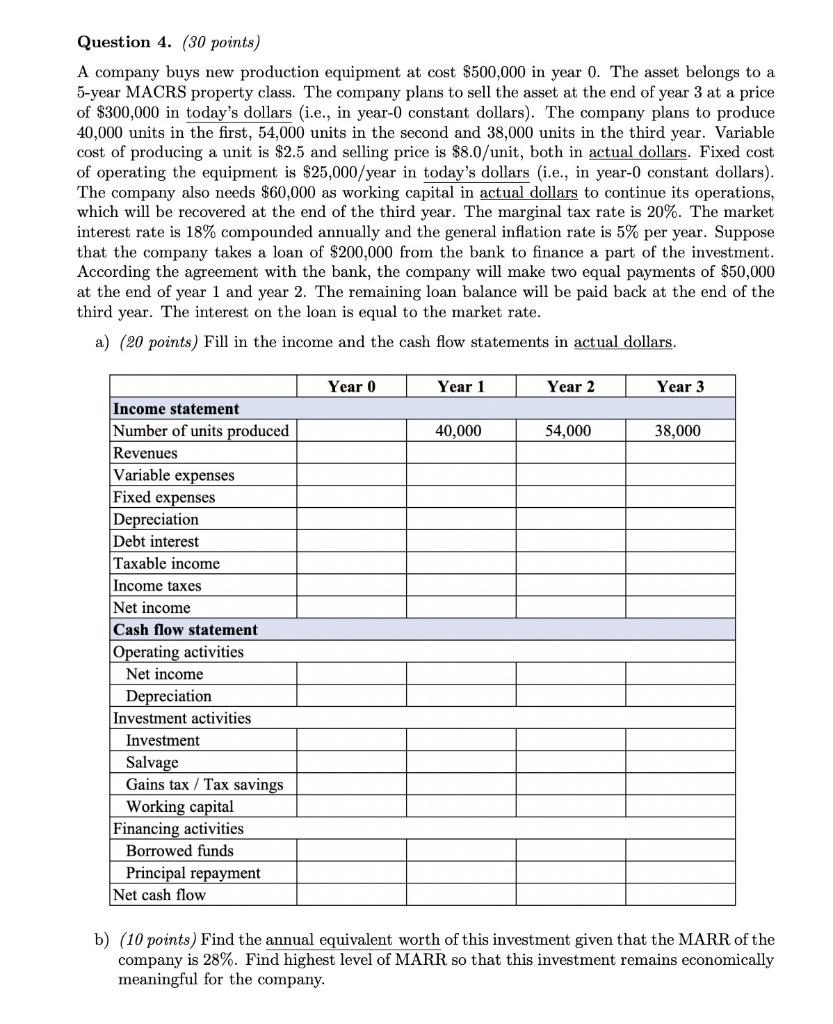

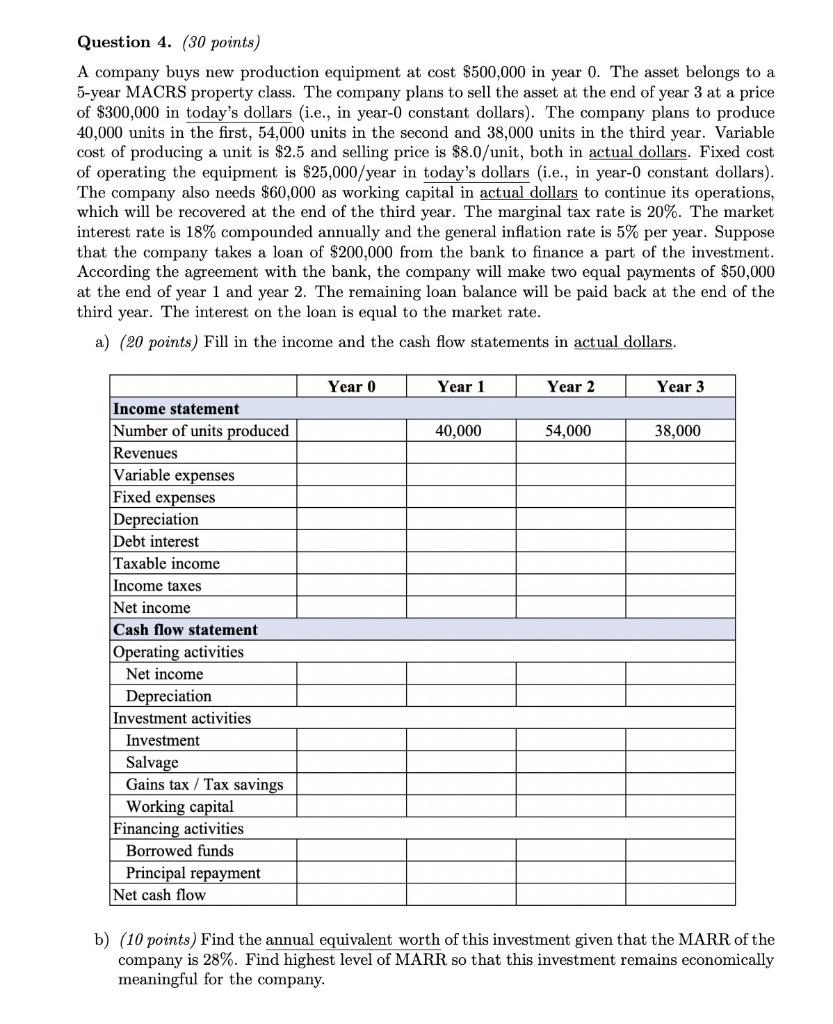

Question 4. (30 points) A company buys new production equipment at cost $500,000 in year 0. The asset belongs to a 5-year MACRS property class. The company plans to sell the asset at the end of year 3 at a price of $300,000 in today's dollars (i.e., in year-0 constant dollars). The company plans to produce 40,000 units in the first, 54,000 units in the second and 38,000 units in the third year. Variable cost of producing a unit is $2.5 and selling price is $8.0/unit, both in actual dollars. Fixed cost of operating the equipment is $25,000/year in today's dollars (i.e., in year-0 constant dollars). The company also needs $60,000 as working capital in actual dollars to continue its operations, which will be recovered at the end of the third year. The marginal tax rate is 20%. The market interest rate is 18% compounded annually and the general inflation rate is 5% per year. Suppose that the company takes a loan of $200,000 from the bank to finance a part of the investment. According the agreement with the bank, the company will make two equal payments of $50,000 at the end of year 1 and year 2. The remaining loan balance will be paid back at the end of the third year. The interest on the loan is equal to the market rate. a) (20 points) Fill in the income and the cash flow statements in actual dollars. Year 0 Year 1 Year 2 Year 3 40,000 54,000 38,000 Income statement Number of units produced Revenues Variable expenses Fixed expenses Depreciation Debt interest Taxable income Income taxes Net income Cash flow statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax / Tax savings Working capital Financing activities Borrowed funds Principal repayment Net cash flow b) (10 points) Find the annual equivalent worth of this investment given that the MARR of the company is 28%. Find highest level of MARR so that this investment remains