FAST PLS ANSWER ALL CLEAR !!!!

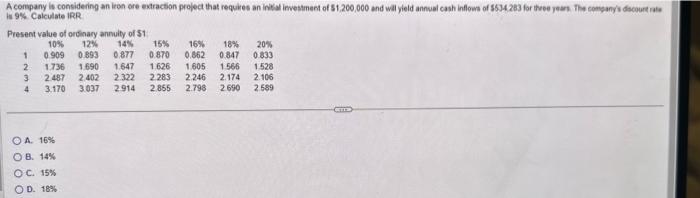

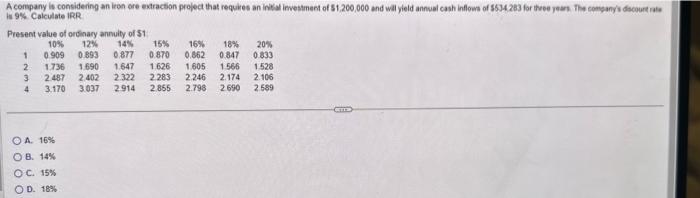

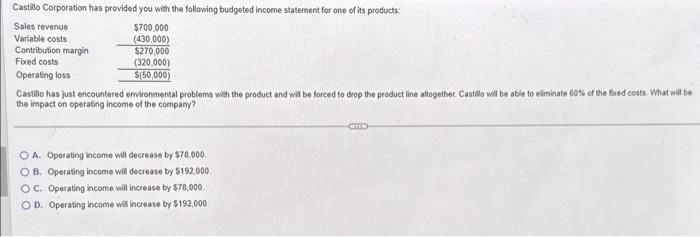

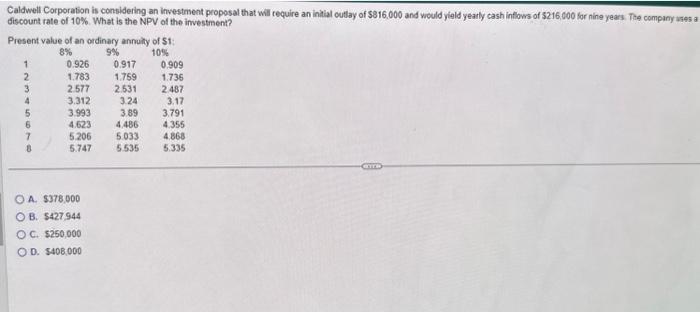

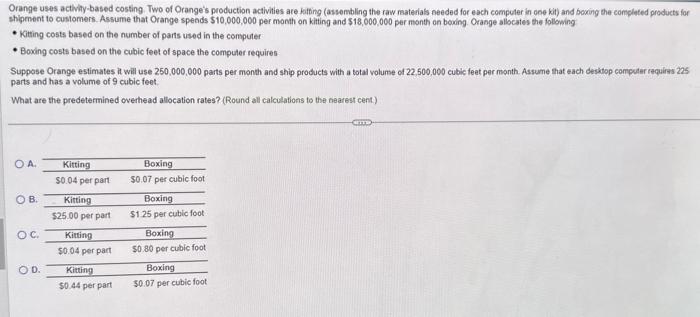

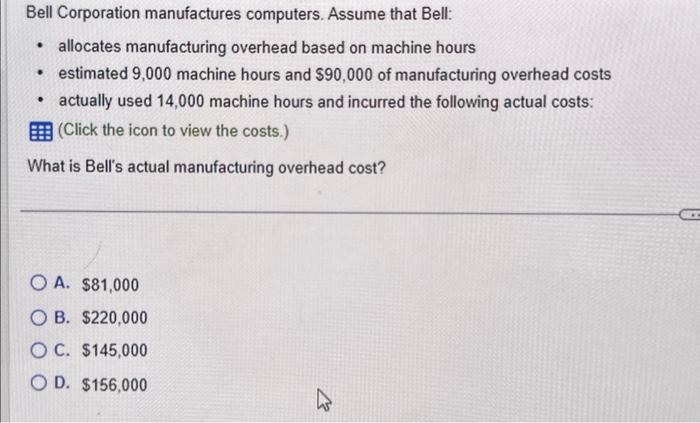

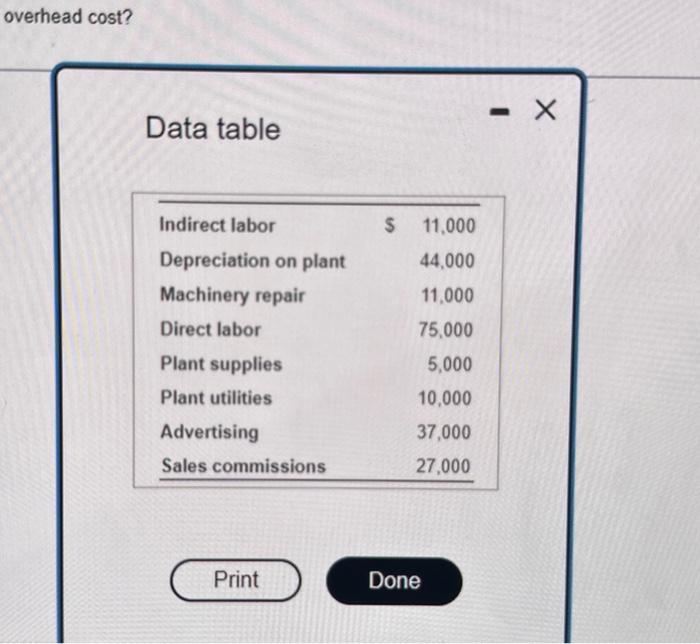

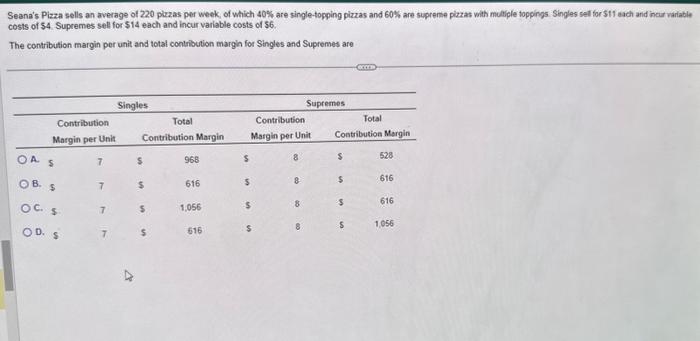

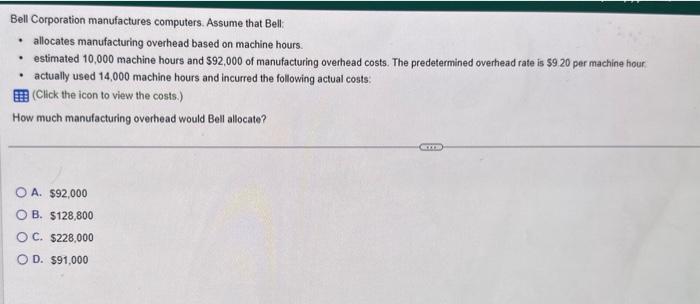

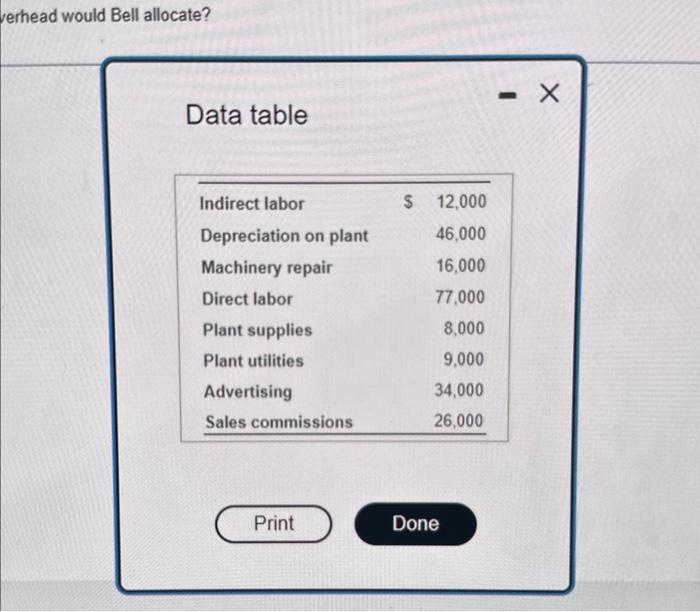

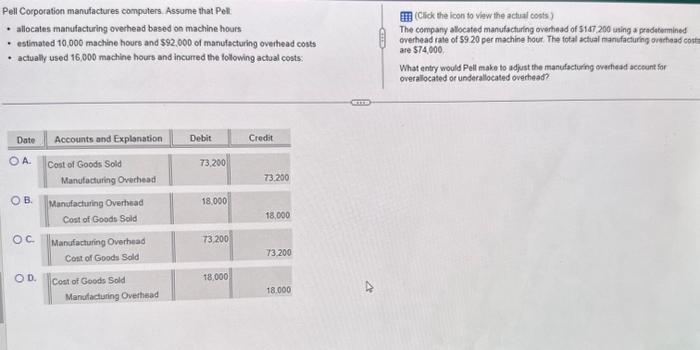

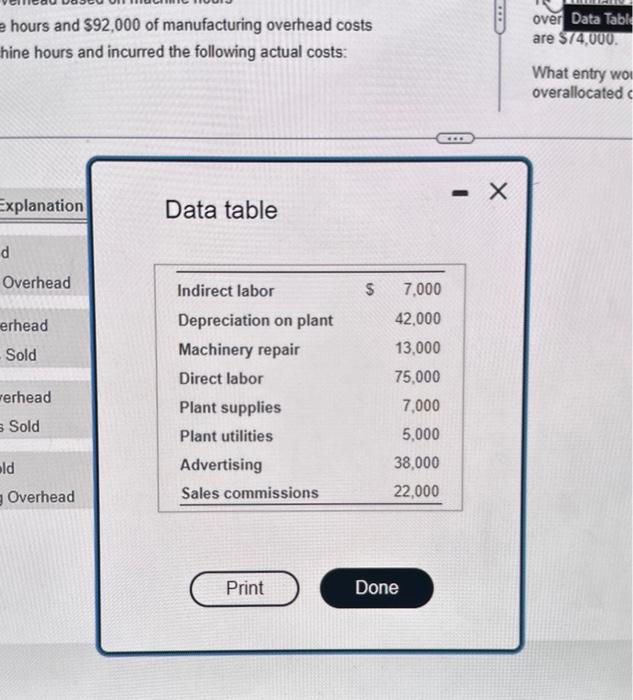

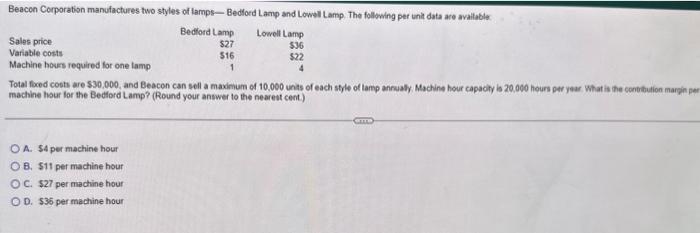

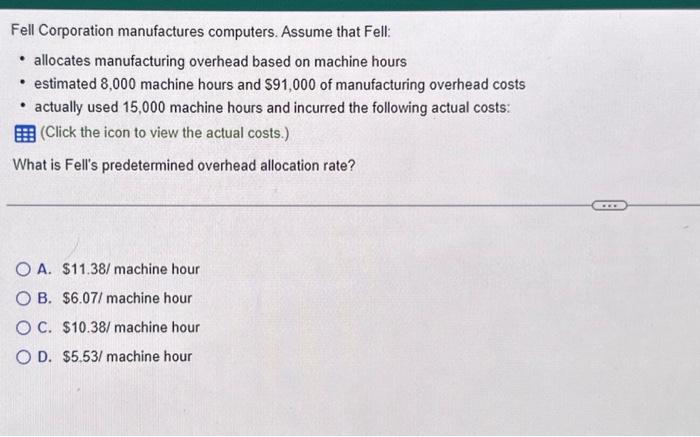

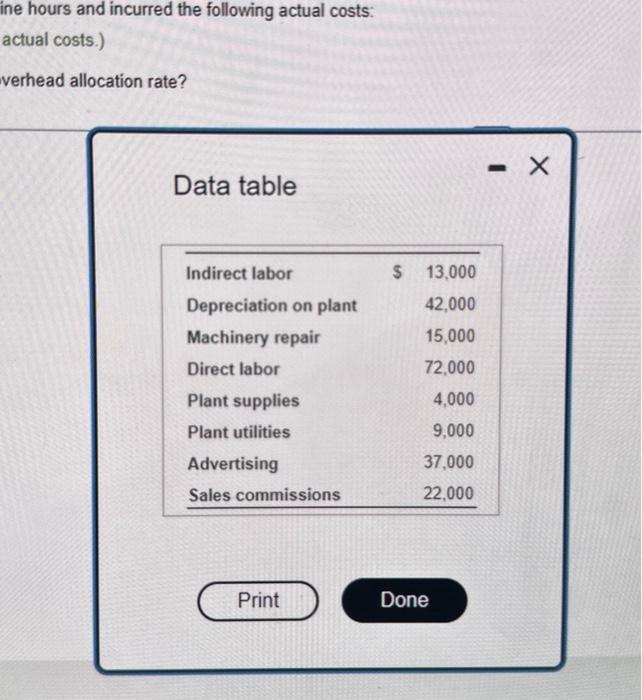

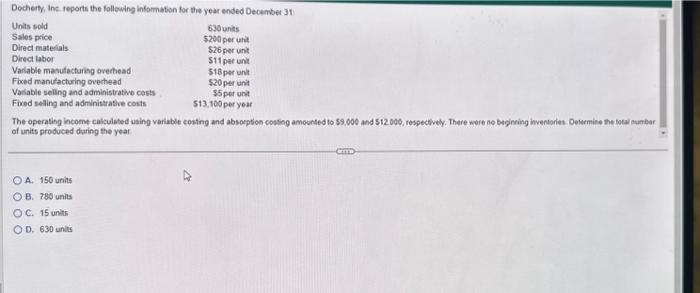

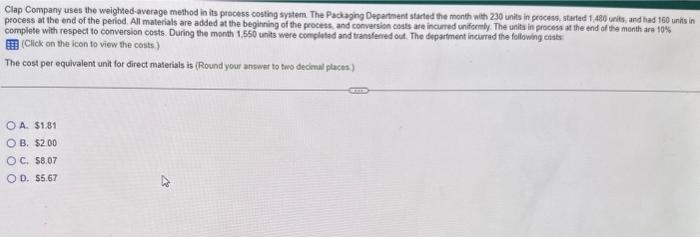

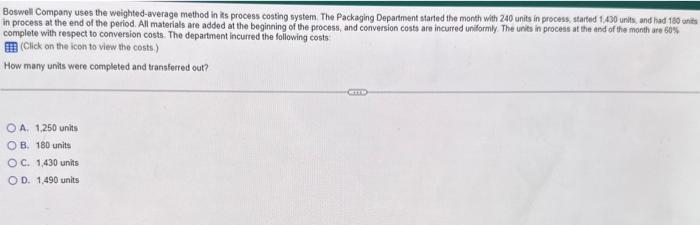

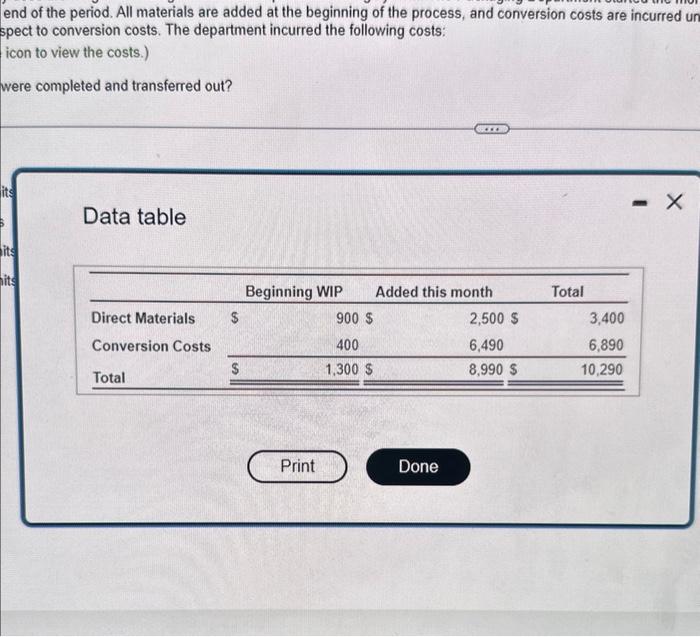

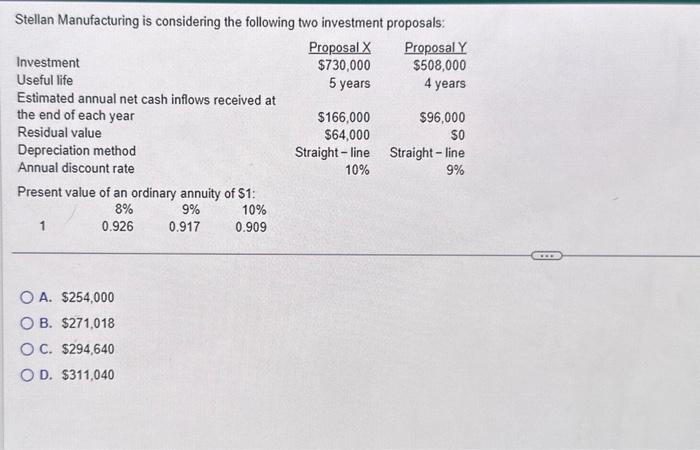

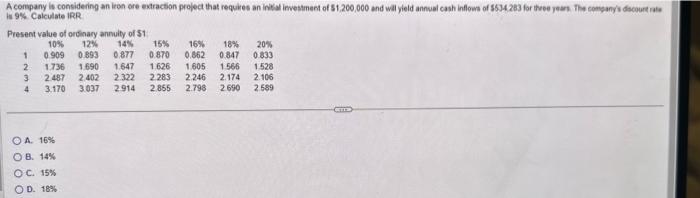

