Answered step by step

Verified Expert Solution

Question

1 Approved Answer

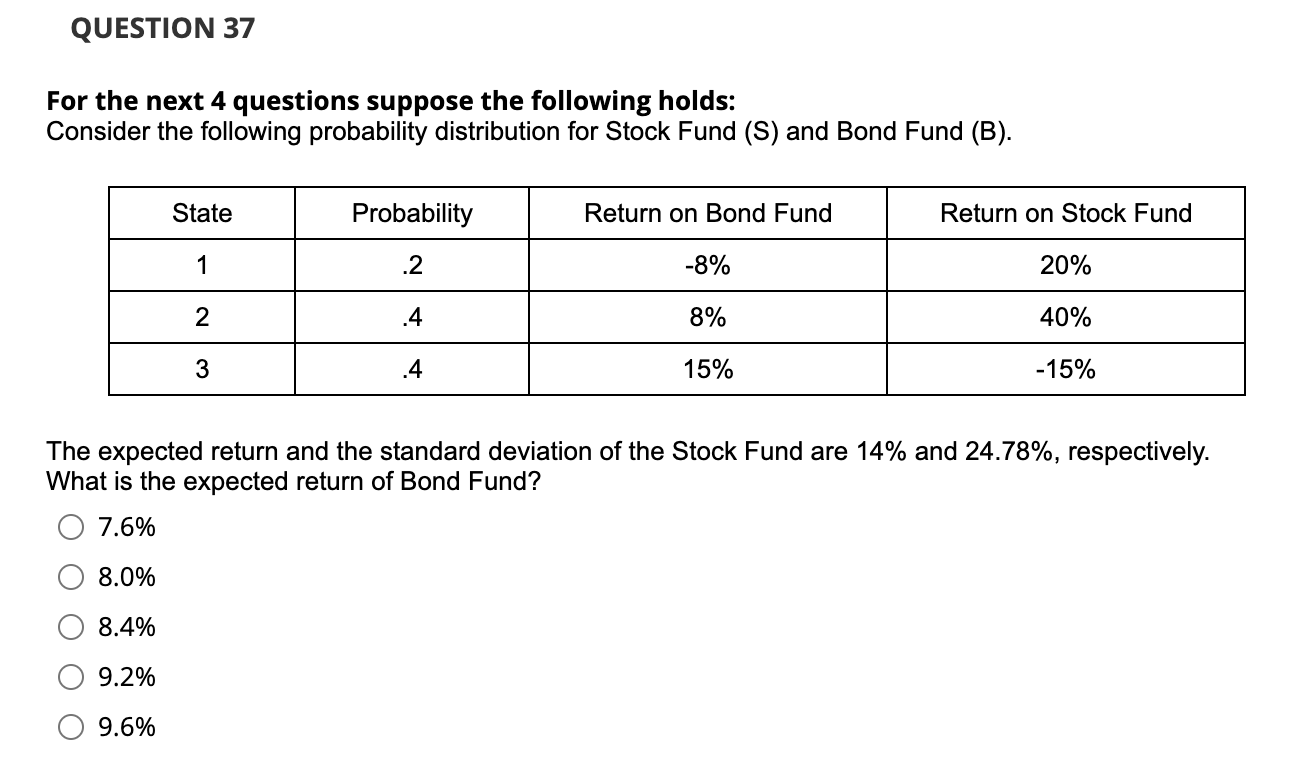

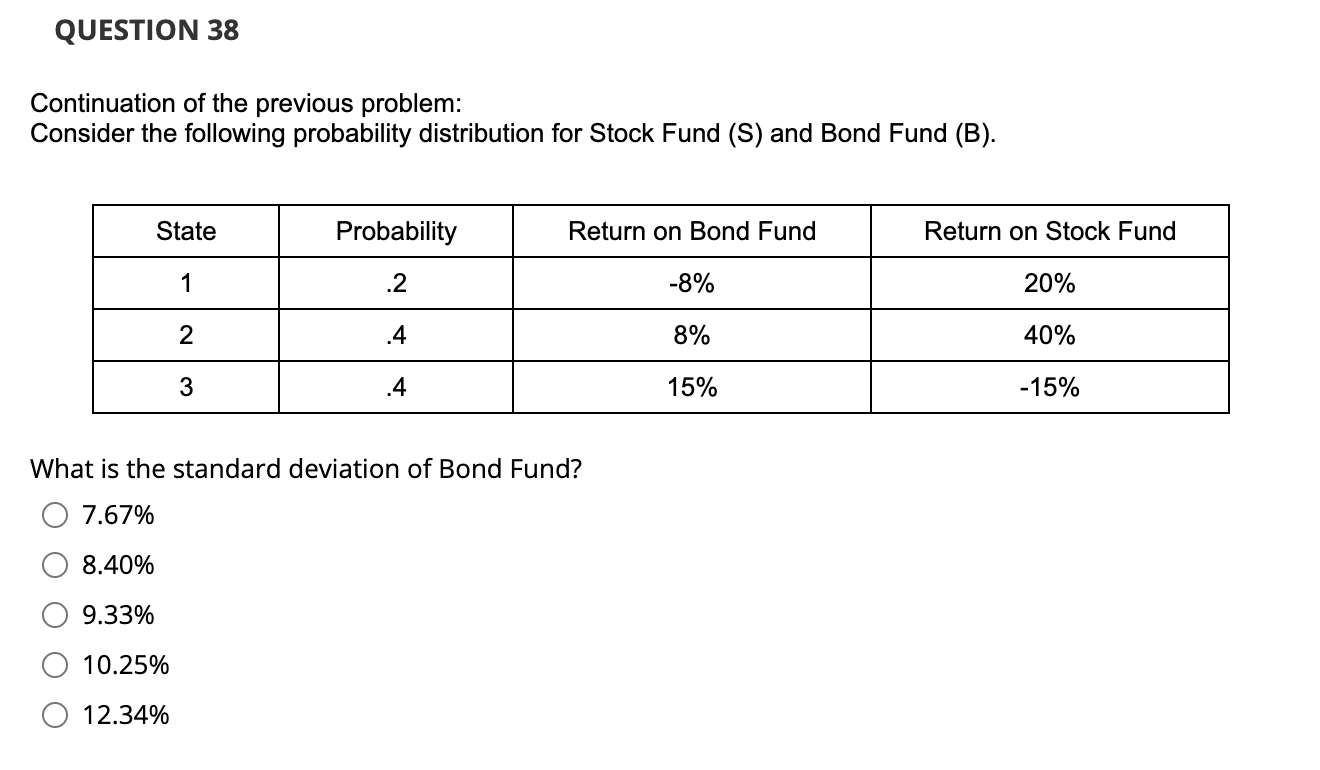

