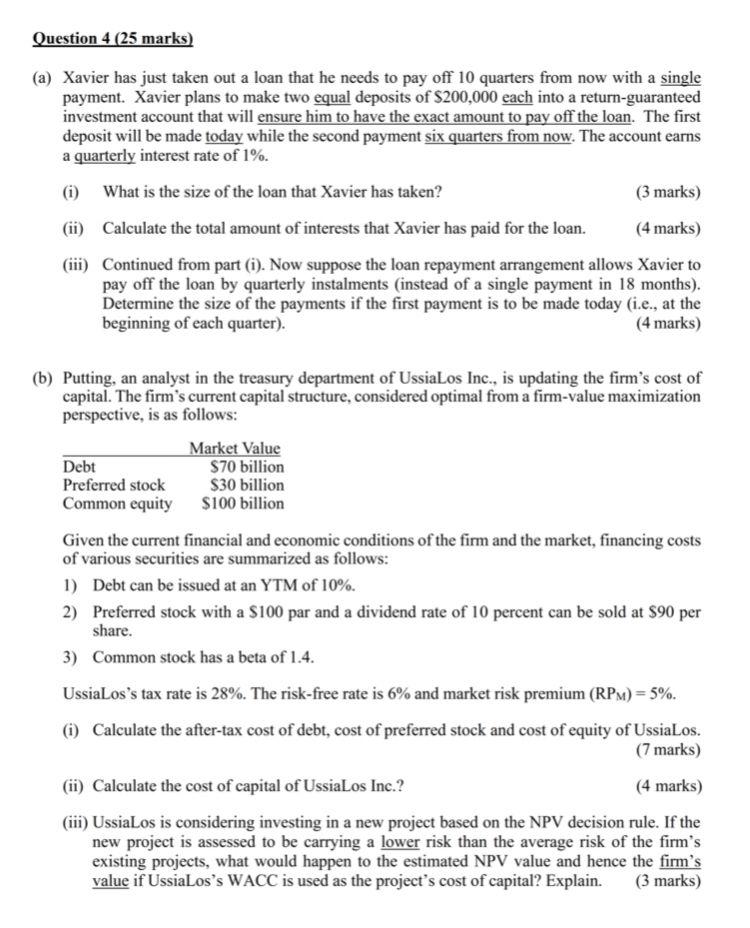

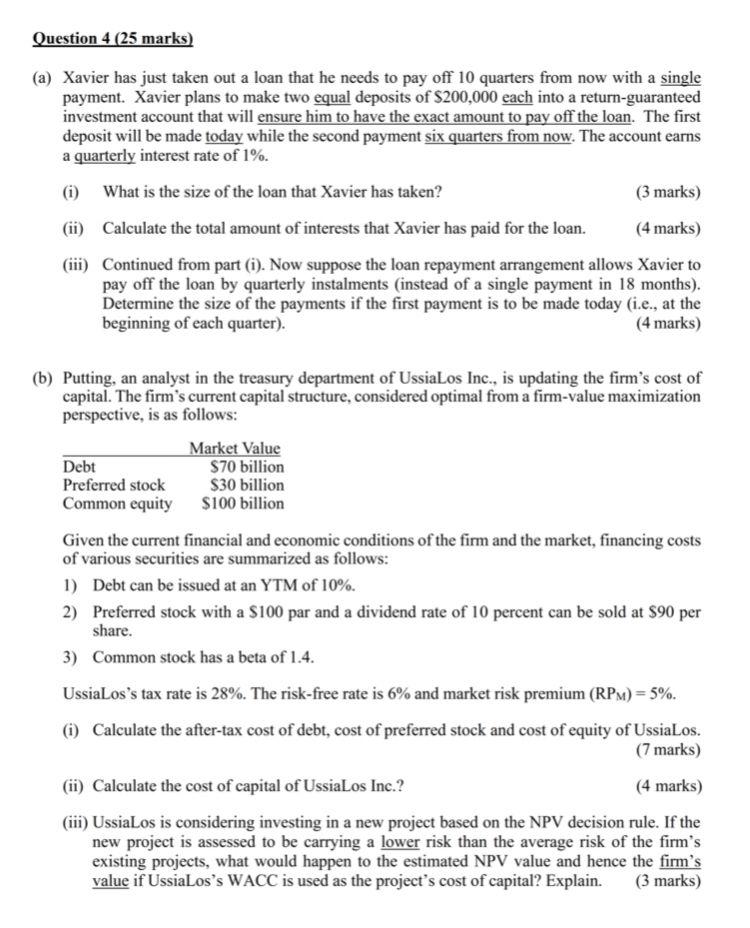

Question 4 (25 marks) (a) Xavier has just taken out a loan that he needs to pay off 10 quarters from now with a single payment. Xavier plans to make two equal deposits of $200,000 each into a return-guaranteed investment account that will ensure him to have the exact amount to pay off the loan. The first deposit will be made today while the second payment six quarters from now. The account earns a quarterly interest rate of 1%. (i) What is the size of the loan that Xavier has taken? (3 marks) (ii) Calculate the total amount of interests that Xavier has paid for the loan. (4 marks) (iii) Continued from part (i). Now suppose the loan repayment arrangement allows Xavier to pay off the loan by quarterly instalments (instead of a single payment in 18 months). Determine the size of the payments if the first payment is to be made today (i.e., at the beginning of each quarter). (4 marks) Debt (b) Putting, an analyst in the treasury department of UssiaLos Inc., is updating the firm's cost of capital. The firm's current capital structure, considered optimal from a firm-value maximization perspective, is as follows: Market Value $70 billion Preferred stock $30 billion Common equity $100 billion Given the current financial and economic conditions of the firm and the market, financing costs of various securities are summarized as follows: 1) Debt can be issued at an YTM of 10%. 2) Preferred stock with a $100 par and a dividend rate of 10 percent can be sold at $90 per share. 3) Common stock has a beta of 1.4. UssiaLos's tax rate is 28%. The risk-free rate is 6% and market risk premium (RPM) = 5%. () Calculate the after-tax cost of debt, cost of preferred stock and cost of equity of UssiaLos. (7 marks) (ii) Calculate the cost of capital of UssiaLos Inc.? (4 marks) (iii) UssiaLos is considering investing in a new project based on the NPV decision rule. If the new project is assessed to be carrying a lower risk than the average risk of the firm's existing projects, what would happen to the estimated NPV value and hence the firm's value if Ussia Los's WACC is used as the project's cost of capital? Explain