Answered step by step

Verified Expert Solution

Question

1 Approved Answer

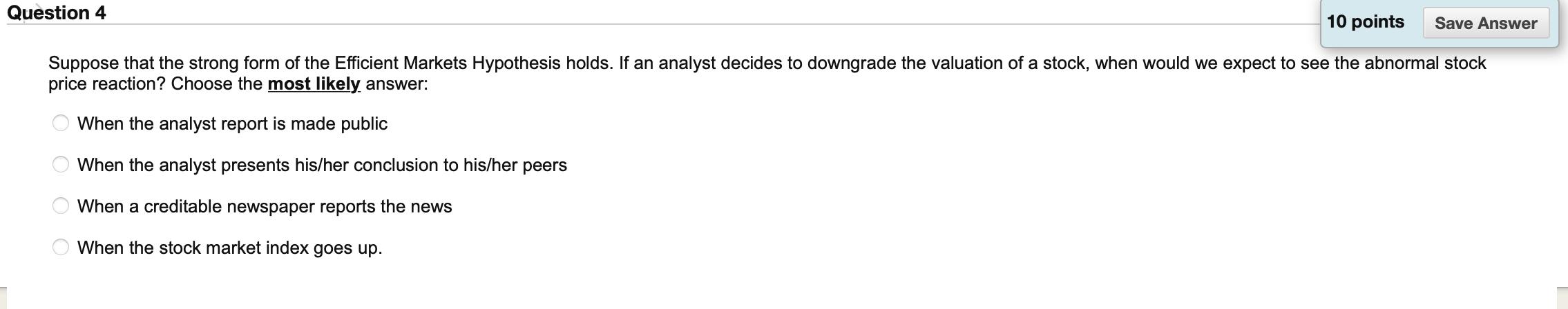

Question 4 10 points Save Answer Suppose that the strong form of the Efficient Markets Hypothesis holds. If an analyst decides to downgrade the

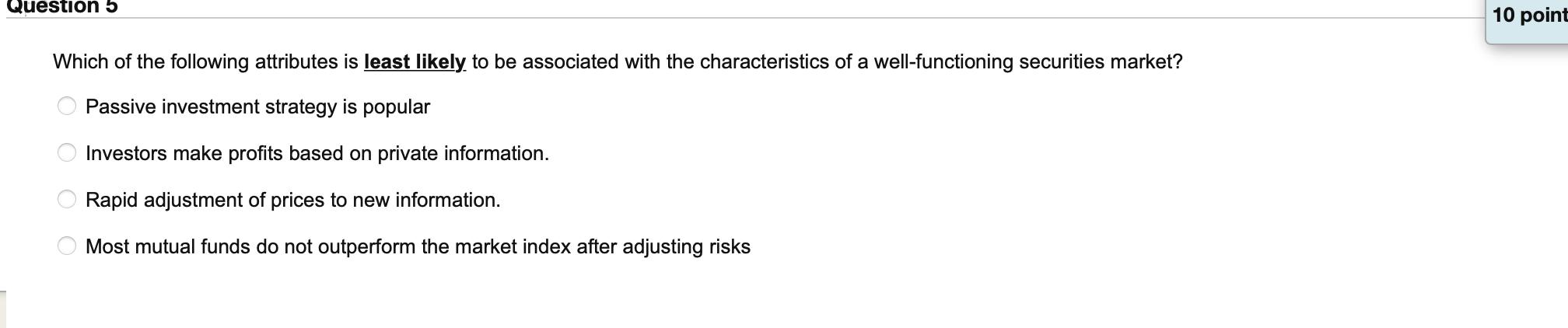

Question 4 10 points Save Answer Suppose that the strong form of the Efficient Markets Hypothesis holds. If an analyst decides to downgrade the valuation of a stock, when would we expect to see the abnormal stock price reaction? Choose the most likely answer: When the analyst report is made public When the analyst presents his/her conclusion to his/her peers When a creditable newspaper reports the news OOO 8 8 When the stock market index goes up. Question 5 Which of the following attributes is least likely to be associated with the characteristics of a well-functioning securities market? Passive investment strategy is popular Investors make profits based on private information. Rapid adjustment of prices to new information. Most mutual funds do not outperform the market index after adjusting risks 10 point Question 6 A person is risk averse over gains and risk loving over losses. This is the Overconfidence OOOO Loss aversion Affection Expected utility maximization

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below It appe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started