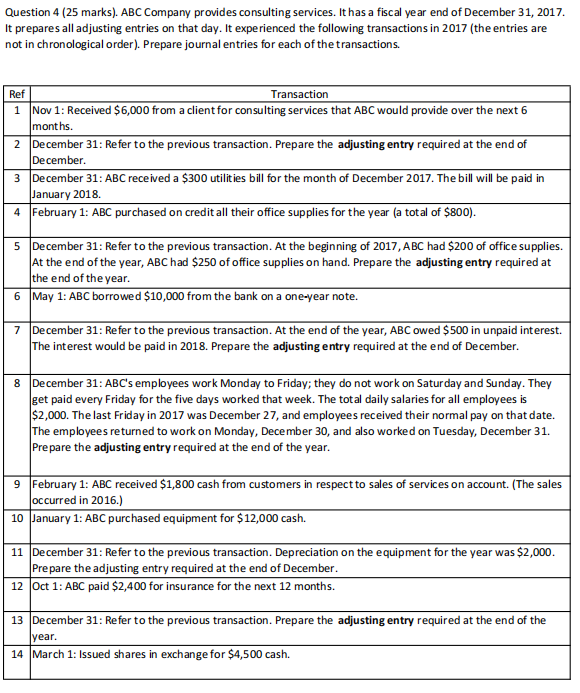

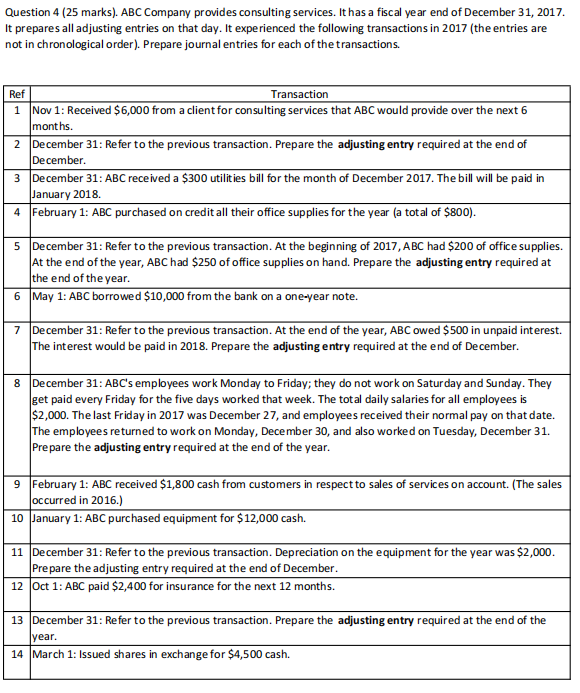

Question 4 (25 marks). ABC Company provides consulting services. It has a fiscal year end of December 31, 2017. It prepares all adjusting entries on that day. It experienced the following transactions in 2017 (the entries are not in chronological order). Prepare journal entries for each of the transactions Ref Transaction 1 Nov 1: Received $6,000 from a client for consulting services that ABC would provide over the next 6 months. 2 December 31: Refer to the previous transaction. Prepare the adjusting entry required at the end of December 3 December 31: ABC received a $300 utilities bill for the month of December 2017. The bill will be paid in January 2018 4 February 1: ABC purchased on credit all their office supplies for the year (a total of $800). 5 December 31: Refer to the previous transaction. At the beginning of 2017, ABC had $200 of office supplies. At the end of the year, ABC had $250 of office supplies on hand. Prepare the adjusting entry required at the end of the year. 6 May 1: ABC borrowed $10,000 from the bank on a one-year note. 7 December 31: Refer to the previous transaction. At the end of the year, ABC owed $500 in unpaid interest. The interest would be paid in 2018. Prepare the adjusting entry required at the end of December. 8 December 31: ABC's employees work Monday to Friday; they do not work on Saturday and Sunday. They get paid every Friday for the five days worked that week. The total daily salaries for all employees is $2,000. The last Friday in 2017 was December 27, and employees received their normal pay on that date. The employees returned to work on Monday, December 30, and also worked on Tuesday, December 31. Prepare the adjusting entry required at the end of the year. 9 February 1: ABC received $1,800 cash from customers in respect to sales of services on account. (The sales occurred in 2016.) 10 January 1: ABC purchased equipment for $12,000 cash. 11 December 31: Refer to the previous transaction. Depreciation on the equipment for the year was $2,000. Prepare the adjusting entry required at the end of December. 12 Oct 1: ABC paid $2,400 for insurance for the next 12 months. 13 December 31: Refer to the previous transaction. Prepare the adjusting entry required at the end of the year. 14 March 1: Issued shares in exchange for $4,500 cash