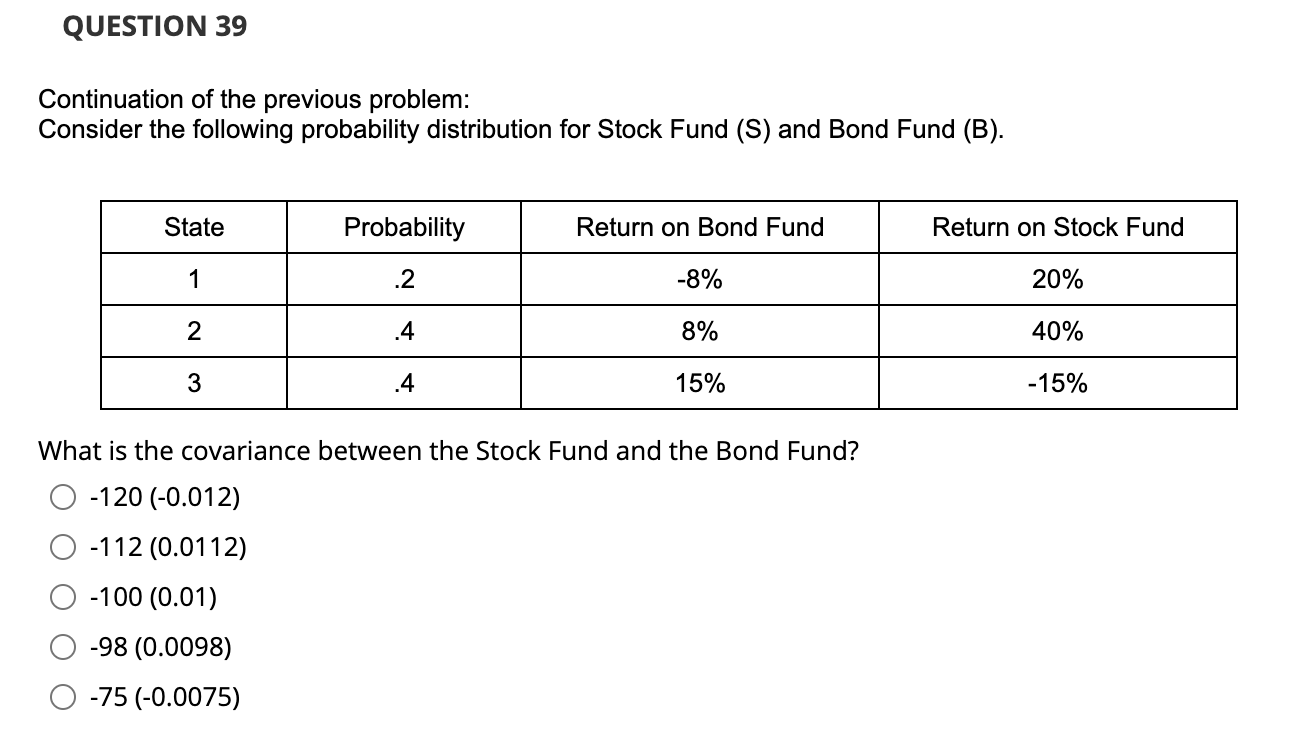

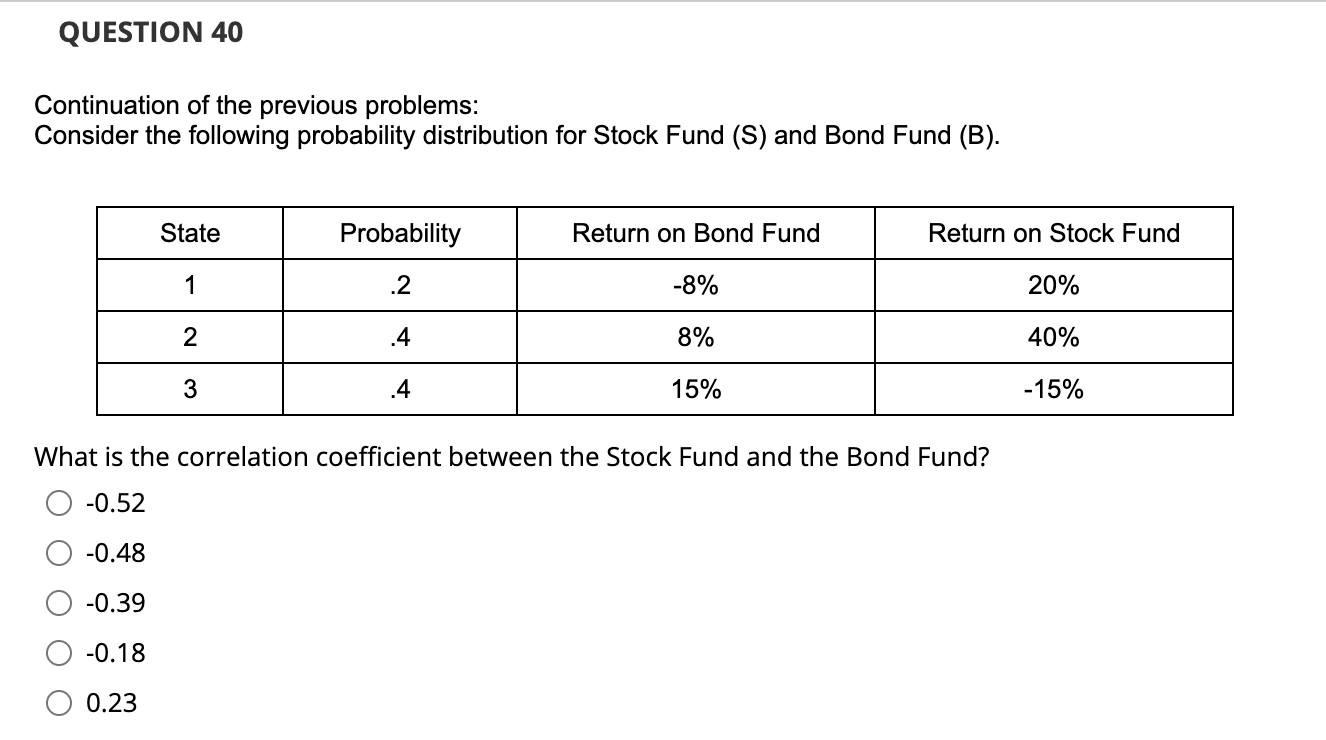

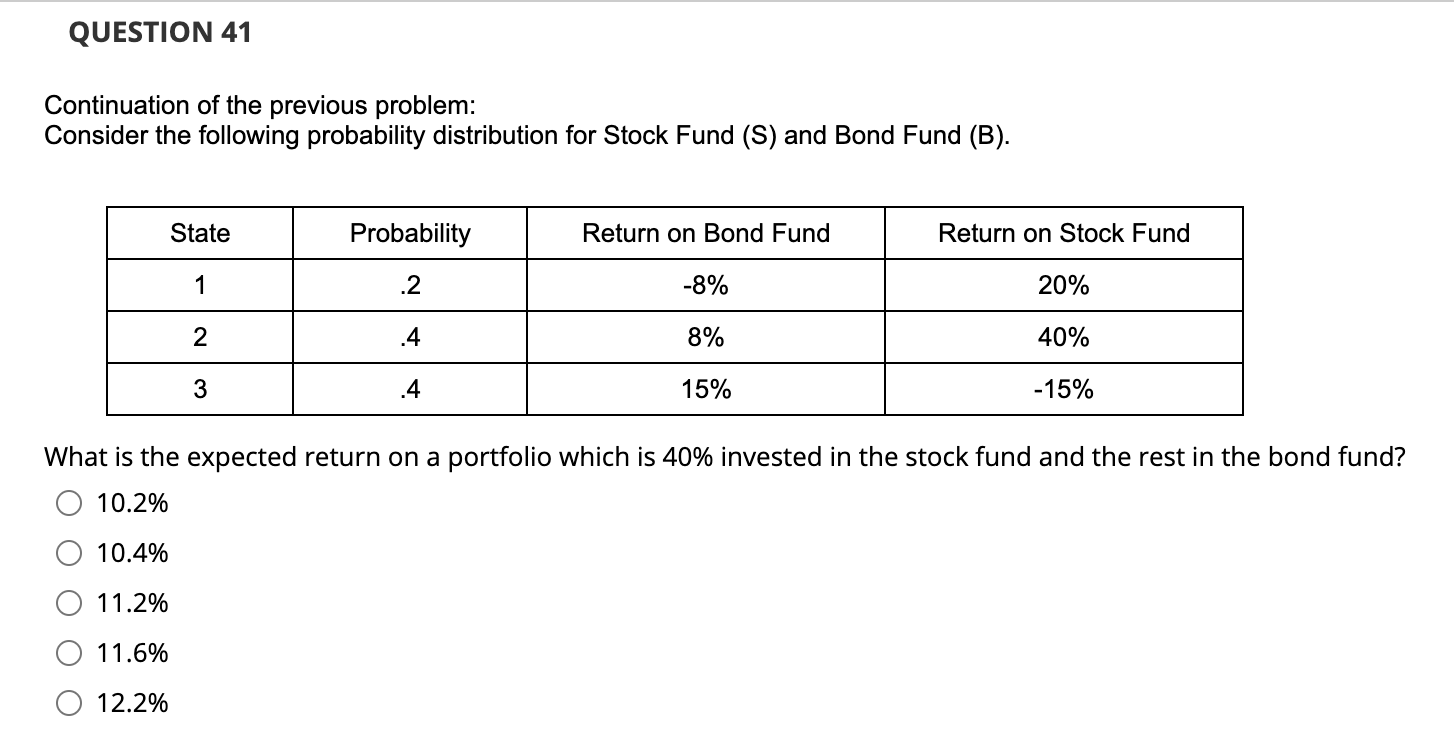