economically meaningful for the company. Question 4. (30 points) A company buys new production equipment at cost $500,000 in year 0. The asset belongs to a 5-year MACRS property class. The company plans to sell the asset at the end of year 3 at a price of $300,000 in today's dollars (i.e., in year-0 constant dollars). The company plans to produce 40,000 units in the first, 54,000 units in the second and 38,000 units in the third year. Variable cost of producing a unit is $2.5 and selling price is $8.0/unit, both in actual dollars. Fixed cost of operating the equipment is $25,000/year in today's dollars (i.e., in year-0 constant dollars). The company also needs $60,000 as working capital in actual dollars to continue its operations, which will be recovered at the end of the third year. The marginal tax rate is 20%. The market interest rate is 18% compounded annually and the general inflation rate is 5% per year. Suppose that the company takes a loan of $200,000 from the bank to finance a part of the investment. According the agreement with the bank, the company will make two equal payments of $50,000 at the end of year 1 and year 2. The remaining loan balance will be paid back at the end of the third year. The interest on the loan is equal to the market rate. a) (20 points) Fill in the income and the cash flow statements in actual dollars. Year 0 Year 1 Year 2 Year 3 40,000 54,000 38,000 Income statement Number of units produced Revenues Variable expenses Fixed expenses Depreciation Debt interest Taxable income Income taxes Net income Cash flow statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax / Tax savings Working capital Financing activities Borrowed funds Principal repayment Net cash flow b) (10 points) Find the annual equivalent worth of this investment given that the MARR of the company is 28%. Find highest level of MARR so that this investment remains economically meaningful for the company