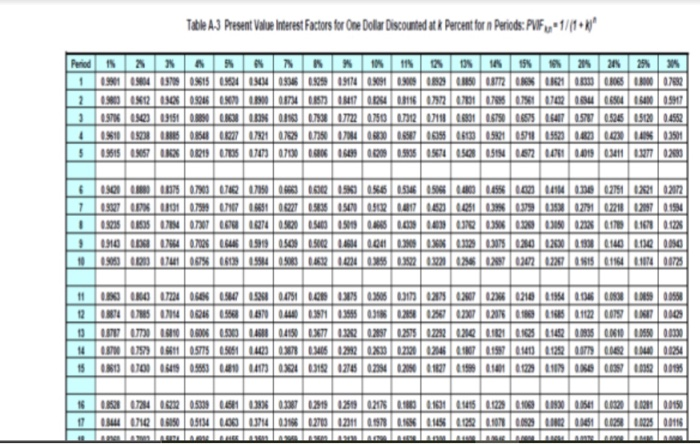

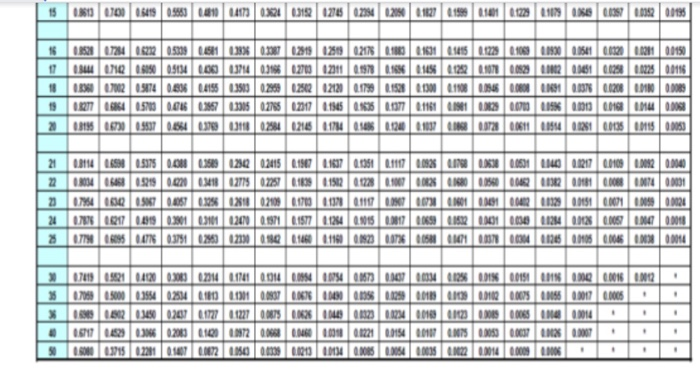

QUESTION 4 (25 MARKS) Harta Bhd leases its luxurious condominiums to some celebrities at below market price. It is as an incentive to the contract of employment between Butik Husna with the celebrities. They are the models of various apparel and accessories. Harta Bhd is considering to treat these condominiums as investment properties. The difference between the market and actual rental will be written off in the statement of profit or loss as employee Melorefit expenses. (4 marks) (CLO1:PLOI:C3) Harta Bhd acquired a piece of land for RM200 million on 1 January 2015. The land was classified as investment property and measured at cost. On 1 January 2019, Harta Bhd changed to fair value measurement for the land. It was able to derive the fair values of the land effective on 31 December 2018 which was RM290 million. The fair value of the land on 31st December 2019 was RM313 million. There was no tax suffered on fair value changes or on sale of the land. classified as investment property and measured at cost. On 1 January 2019, Harta Bhd changed to fair value measurement for the land. It was able to derive the fair values of the land effective on 31 December 2018 which was RM290 million. The fair value of the land on 31st December 2019 was RM313 million. There was no tax suffered on fair value changes or on sale of the land. (9 marks) (CLO1:PLO1:04) Harta Bhd Bhd had used an office building for administrative purposes with a depreciated cost of historical cost of RM3.6 million on 1 April 2019 with a remaining life of 20 years. There were some reorganizations to Harta's properties during the year of 2019. The office building was rented to a third party and reclassified as an investment property applying the fair value on 1 October 2019. Harta Bhd had consulted an independent professional assessor valued on the property. The fair value of the building was valued at RM4.14 million at October 2019 by the assessor. This value rose further to RM4.212 million at 31 March 2020. (12 marks) (CLO1:PL01:06) Required: Discuss the accounting treatment of the above scenarios in accordance to the relevant MFRS. Show the effects to the financial statements of Kaya Bhd. Marks as allocated (CLO1:PLO1:C6) Required: Discuss the accounting treatment of the above scenarios in accordance to the relevant MFRS. Show the effects to the financial statements of Kaya Bhd. Marks as allocated ACCT2131/June 2020 Page 6 of 8 APPENDICE: Table A3 Present Value Interest Factors for One Dollar Discounted atk Percent for n Periods: PUF, 1/1988]" Period 1 X X ANN 111 18 19 215 21 25% 109109804 1970 09615 096202344 09346 0.3290 191140.9691 0.910 1989 19880087720884 1821 080806580000782 2 098005120500321810190004 015730100310792070107907910020068015410 0597 197819151 LLON 1998 0.750 073121101 1.570 105518407 0.57705085151204552 4 098100523818801548027 1722101207070683008705750913005321 0571819920020423003501 5 09615 09657 101219 070 071906.80615062090901571150051 06724001903411702080 6 7 . 0.500 1800 117078076217050080136002150055 0.52615060.000 1.4556 1021111 0000002751 022102172 0907070107909071071.8631062209250.500.502141618230.01 0.300.379 09002791 022180291019 0.323500570730719740920 0.540 1.9019 0.16 0.00 0.00 0.035 0.320030800238 0.17 0.16780123 0.910 0.7028 15419990.50 0.502.66140041 0.300.38 0.0028 0.00750230 02000 23001011100110 0.90500000000003055140903663216240.00022 0.2220023 02210102202287015011660117401725 9 10 11 12 19 14 0.0200.1504751 0.01300.350500237502007020210194 2010.08.2005 0878000405180440039711.35680.21 029 0256702702078018118011226070109 077701010 