Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 (20 MARKS) Champro Berhad is a leading gadget manufacturer. Due to rapid expansion of its operations, the company acquired additional machine on 1st

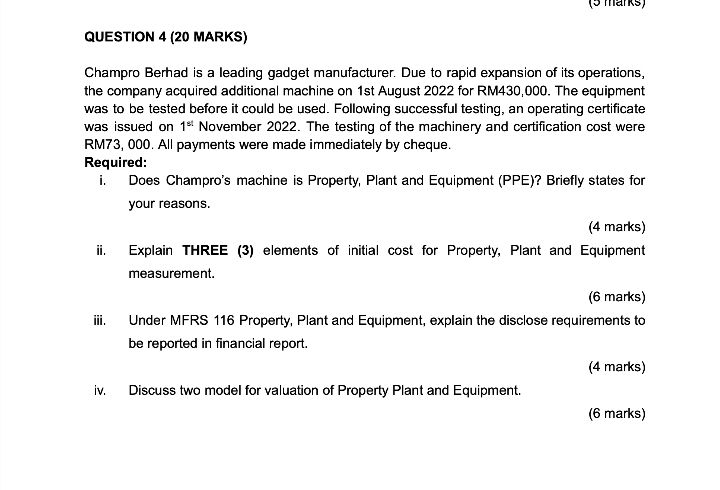

QUESTION 4 (20 MARKS) Champro Berhad is a leading gadget manufacturer. Due to rapid expansion of its operations, the company acquired additional machine on 1st August 2022 for RM430,000. The equipment was to be tested before it could be used. Following successful testing, an operating certificate was issued on 181 November 2022 . The testing of the machinery and certification cost were RM73, 000. All payments were made immediately by cheque. Required: i. Does Champro's machine is Property, Plant and Equipment (PPE)? Briefly states for your reasons. (4 marks) ii. Explain THREE (3) elements of initial cost for Property, Plant and Equipment measurement. (6 marks) iii. Under MFRS 116 Property, Plant and Equipment, explain the disclose requirements to be reported in financial report. (4 marks) iv. Discuss two model for valuation of Property Plant and Equipment. (6 marks)

QUESTION 4 (20 MARKS) Champro Berhad is a leading gadget manufacturer. Due to rapid expansion of its operations, the company acquired additional machine on 1st August 2022 for RM430,000. The equipment was to be tested before it could be used. Following successful testing, an operating certificate was issued on 181 November 2022 . The testing of the machinery and certification cost were RM73, 000. All payments were made immediately by cheque. Required: i. Does Champro's machine is Property, Plant and Equipment (PPE)? Briefly states for your reasons. (4 marks) ii. Explain THREE (3) elements of initial cost for Property, Plant and Equipment measurement. (6 marks) iii. Under MFRS 116 Property, Plant and Equipment, explain the disclose requirements to be reported in financial report. (4 marks) iv. Discuss two model for valuation of Property Plant and Equipment. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started