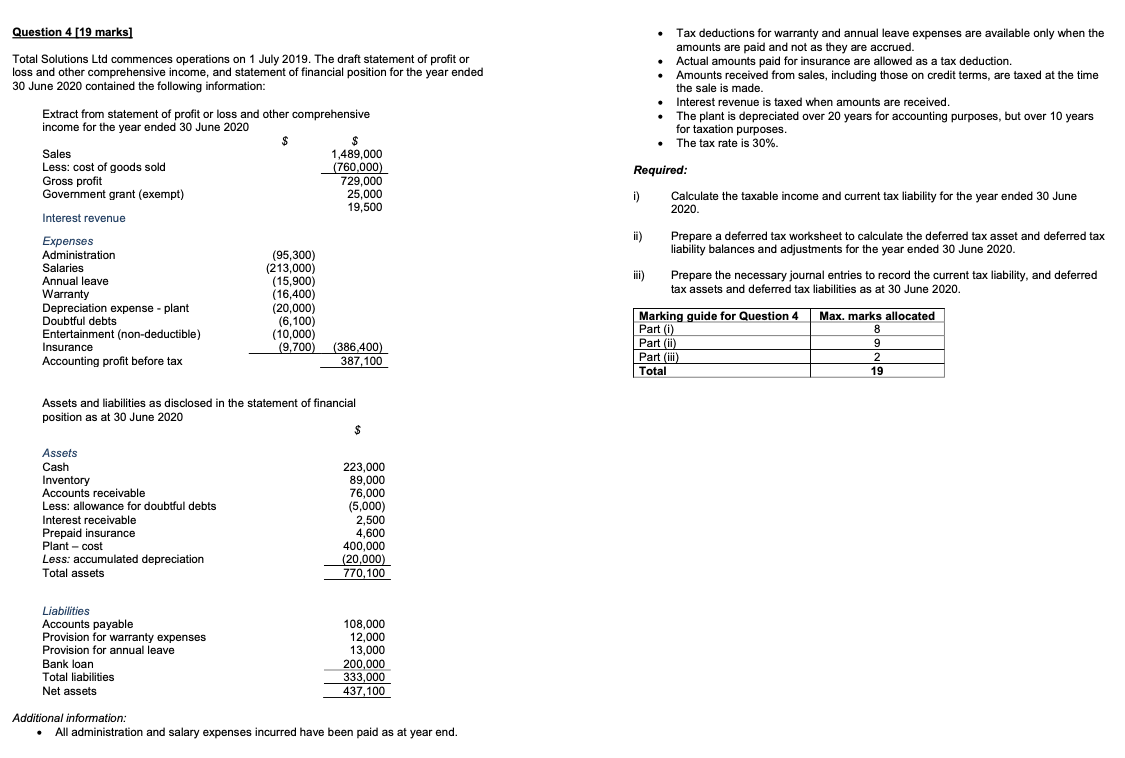

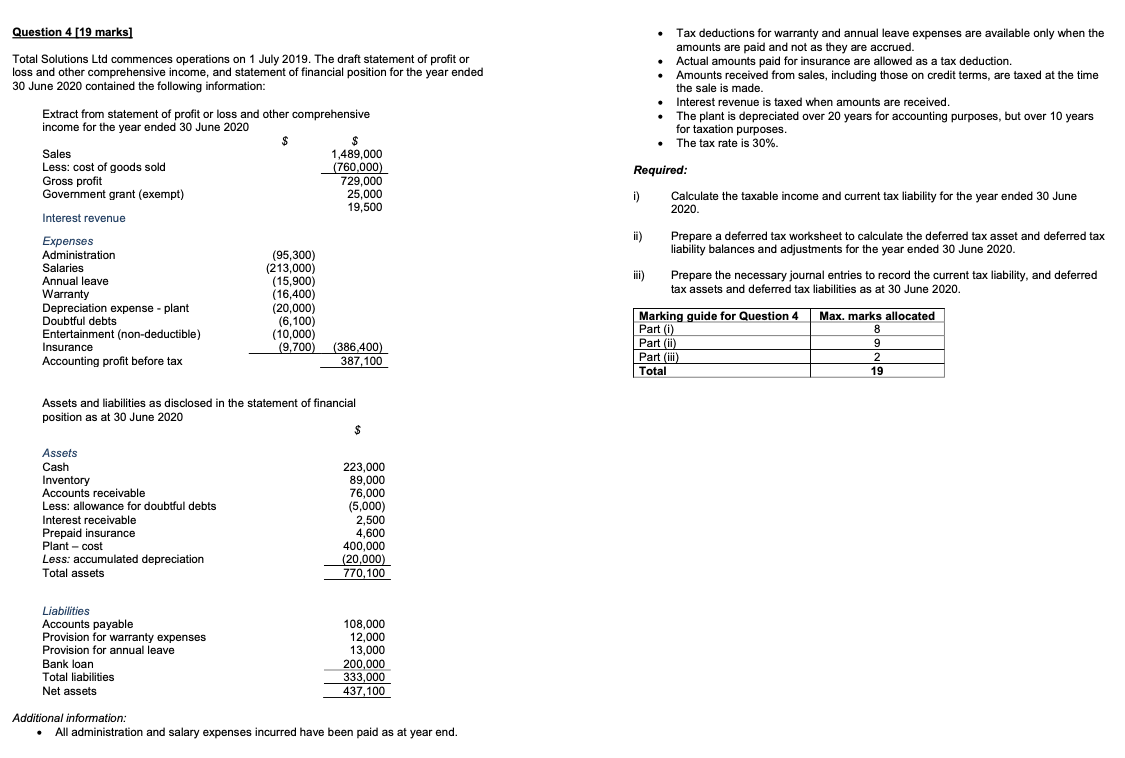

Question 4 [19 marks] Total Solutions Ltd commences operations on 1 July 2019. The draft statement of profit or loss and other comprehensive income, and statement of financial position for the year ended 30 June 2020 contained the following information: Tax deductions for warranty and annual leave expenses are available only when the amounts are paid and not as they are accrued. Actual amounts paid for insurance are allowed as a tax deduction. Amounts received from sales, including those on credit terms, are taxed at the time the sale is made Interest revenue is taxed when amounts are received. The plant is depreciated over 20 years for accounting purposes, but over 10 years for taxation purposes. The tax rate is 30% Required: i) Calculate the taxable income and current tax liability for the year ended 30 June 2020. Extract from statement of profit or loss and other comprehensive income for the year ended 30 June 2020 $ $ Sales 1,489,000 Less: cost of goods sold (760,000) Gross profit 729,000 Goverment grant (exempt) 25,000 19,500 Interest revenue Expenses Administration (95,300) Salaries (213,000) Annual leave (15,900) Warranty (16,400) Depreciation expense - plant (20,000) Doubtful debts (6,100) Entertainment (non-deductible) (10,000) Insurance (9,700) (386,400) Accounting profit before tax 387,100 ii) Prepare a deferred tax worksheet to calculate the deferred tax asset and deferred tax liability balances and adjustments for the year ended 30 June 2020. iii) Prepare the necessary journal entries to record the current tax liability, and deferred tax assets and deferred tax liabilities as at 30 June 2020. Marking guide for Question 4 Part (0) Part (ii) Part (iii) Total Max. marks allocated 8 9 9 2 19 Assets and liabilities as disclosed in the statement of financial position as at 30 June 2020 $ Assets Cash Inventory Accounts receivable Less: allowance for doubtful debts Interest receivable Prepaid insurance Plant-cost Less: accumulated depreciation Total assets 223,000 89,000 76,000 (5,000) 2,500 4,600 400,000 (20,000) 770,100 Liabilities Accounts payable Provision for warranty expenses Provision for annual leave Bank loan Total liabilities Net assets 108,000 12,000 13,000 200,000 333,000 437,100 Additional information: All administration and salary expenses