Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 25 Marks (45 minutes) Rainbow Cc, a multinational organisation, is currently appraising a major capital investment project which will revolutionize its business. This

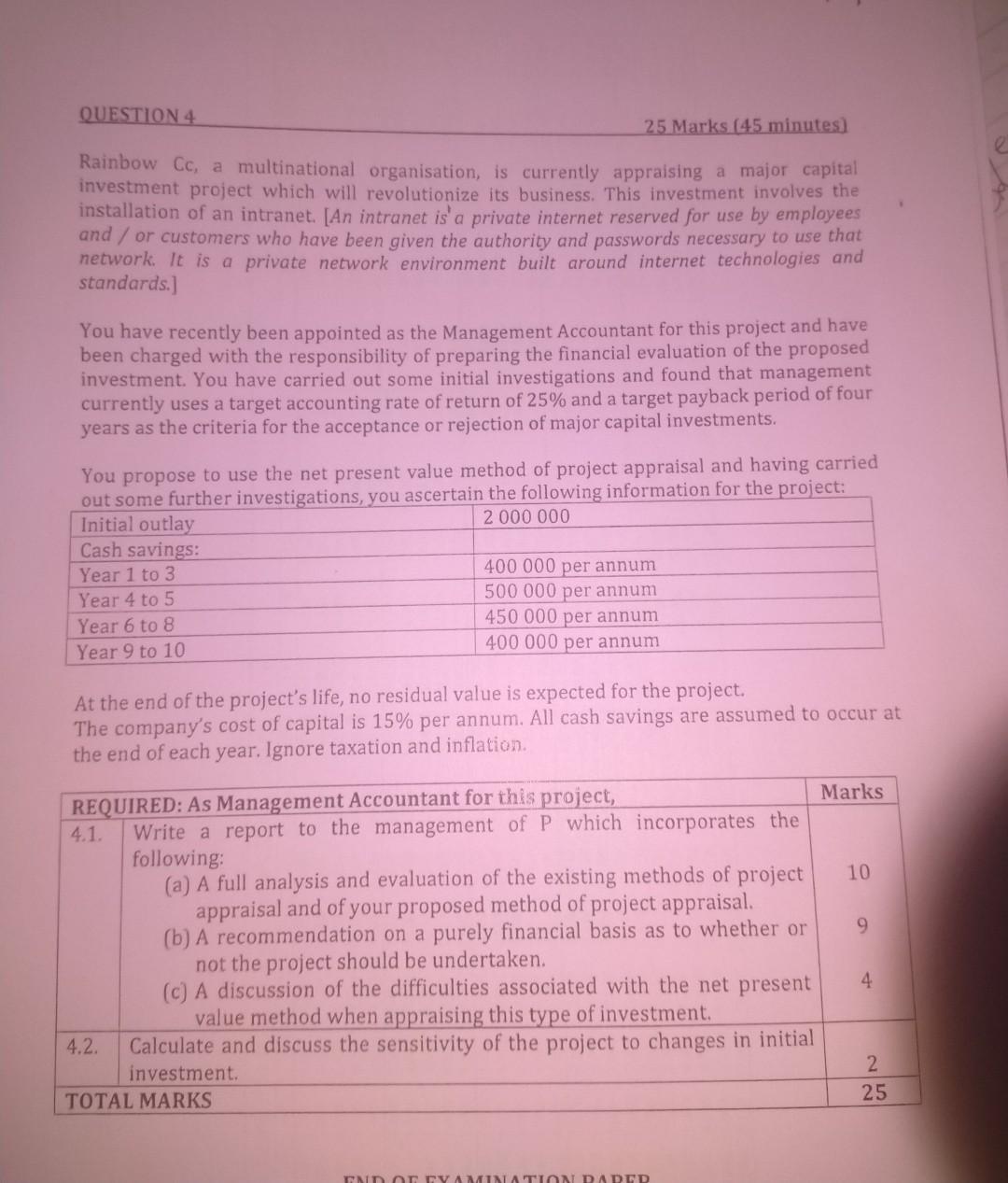

QUESTION 4 25 Marks (45 minutes) Rainbow Cc, a multinational organisation, is currently appraising a major capital investment project which will revolutionize its business. This investment involves the installation of an intranet. [An intranet is a private internet reserved for use by employees and / or customers who have been given the authority and passwords necessary to use that network It is a private network environment built around internet technologies and standards.] You have recently been appointed as the Management Accountant for this project and have been charged with the responsibility of preparing the financial evaluation of the proposed investment. You have carried out some initial investigations and found that management currently uses a target accounting rate of return of 25% and a target payback period of four years as the criteria for the acceptance or rejection of major capital investments. You propose to use the net present value method of project appraisal and having carried out some further investigations, you ascertain the following information for the project: Initial outlay 2 000 000 Cash savings: Year 1 to 3 400 000 per annum Year 4 to 5 500 000 per annum Year 6 to 8 450 000 per annum Year 9 to 10 400 000 per annum At the end of the project's life, no residual value is expected for the project. The company's cost of capital is 15% per annum. All cash savings are assumed to occur at the end of each year. Ignore taxation and inflation REQUIRED: As Management Accountant for this project, Marks 4.1. Write a report to the management of P which incorporates the following: (a) A full analysis and evaluation of the existing methods of project 10 appraisal and of your proposed method of project appraisal. (b) A recommendation on a purely financial basis as to whether or 9 not the project should be undertaken. (c) A discussion of the difficulties associated with the net present 4. value method when appraising this type of investment Calculate and discuss the sensitivity of the project to changes in initial investment 2 TOTAL MARKS 25 4.2 UN TITVAMINATION DADTD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started