Answered step by step

Verified Expert Solution

Question

1 Approved Answer

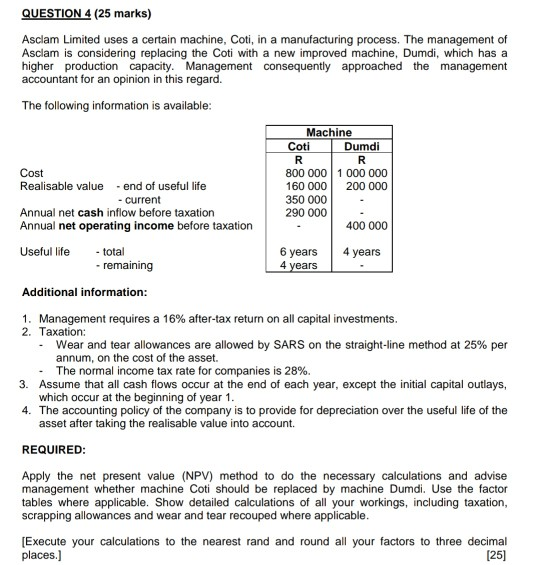

QUESTION 4 (25 marks) Asciam Limited uses a certain machine, Coti, in a manufacturing process. The management of Asclam is considering replacing the Coti with

QUESTION 4 (25 marks) Asciam Limited uses a certain machine, Coti, in a manufacturing process. The management of Asclam is considering replacing the Coti with a new improved machine, Dumdi, which has a higher production capacity. Management consequently approached the management accountant for an opinion in this regard. The following information is available: Machine Coti Dumdi Cost Realisable value -end of useful life - current Annual net cash inflow before taxation Annual net operating income before taxation 800 000 1 000 000 160 000 200 000 350 000 290 000 400 000 Useful life 4 years total - remaining 6 years 4 years Additional information: 1. Management requires a 16% after-tax return on all capital investments 2. Taxation: Wear and tear allowances are allowed by SARS on the straight-line method at 25% per annum, on the cost of the asset. The normal income tax rate for companies is 28%. 3. Assume that all cash flows occur at the end of each year, except the initial capital outlays, which occur at the beginning of year 1. 4. The accounting policy of the company is to provide for depreciation over the useful life of the asset after taking the realisable value into account. REQUIRED: Apply the net present value (NPV) method to do the necessary calculations and advise management whether machine Coti should be replaced by machine Dumdi. Use the factor tables where applicable. Show detailed calculations of all your workings, including taxation, scrapping allowances and wear and tear recouped where applicable. (Execute your calculations to the nearest rand and round all your factors to three decimal places.] (25)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started