incurred have been paid as at year end. Question 4 [19 marks] Total Solutions Ltd commences operations on 1 July 2019. The draft statement of profit or loss and other comprehensive income, and statement of financial position for the year ended 30 June 2020 contained the following information: Tax deductions for warranty and annual leave expenses are available only when the amounts are paid and not as they are accrued. Actual amounts paid for insurance are allowed as a tax deduction. Amounts received from sales, including those on credit terms, are taxed at the time the sale is made Interest revenue is taxed when amounts are received. The plant is depreciated over 20 years for accounting purposes, but over 10 years for taxation purposes. The tax rate is 30% Required: i) Calculate the taxable income and current tax liability for the year ended 30 June 2020. Extract from statement of profit or loss and other comprehensive income for the year ended 30 June 2020 $ $ Sales 1,489,000 Less: cost of goods sold (760,000) Gross profit 729,000 Goverment grant (exempt) 25,000 19,500 Interest revenue Expenses Administration (95,300) Salaries (213,000) Annual leave (15,900) Warranty (16,400) Depreciation expense - plant (20,000) Doubtful debts (6,100) Entertainment (non-deductible) (10,000) Insurance (9,700) (386,400) Accounting profit before tax 387,100 ii) Prepare a deferred tax worksheet to calculate the deferred tax asset and deferred tax liability balances and adjustments for the year ended 30 June 2020. iii) Prepare the necessary journal entries to record the current tax liability, and deferred tax assets and deferred tax liabilities as at 30 June 2020. Marking guide for Question 4 Part (0) Part (ii) Part (iii) Total Max. marks allocated 8 9 9 2 19 Assets and liabilities as disclosed in the statement of financial position as at 30 June 2020 $ Assets Cash Inventory Accounts receivable Less: allowance for doubtful debts Interest receivable Prepaid insurance Plant-cost Less: accumulated depreciation Total assets 223,000 89,000 76,000 (5,000) 2,500 4,600 400,000 (20,000) 770,100 Liabilities Accounts payable Provision for warranty expenses Provision for annual leave Bank loan Total liabilities Net assets 108,000 12,000 13,000 200,000 333,000 437,100 Additional information: All administration and salary expenses incurred have been paid as at year end