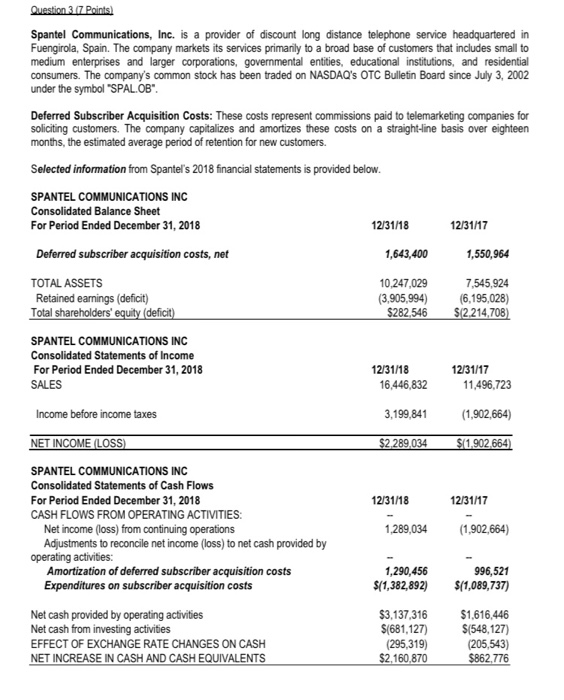

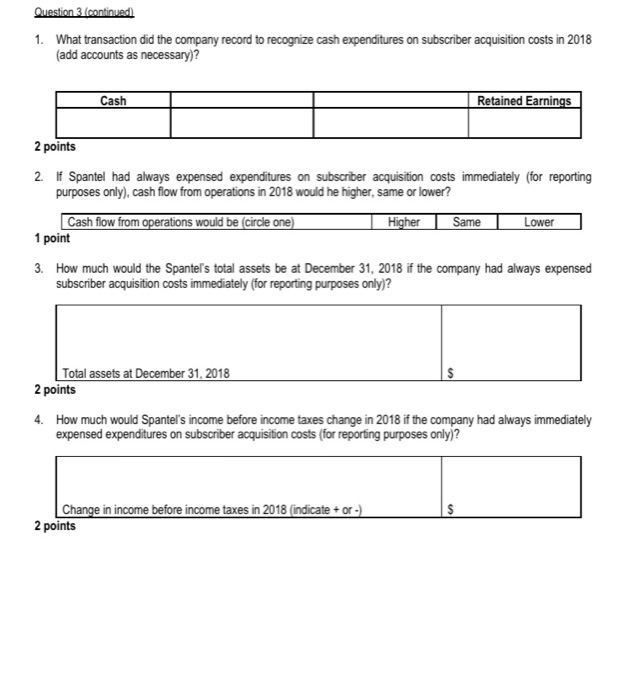

Question 3.7 Points) Spantel Communications, Inc. is a provider of discount long distance telephone service headquartered in Fuengirola, Spain. The company markets its services primarily to a broad base of customers that includes small to medium enterprises and larger corporations, governmental entities, educational institutions, and residential consumers. The company's common stock has been traded on NASDAQ's OTC Bulletin Board since July 3, 2002 under the symbol "SPAL.OB". Deferred Subscriber Acquisition Costs: These costs represent commissions paid to telemarketing companies for soliciting customers. The company capitalizes and amortizes these costs on a straight-line basis over eighteen months, the estimated average period of retention for new customers. Selected information from Spantel's 2018 financial statements is provided below. SPANTEL COMMUNICATIONS INC Consolidated Balance Sheet For Period Ended December 31, 2018 12/31/18 12/31/17 Deferred subscriber acquisition costs, net 1,643,400 1,550,964 TOTAL ASSETS Retained earnings (deficit) Total shareholders' equity (deficit) 10,247,029 (3,905,994) $282.546 7,545,924 (6,195,028) $12.214,708) SPANTEL COMMUNICATIONS INC Consolidated Statements of Income For Period Ended December 31, 2018 SALES 12/31/18 16,446,832 12/31/17 11,496,723 Income before income taxes 3,199,841 (1,902,664) NET INCOME (LOSS) $2.289.034 $(1,902.664) 12/31/18 12/31/17 SPANTEL COMMUNICATIONS INC Consolidated Statements of Cash Flows For Period Ended December 31, 2018 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) from continuing operations Adjustments to reconcile net income (loss) to net cash provided by operating activities: Amortization of deferred subscriber acquisition costs Expenditures on subscriber acquisition costs 1,289,034 (1,902,664) 1,290,456 $(1,382,892) 996,521 $(1,089,737) Net cash provided by operating activities Net cash from investing activities EFFECT OF EXCHANGE RATE CHANGES ON CASH NET INCREASE IN CASH AND CASH EQUIVALENTS $3,137,316 $(681,127) (295,319) $2.160.870 $1,616,446 $(548,127) (205,543) $862,776 Question 3 (continued) 1. What transaction did the company record to recognize cash expenditures on subscriber acquisition costs in 2018 (add accounts as necessary)? Cash Retained Earnings 2 points 2. If Spantel had always expensed expenditures on subscriber acquisition costs immediately (for reporting purposes only). cash flow from operations in 2018 would he higher, same or lower? Higher Same Lower Cash flow from operations would be circle one) 1 point 3. How much would the Spantel's total assets be at December 31, 2018 if the company had always expensed subscriber acquisition costs immediately (for reporting purposes only)? Total assets at December 31, 2018 2 points 4. How much would Spantel's income before income taxes change in 2018 if the company had always immediately expensed expenditures on subscriber acquisition costs for reporting purposes only)? Change in income before income taxes in 2018 (indicate + or -) 2 points