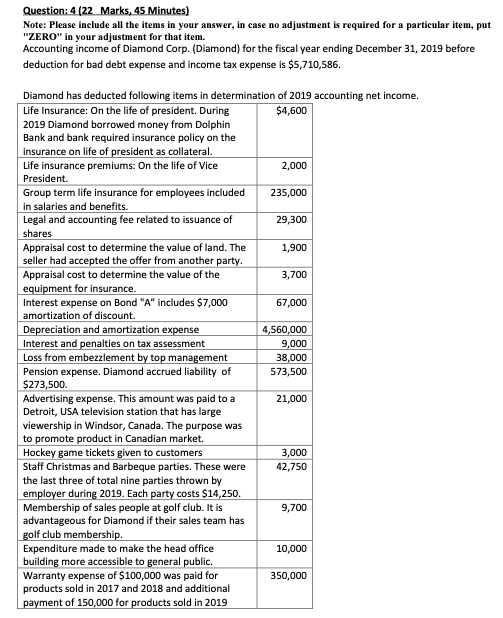

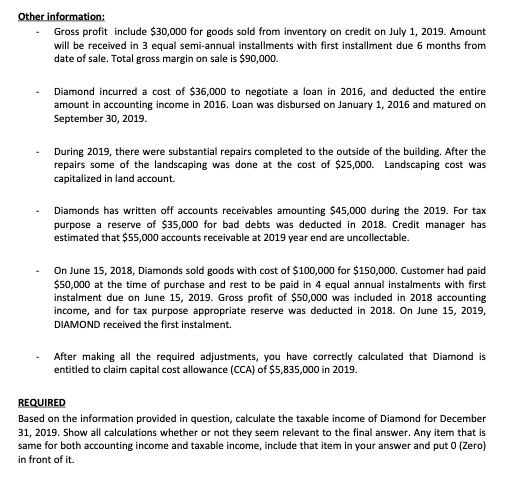

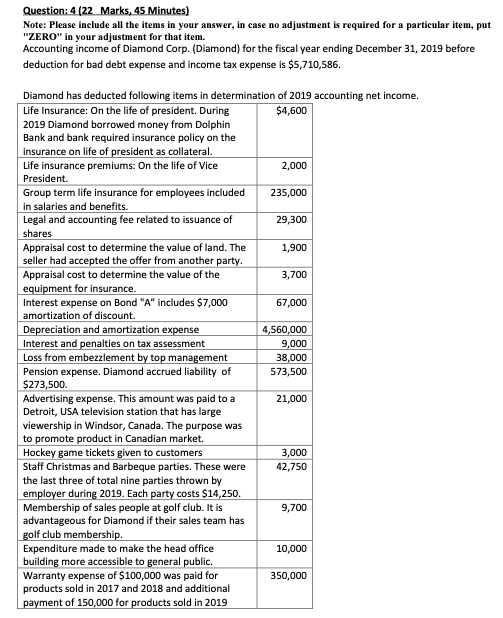

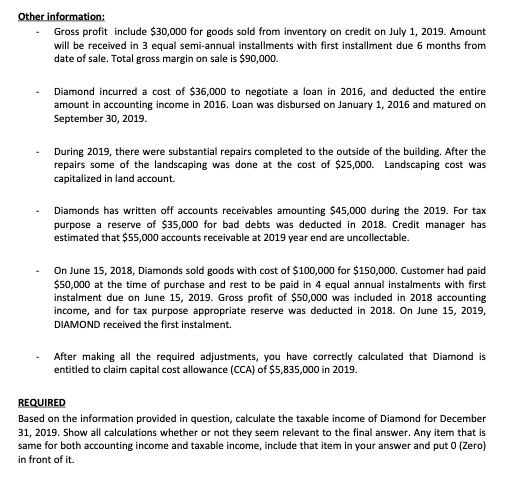

Question: 4 (22 Marks, 45 Minutes) Note: Please include all the items in your answer, in case no adjustment is required for a particular item, put "ZERO" in your adjustment for that item. Accounting income of Diamond Corp. (Diamond) for the fiscal year ending December 31, 2019 before deduction for bad debt expense and income tax expense is $5,710,586. Diamond has deducted following items in determination of 2019 accounting net income. Life Insurance: On the life of president. During $4,600 2019 Diamond borrowed money from Dolphin Bank and bank required insurance policy on the insurance on life of president as collateral. Life insurance premiums: On the life of Vice 2,000 President. Group term life insurance for employees included 235,000 in salaries and benefits. Legal and accounting fee related to issuance of 29,300 shares Appraisal cost to determine the value of land. The 1,900 seller had accepted the offer from another party. Appraisal cost to determine the value of the 3,700 equipment for insurance. Interest expense on Bond "A" includes $7,000 67,000 amortization of discount. Depreciation and amortization expense 4,560,000 Interest and penalties on tax assessment 9,000 Loss from embezzlement by top management 38,000 Pension expense. Diamond accrued liability of 573,500 $273,500. Advertising expense. This amount was paid to a 21,000 Detroit, USA television station that has large viewership in Windsor, Canada. The purpose was to promote product in Canadian market. Hockey game tickets given to customers 3,000 Staff Christmas and Barbeque parties. These were 42,750 the last three of total nine parties thrown by employer during 2019. Each party costs $14,250. Membership of sales people at golf club. It is 9,700 advantageous for Diamond if their sales team has golf club membership Expenditure made to make the head office 10,000 building more accessible to general public. Warranty expense of $100,000 was paid for 350,000 products sold in 2017 and 2018 and additional payment of 150,000 for products sold in 2019 Other information: Gross profit include $30,000 for goods sold from inventory on credit on July 1, 2019. Amount will be received in 3 equal semi-annual installments with first installment due 6 months from date of sale. Total gross margin on sale is $90,000. Diamond incurred a cost of $36,000 to negotiate a loan in 2016, and deducted the entire amount in accounting income in 2016. Loan was disbursed on January 1, 2016 and matured on September 30, 2019. During 2019, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping was done at the cost of $25,000. Landscaping cost was capitalized in land account. Diamonds has written off accounts receivables amounting $45,000 during the 2019. For tax purpose a reserve of $35,000 for bad debts was deducted in 2018. Credit manager has estimated that $55,000 accounts receivable at 2019 year end are uncollectable. On June 15, 2018, Diamonds sold goods with cost of $100,000 for $150,000. Customer had paid $50,000 at the time of purchase and rest to be paid in 4 equal annual instalments with first instalment due on June 15, 2019. Gross profit of $50,000 was included in 2018 accounting income, and for tax purpose appropriate reserve was deducted in 2018. On June 15, 2019, DIAMOND received the first instalment. After making all the required adjustments, you have correctly calculated that Diamond is entitled to claim capital cost allowance (CCA) of $5,835,000 in 2019. REQUIRED Based on the information provided in question, calculate the taxable income of Diamond for December 31, 2019. Show all calculations whether or not they seem relevant to the final answer. Any item that is same for both accounting income and taxable income, include