Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 4 (25 Marks) a. The Curry Company is analyzing 2 capital investments. The financial vice president insists on examining the risk of the projects

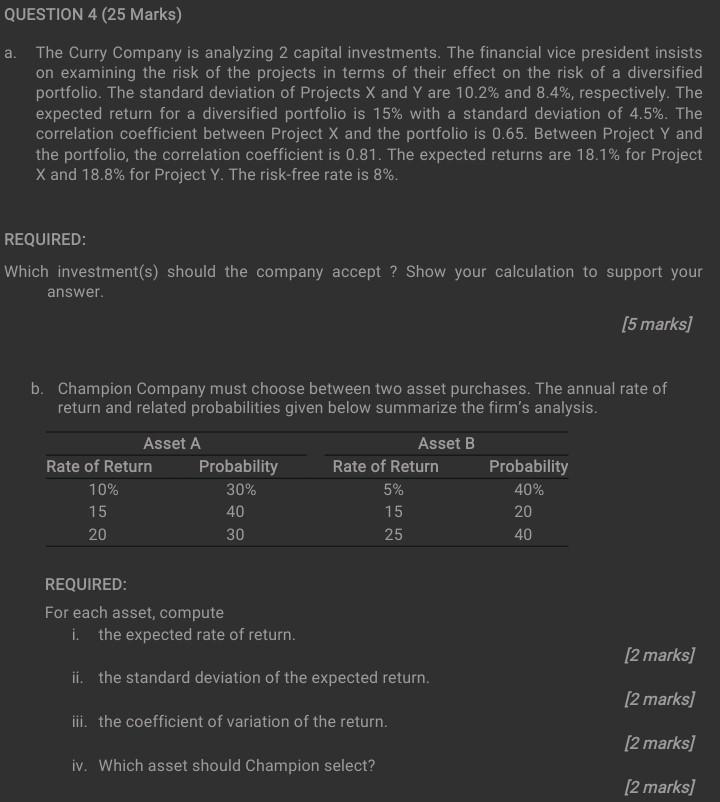

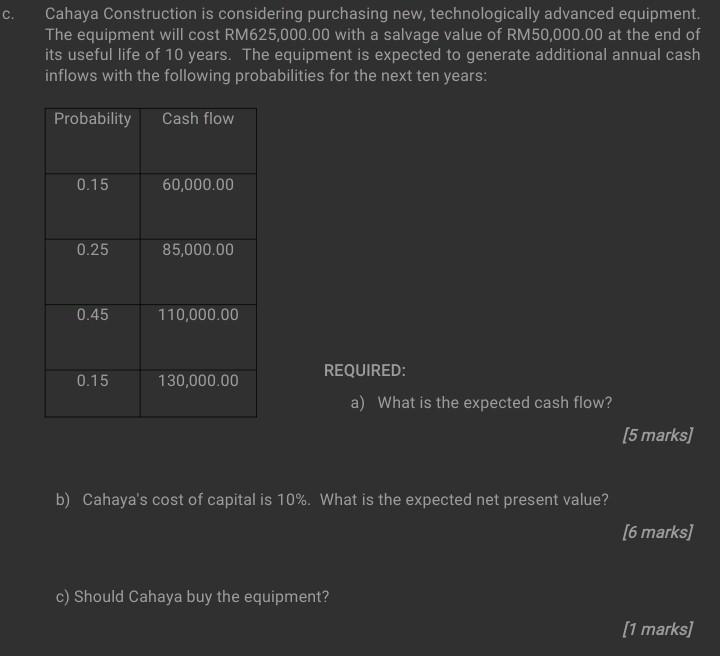

QUESTION 4 (25 Marks) a. The Curry Company is analyzing 2 capital investments. The financial vice president insists on examining the risk of the projects in terms of their effect on the risk of a diversified portfolio. The standard deviation of Projects X and Y are 10.2% and 8.4%, respectively. The expected return for a diversified portfolio is 15% with a standard deviation of 4.5%. The correlation coefficient between Project X and the portfolio is 0.65. Between Project Y and the portfolio, the correlation coefficient is 0.81. The expected returns are 18.1% for Project X and 18.8% for Project Y. The risk-free rate is 8%. REQUIRED: Which investment(s) should the company accept ? Show your calculation to support your answer. (5 marks] b. Champion Company must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis. Asset A Rate of Return Probability 10% 30% 15 40 20 30 Asset B Rate of Return 5% 15 25 Probability 40% 20 40 REQUIRED: For each asset, compute i the expected rate of return. [2 marks] ii. the standard deviation of the expected return. [2 marks] iii. the coefficient of variation of the return. [2 marks] iv. Which asset should Champion select? [2 marks] c. Cahaya Construction is considering purchasing new, technologically advanced equipment. The equipment will cost RM625,000.00 with a salvage value of RM50,000.00 at the end of its useful life of 10 years. The equipment is expected to generate additional annual cash inflows with the following probabilities for the next ten years: Probability Cash flow 0.15 60,000.00 0.25 85,000.00 0.45 110,000.00 0.15 130,000.00 REQUIRED: a) What is the expected cash flow? [5 marks] b) Cahaya's cost of capital is 10%. What is the expected net present value? [6 marks] c) Should Cahaya buy the equipment? [1 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started