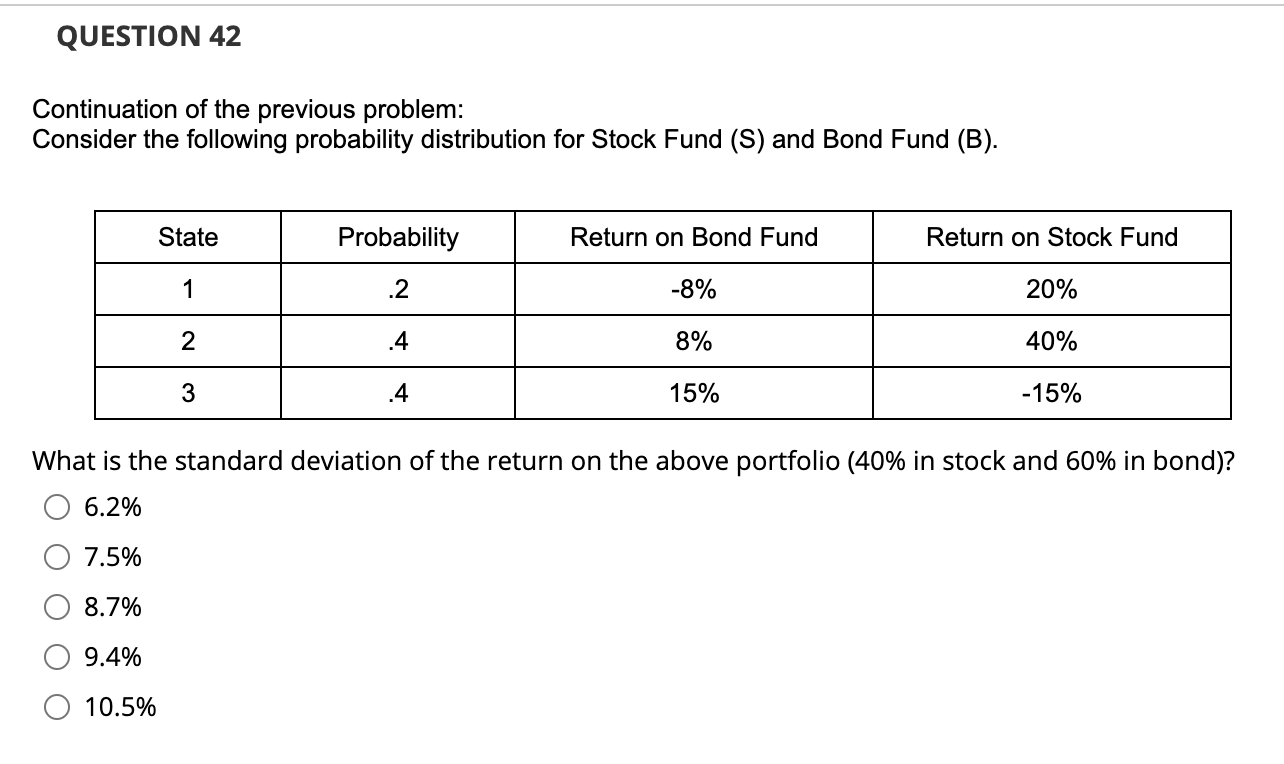

QUESTION 37 For the next 4 questions suppose the following holds: Consider the following probability distribution for Stock Fund (S) and Bond Fund (B). State

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these problems well handle each question one by one Question 37 Expected Return of Bond Fund The expected return is calculated as follows ER ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started