that item in your answer and put 0 (Zero) in front of it. Question: 4 (22 Marks, 45 Minutes) Note: Please include all the items in your answer, in case no adjustment is required for a particular item, put "ZERO" in your adjustment for that item. Accounting income of Diamond Corp. (Diamond) for the fiscal year ending December 31, 2019 before deduction for bad debt expense and income tax expense is $5,710,586. Diamond has deducted following items in determination of 2019 accounting net income. Life Insurance: On the life of president. During $4,600 2019 Diamond borrowed money from Dolphin Bank and bank required insurance policy on the insurance on life of president as collateral. Life insurance premiums: On the life of Vice 2,000 President. Group term life insurance for employees included 235,000 in salaries and benefits. Legal and accounting fee related to issuance of 29,300 shares Appraisal cost to determine the value of land. The 1,900 seller had accepted the offer from another party. Appraisal cost to determine the value of the 3,700 equipment for insurance. Interest expense on Bond "A" includes $7,000 67,000 amortization of discount. Depreciation and amortization expense 4,560,000 Interest and penalties on tax assessment 9,000 Loss from embezzlement by top management 38,000 Pension expense. Diamond accrued liability of 573,500 $273,500. Advertising expense. This amount was paid to a 21,000 Detroit, USA television station that has large viewership in Windsor, Canada. The purpose was to promote product in Canadian market. Hockey game tickets given to customers 3,000 Staff Christmas and Barbeque parties. These were 42,750 the last three of total nine parties thrown by employer during 2019. Each party costs $14,250. Membership of sales people at golf club. It is 9,700 advantageous for Diamond if their sales team has golf club membership Expenditure made to make the head office 10,000 building more accessible to general public. Warranty expense of $100,000 was paid for 350,000 products sold in 2017 and 2018 and additional payment of 150,000 for products sold in 2019 Other information: Gross profit include $30,000 for goods sold from inventory on credit on July 1, 2019. Amount will be received in 3 equal semi-annual installments with first installment due 6 months from date of sale. Total gross margin on sale is $90,000. Diamond incurred a cost of $36,000 to negotiate a loan in 2016, and deducted the entire amount in accounting income in 2016. Loan was disbursed on January 1, 2016 and matured on September 30, 2019. During 2019, there were substantial repairs completed to the outside of the building. After the repairs some of the landscaping was done at the cost of $25,000. Landscaping cost was capitalized in land account. Diamonds has written off accounts receivables amounting $45,000 during the 2019. For tax purpose a reserve of $35,000 for bad debts was deducted in 2018. Credit manager has estimated that $55,000 accounts receivable at 2019 year end are uncollectable. On June 15, 2018, Diamonds sold goods with cost of $100,000 for $150,000. Customer had paid $50,000 at the time of purchase and rest to be paid in 4 equal annual instalments with first instalment due on June 15, 2019. Gross profit of $50,000 was included in 2018 accounting income, and for tax purpose appropriate reserve was deducted in 2018. On June 15, 2019, DIAMOND received the first instalment. After making all the required adjustments, you have correctly calculated that Diamond is entitled to claim capital cost allowance (CCA) of $5,835,000 in 2019. REQUIRED Based on the information provided in question, calculate the taxable income of Diamond for December 31, 2019. Show all calculations whether or not they seem relevant to the final answer. Any item that is same for both accounting income and taxable income, include that item in your answer and put 0 (Zero) in front of it