Question

Question 4 (22 marks) Accumulated depreciation Vehicles Accounts payable.. Sales returns and allowances Sales discounts. Vehicles. Cash. Merchandise Inventory. Purchase discounts. Purchase returns and allowance.

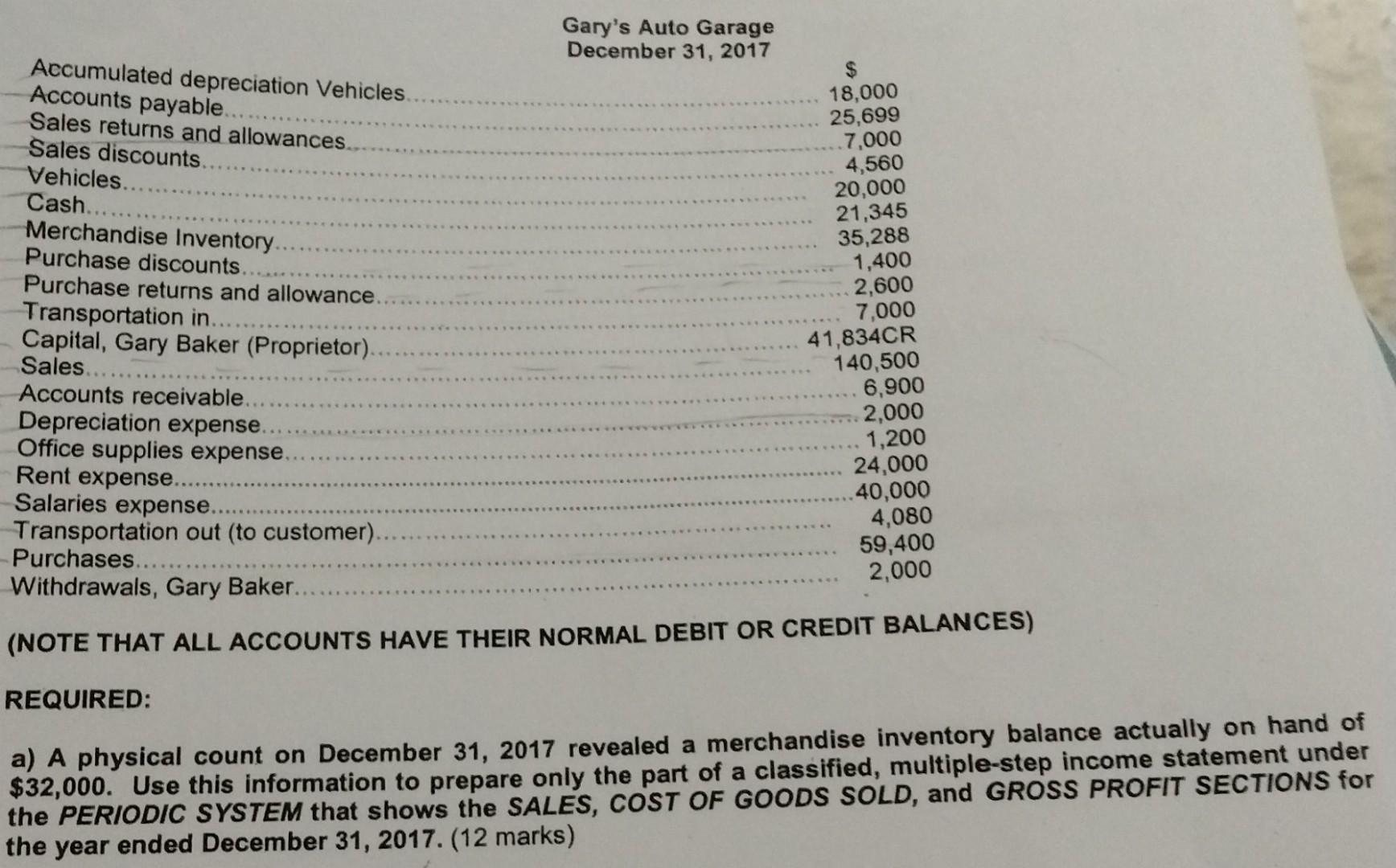

Question 4 (22 marks) Accumulated depreciation Vehicles Accounts payable.. Sales returns and allowances Sales discounts. Vehicles. Cash. Merchandise Inventory. Purchase discounts. Purchase returns and allowance. Transportation in... Capital, Gary Baker (Proprietor). Sales. Accounts receivable. Depreciation expense. Office supplies expense. Rent expense. Salaries expense. Transportation out (to customer). Purchases. Withdrawals, Gary Baker. REQUIRED: Gary's Auto Garage Decemnber 31, 2017 18,000 (Use the next page to write your answer on) 25,699 7.000 4,560 20,000 21,345 35,288 1,400 2,600 7,000 41,834CR 140,500 6,900 2,000 1,200 24,000 40,000 4,080 59,400 (NOTE THAT ALL ACCOUNTS HAVE THEIR NORMAL DEBIT OR CREDIT BALANCES) 2,000 a) A physical count on December 31, 2017 revealed a merchandise inventory balance actually on hand of $32,000. Use this information to prepare only the part of a classified, multiple-step income statement under the PERIODIC SYSTEM that shows the SALES, COST OF GOODS SOLD, and GROSS PROFIT SECTIONS for the year ended December 31, 2017. (12 marks)

show closing enteries in periodic system

REQUIRED: a) A physical count on December 31, 2017 revealed a merchandise inventory balance actually on hand of $32,000. Use this information to prepare only the part of a classified, multiple-step income statement under the PERIODIC SYSTEM that shows the SALES, COST OF GOODS SOLD, and GROSS PROFIT SECTIONS for the year ended December 31,2017 . (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started