A. \16 B. \14 c. \15 D. \18 Castillo Corporation has provided you with the following budgeted income statement for one of its products: Castillo has just encountered emironmental problems with the product and wai be forced to drop the product line allogether. Castallo will be able to elminate 60 s of the ficed costs. What will be the impact on operating income of the company? A. Operating income will decrease by \\( \\$ 78,000 \\). B. Operating income will decrease by \\( \\$ 192,000 \\) C. Operating hcome will increase by \\( \\$ 78,000 \\). D. Operating income will increase by \\( \\$ 192,000 \\) A. Operating income will decrease by \\( \\$ 18.450 \\). B. Operating income will increase by \\( \\$ 26,250 \\), C. Operating income will decrease by \\$26,250. D. Operating income will increase by \\( \\$ 18,450 \\) Caldwell Corporation is considering an investment proposal that will require an initial cutlay of \\( \\$ 816,000 \\) and would yield yearly cash inflows of \\( \\$ 216 \\), 000 for nine years. The company wses a discount rate of \10. What is the NPV of the investment? A. \\( \\$ 378,000 \\) B. \\( \\$ 427,944 \\) C. \\( \\$ 250,000 \\) D. \\( \\$ 406,000 \\) Bell Corporation manufactures computers. Assume that Bell: - allocates manufacturing overhead based on machine hours - estimated 9,000 machine hours and \\( \\$ 90,000 \\) of manufacturing overhead costs - actually used 14,000 machine hours and incurred the following actual costs: (Click the icon to view the costs.) What is Bell's actual manufacturing overhead cost? A. \\( \\$ 81,000 \\) B. \\( \\$ 220,000 \\) C. \\( \\$ 145,000 \\) D. \\( \\$ 156,000 \\) Seana's Pizza sells an average of 220 pizzas per week, of which \40 are single-topping pizzas and \60 are suprene pizzas with mulliple toppings. Singles sel for \\( \\$ 11 \\) ach and incar varlable costs of \\( \\$ 4 \\). Supremes sell for \\( \\$ 14 \\) each and incur variable costs of \\( \\$ 6 \\). The contribution margin per unit and total contribution margh for Singles and Supremes are Bell Corporation manufactures computers. Assume that Bell: - allocates manufacturing overhead based on machine hours. - estimated 10,000 machine hours and \\( \\$ 92,000 \\) of manufacturing overhead costs. The predetermined overhead rate is \\( \\$ 9.20 \\) per machine hour - actually used 14,000 machine hours and incurred the following actual costs: (Click the icon to view the costs.) How much manufacturing overhead would Bell allocate? A. \\( \\$ 92,000 \\) B. \\( \\$ 128,800 \\) C. \\( \\$ 228,000 \\) D. \\( \\$ 91,000 \\) verhead would Bell allocate? Pell Corporation manufactures computers. Assume that Pel: - allocates manufacturing overhead based on machine hours - estimated 10,000 machine hours and \\$92,000 of manufacturing overhead costs - actually used 16,000 machine hours and incurred the following actual costs: (Click the icon to viaw the achual costs) The company allocated manufacturing overhead of \\( \\$ 147,200 \\) using a pradetermined everhead rate of \\( \\$ 9.20 \\) per machine hour. The fotal actual manufacturng ovarhead cost are 574,000 . What entry would Pell make to adjust the manufacturng overhead acceunt for overallocated of underallocated overhead? Total foced costs are \\( \\$ 30,000 \\), and Beacon can sell a maximum of 10,000 units of each style of lamp annusly. Machine hour capachy is 20,000 hours per year What is the contitution margin pe machine hour for the Bedford Lamp? (Round your answer to the nearest cent) A. \\( \\$ 4 \\) per machine hour B. \\( \\$ 11 \\) per machine hour C. \\( \\$ 27 \\) per machine hour D. \\( \\$ 35 \\) per machine hour Fell Corporation manufactures computers. Assume that Fell: - allocates manufacturing overhead based on machine hours - estimated 8,000 machine hours and \\( \\$ 91,000 \\) of manufacturing overhead costs - actually used 15,000 machine hours and incurred the following actual costs: (Click the icon to view the actual costs.) What is Fell's predetermined overhead allocation rate? A. \\( \\$ 11.38 / \\) machine hour B. \\( \\$ 6.07 / \\) machine hour C. \\( \\$ 10.38 / \\) machine hour D. \\( \\$ 5.53 / \\) machine hour ine hours and incurred the following actual costs: actual costs.) verhead allocation rate? Docherty, Inc. reports the follewing information for the year ended Decenver 31 of units produced during the year A. 150 units B. 780 units C. 15 units D. 630 units Boswell Company uses the weighted-average method in is process costing system. Tho Packaging Department started the month with 240 units in process, started 1.430 units, and had 180 anits in process at the end of the period. All materials are added at the beginning of the process, and conversion costs are incurred unilormly. The units in process at the end of the month are 60\\% complete with respect to conversion costs. The department incurred the following costs (Click on the icon to view the costs.) How many units were completed and transferred out? A. 1,250 units B. 180 units C. 1,430 units D. 1,490 units end of the period. All materials are added at the beginning of the process, and conversion costs are incurred ur pect to conversion costs. The department incurred the following costs: icon to view the costs.) vere completed and transferred out? Data table Stellan Manufacturing is considering the following two investment proposals: Present value of an ordinary annuity of \\$1: A. \\( \\$ 254,000 \\) B. \\( \\$ 271,018 \\) C. \\( \\$ 294,640 \\) D. \\( \\$ 311,040 \\)