Jess also owns a shop selling speciality donuts. Jess is completing her Masters in Marketing part-time to help her with the future promotion of the donut shop. The following information is provided by Jess Hnat for the purposes of preparing her income tax return for the year ended 30 June 2022: Income Salary Rent received from an investment property Part-time scholarship 90,000 23,400 13,000 Director's fees from Pencil Pushers Ltd Bank account interest from a Polish bank account 6,250 670 Dividend from Poland resident company (after deduction of Polish withholding tax at 15% - $60) 340 Dividend from a resident Australian company (franked amount of $140 and unfranked amount of $60) 200 Expenses Premium on sickness and accident policy for herself Rates on shop Insurance for shop Interest on shop mortgage Repairs to shop: Painting of shop - internally 2,150 2,350 12,000 9,900 1,500 1,200 850 Painting of shop - externally After a request from the council, Jess trimmed back a shop awning that was protruding over a driveway Jess advises that: Tim, Jess's husband aged 49, does not work and was in receipt of an invalid pension constituting his adjusted taxable income of $14 000. The couple did not receive any family tax benefits but Jess received a carer allowance on behalf of Tim. On account of Tim's health concerns, their family has top-level private health cover. : Jess's twins are aged 15. Both are still at school and neither has any income Jess sold some artwork purchased on 1 February 1996 for $3,000 and sold it on 28 April 2022 for $44,000. Jess also sold shares in BHP Ltd, purchased on 5 August 1991 for $5,900 and sold on 22 September 2021 for $86,000. Jess also sold a yacht she had purchased on 5 July 2003 for $7,000. She sold it on 7 March 2022 for $4,000. the painting of the shop internally and externally was necessary after water damage from a burst pipe. payment summaries showed that $33,300 tax had been withheld, and the family trust of which Jess is a beneficiary gave her share of the net trust income as $18,500. Required: a) Determine Jess's residency status (3 marks) b) Determine any capital gains or losses for Jess (8 marks) c) Prepare a statement of Jess's taxation position and determine the tax payable/refundable for the year ended 30 June 2022. (19 marks) Minor's tax rates 2021-22 Income $0 - $416 $417 - $1,307 $1,308 and above Tax rates for 2018-19 income year Nil 66% for the part over $416 47% of total income that is not excepted income 2021-22 Low Income Tax Offset Taxable income Up to $37,500 $37,501 to $45,000 $45,001 to $66,667 Tax offset $700 $700 - (5% of excess over $37,500) $325 - (1.5% of excess over $45,000) $66,668 and above Nil 2021-22 Low and Middle Income Tax Offset Taxable income Up to $37,000 Tax on this income $675 $675 plus 7.5c for each $1 over $37,000 $37,001 to $48,000 $48,001 to $90,000 $1,500 $90,001 to $126,000 $1,500 less 3c for each $1 over $90,000 $126,001 and above Nil Medicare rate 2020-21 Medicare rate Threshold single Threshold family 2% < $23226 < $39167 + $3,597 Medicare Levy Base tier Tier 1 Tier 2 Tier 3 Surcharge Single $105,001 - $140,001 or $90,000 or less $90,001-$105,000 threshold $140,000 more Family $210,001 - $280,001 or $180,000 or less $180,001 - $210,000 threshold $280,000 more Medicare levy 0% 1% surcharge 1.50% Note: If you have two or more dependent children, the family income threshold is increased by $1,500 for each dependent child after the first child. 1.25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started