0.00 0.00 5180455003770322 0.28970257502292 02101101010 01010000000000000 0.870 0904611057781501 1.42 0.7 0.340812922 031 0.222002046 287 0.1970.100 2.1252 009 01.04001254 098001000190585304173 032 0349212785020020000.11827150010122100000019200195 el 15 $ 0.0521 07240220.530 1.50 330.000 029 02519 02178 1800 11001 11415 0.1223 0.10 0.1920 015 013201120101150 11 0.3407100.00051341.00 1.374002700 12001 1970 11150122.07.2012 061 0.125 0.022500116 ninama 1981 11000549 058 00 17 032 031520276 02380 02000018272199001001 0.1229 2.1179 180.008 0.005200195 11 1 0152072 205379541033303381 122 1219 02178 2180 21001 2145 1.122 0.100 1.1920 015161201120100150 030NQ 1.500.5134 0.00 0.37140319 02700020110978 0.18 0.18 21282 0.807200829 LN2 061 0.025 0.022800118 139020517408304155351002000250202120179 1.1528111000 1100137012080180 000 0127 0986157000.01638671030502788 02217.15 0.16350070116100.000 150.0160.000 0.819516730098070.55403703710025340215 17.10.200.1037 089800720081111510120100138 0.0115 00050 21 22 23 03114115175 0.0009512300015 2.1907 110701051011170092890000601401217 2010 1.002 0.0040 0.00040546805299 0.0200.218027790725701801512012280.007000316800.15000062013120.1481 0.0088 087400031 0.794 000 0.0005 0.82980200210001700013780.1110.007301001 0.01 0.04121132901151 0.0071 0.00 0.0024 07280011 000.01 0.3101024100371 0.15770125421000170069 02 00010030112010005 0.14 0.0018 706095016037510220002000090 0.146011900182300738 0.053010070030010011050.006 0.0000014 24 > . . RG 071190921041200.0000211114100140.195407540067301020034012980015001510010000000016 0.0012 07080.50000.3554025341100001 0.007 0.6781000000.129001010000112 0.0075.1058 0.007 0.0005 000120020101727012270087506281013230124000 230.0065 N 00014 . 1.571118290201011002 0.0002 0.06 0901221 0.0154 0.010 ENTS 0.000 0.00 120.000 SON 0.3715022010.100700872 10100120101340.100.150.00382 0.00140.0001006 . . . . . QUESTION 4 (25 MARKS) Harta Bhd leases its luxurious condominiums to some celebrities at below market price. It is as an incentive to the contract of employment between Butik Husna with the celebrities. They are the models of various apparel and accessories. Harta Bhd is considering to treat these condominiums as investment properties. The difference between the market and actual rental will be written off in the statement of profit or loss as employee Melorefit expenses. (4 marks) (CLO1:PLOI:C3) Harta Bhd acquired a piece of land for RM200 million on 1 January 2015. The land was classified as investment property and measured at cost. On 1 January 2019, Harta Bhd changed to fair value measurement for the land. It was able to derive the fair values of the land effective on 31 December 2018 which was RM290 million. The fair value of the land on 31st December 2019 was RM313 million. There was no tax suffered on fair value changes or on sale of the land. classified as investment property and measured at cost. On 1 January 2019, Harta Bhd changed to fair value measurement for the land. It was able to derive the fair values of the land effective on 31 December 2018 which was RM290 million. The fair value of the land on 31st December 2019 was RM313 million. There was no tax suffered on fair value changes or on sale of the land. (9 marks) (CLO1:PLO1:04) Harta Bhd Bhd had used an office building for administrative purposes with a depreciated cost of historical cost of RM3.6 million on 1 April 2019 with a remaining life of 20 years. There were some reorganizations to Harta's properties during the year of 2019. The office building was rented to a third party and reclassified as an investment property applying the fair value on 1 October 2019. Harta Bhd had consulted an