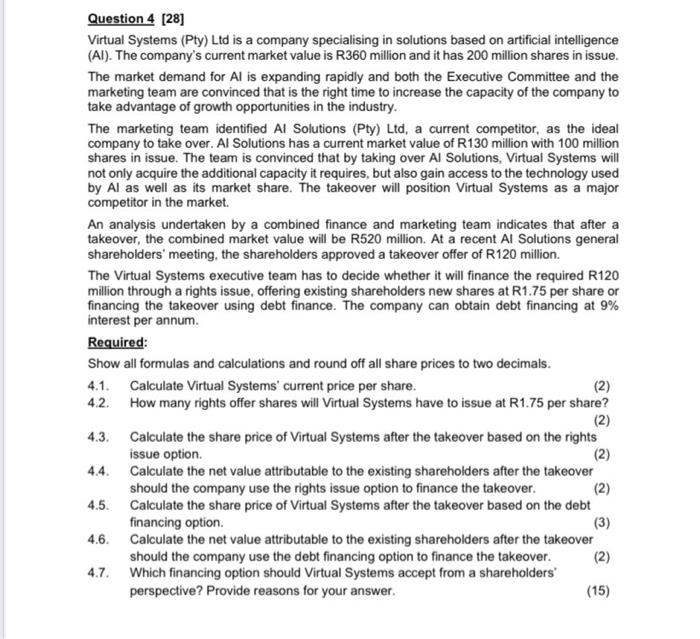

Question 4 (28) Virtual Systems (Pty) Ltd is a company specialising in solutions based on artificial intelligence (AI). The company's current market value is R360 million and it has 200 million shares in issue. The market demand for Al is expanding rapidly and both the Executive Committee and the marketing team are convinced that is the right time to increase the capacity of the company to take advantage of growth opportunities in the industry. The marketing team identified Al Solutions (Pty) Ltd, a current competitor, as the ideal company to take over. Al Solutions has a current market value of R130 million with 100 million shares in issue. The team is convinced that by taking over Al Solutions, Virtual Systems will not only acquire the additional capacity it requires, but also gain access to the technology used by Al as well as its market share. The takeover will position Virtual Systems as a major competitor in the market. An analysis undertaken by a combined finance and marketing team indicates that after a takeover, the combined market value will be R520 million. At a recent Al Solutions general shareholders' meeting, the shareholders approved a takeover offer of R120 million. The Virtual Systems executive team has to decide whether it will finance the required R120 million through a rights issue, offering existing shareholders new shares at R1.75 per share or financing the takeover using debt finance. The company can obtain debt financing at 9% interest per annum Required: Show all formulas and calculations and round off all share prices to two decimals. 4.1. Calculate Virtual Systems' current price per share. (2) 4.2. How many rights offer shares will Virtual Systems have to issue at R1.75 per share? (2) 4.3. Calculate the share price of Virtual Systems after the takeover based on the rights issue option. (2) 4.4. Calculate the net value attributable to the existing shareholders after the takeover should the company use the rights issue option to finance the takeover. (2) 4.5. Calculate the share price of Virtual Systems after the takeover based on the debt financing option. (3) 4.6. Calculate the net value attributable to the existing shareholders after the takeover should the company use the debt financing option to finance the takeover. (2) 4.7. Which financing option should Virtual Systems accept from a shareholders' perspective? Provide reasons for your answer. (15)