independent professional assessor valued on the property. The fair value of the building was valued at RM4.14 million at October 2019 by the assessor. This value rose further to RM4.212 million at 31 March 2020. (12 marks) (CLO1:PL01:06) Required: Discuss the accounting treatment of the above scenarios in accordance to the relevant MFRS. Show the effects to the financial statements of Kaya Bhd. Marks as allocated (CLO1:PLO1:C6) Required: Discuss the accounting treatment of the above scenarios in accordance to the relevant MFRS. Show the effects to the financial statements of Kaya Bhd. Marks as allocated ACCT2131/June 2020 Page 6 of 8 APPENDICE: Table A3 Present Value Interest Factors for One Dollar Discounted atk Percent for n Periods: PUF, 1/1988]" Period 1 X X ANN 111 18 19 215 21 25% 109109804 1970 09615 096202344 09346 0.3290 191140.9691 0.910 1989 19880087720884 1821 080806580000782 2 098005120500321810190004 015730100310792070107907910020068015410 0597 197819151 LLON 1998 0.750 073121101 1.570 105518407 0.57705085151204552 4 098100523818801548027 1722101207070683008705750913005321 0571819920020423003501 5 09615 09657 101219 070 071906.80615062090901571150051 06724001903411702080 6 7 . 0.500 1800 117078076217050080136002150055 0.52615060.000 1.4556 1021111 0000002751 022102172 0907070107909071071.8631062209250.500.502141618230.01 0.300.379 09002791 022180291019 0.323500570730719740920 0.540 1.9019 0.16 0.00 0.00 0.035 0.320030800238 0.17 0.16780123 0.910 0.7028 15419990.50 0.502.66140041 0.300.38 0.0028 0.00750230 02000 23001011100110 0.90500000000003055140903663216240.00022 0.2220023 02210102202287015011660117401725 9 10 11 12 19 14 0.0200.1504751 0.01300.350500237502007020210194 2010.08.2005 0878000405180440039711.35680.21 029 0256702702078018118011226070109 077701010 0.00 0.00 5180455003770322 0.28970257502292 02101101010 01010000000000000 0.870 0904611057781501 1.42 0.7 0.340812922 031 0.222002046 287 0.1970.100 2.1252 009 01.04001254 098001000190585304173 032 0349212785020020000.11827150010122100000019200195 el 15 $ 0.0521 07240220.530 1.50 330.000 029 02519 02178 1800 11001 11415 0.1223 0.10 0.1920 015 013201120101150 11 0.3407100.00051341.00 1.374002700 12001 1970 11150122.07.2012 061 0.125 0.022500116 ninama 1981 11000549 058 00 17 032 031520276 02380 02000018272199001001 0.1229 2.1179 180.008 0.005200195 11 1 0152072 205379541033303381 122 1219 02178 2180 21001 2145 1.122 0.100 1.1920 015161201120100150 030NQ 1.500.5134 0.00 0.37140319 02700020110978 0.18 0.18 21282 0.807200829 LN2 061 0.025 0.022800118 139020517408304155351002000250202120179 1.1528111000 1100137012080180 000 0127 0986157000.01638671030502788 02217.15 0.16350070116100.000 150.0160.000 0.819516730098070.55403703710025340215 17.10.200.1037 089800720081111510120100138 0.0115 00050 21 22 23 03114115175 0.0009512300015 2.1907 110701051011170092890000601401217 2010 1.002 0.0040 0.00040546805299 0.0200.218027790725701801512012280.007000316800.15000062013120.1481 0.0088 087400031 0.794 000 0.0005 0.82980200210001700013780.1110.007301001 0.01 0.04121132901151 0.0071 0.00 0.0024 07280011 000.01 0.3101024100371 0.15770125421000170069 02 00010030112010005 0.14 0.0018 706095016037510220002000090 0.146011900182300738 0.053010070030010011050.006 0.0000014 24 > . . RG 071190921041200.0000211114100140.195407540067301020034012980015001510010000000016 0.0012 07080.50000.3554025341100001 0.007 0.6781000000.129001010000112 0.0075.1058 0.007 0.0005 000120020101727012270087506281013230124000 230.0065 N 00014 . 1.571118290201011002 0.0002 0.06 0901221 0.0154 0.010 ENTS 0.000 0.00 120.000 SON 0.3715022010.100700872 10100120101340.100.150.00382 0.00140.0001006