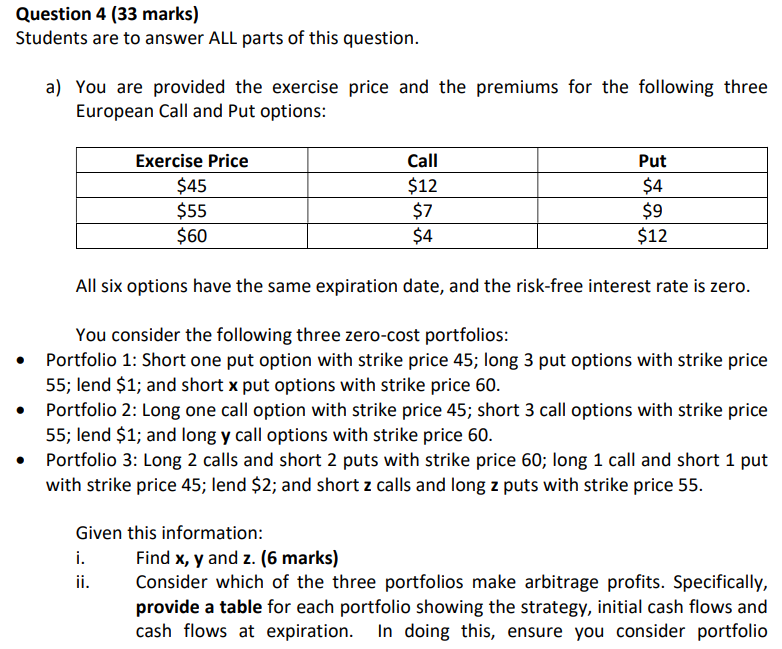

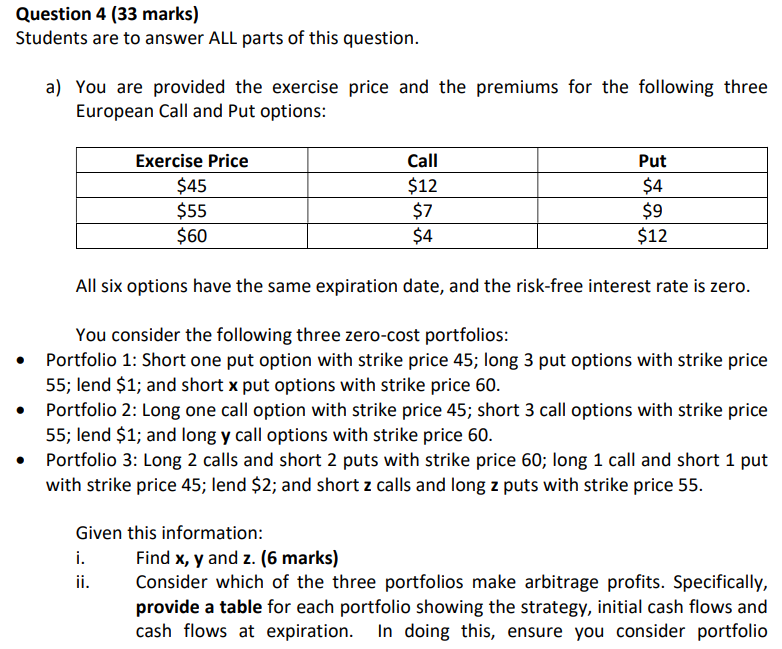

Question 4 (33 marks) Students are to answer ALL parts of this question. a) You are provided the exercise price and the premiums for the following three European Call and Put options: Exercise Price Call Put $45 $12 $4 $55 $7 $9 $60 $4 $12 All six options have the same expiration date, and the risk-free interest rate is zero. You consider the following three zero-cost portfolios: Portfolio 1: Short one put option with strike price 45; long 3 put options with strike price 55; lend $1; and short x put options with strike price 60. Portfolio 2: Long one call option with strike price 45; short 3 call options with strike price 55; lend $1; and long y call options with strike price 60. Portfolio 3: Long 2 calls and short 2 puts with strike price 60; long 1 call and short 1 put with strike price 45; lend $2; and short z calls and long z puts with strike price 55. Given this information: i. Find x, y and z. (6 marks) ii. Consider which of the three portfolios make arbitrage profits. Specifically, provide a table for each portfolio showing the strategy, initial cash flows and cash flows at expiration. In doing this, ensure you consider portfolio performance when the exercise price is less than $45 (St $60). Make sure you specify which portfolio(s) would make arbitrage profits, and why. (15 marks) Question 4 (33 marks) Students are to answer ALL parts of this question. a) You are provided the exercise price and the premiums for the following three European Call and Put options: Exercise Price Call Put $45 $12 $4 $55 $7 $9 $60 $4 $12 All six options have the same expiration date, and the risk-free interest rate is zero. You consider the following three zero-cost portfolios: Portfolio 1: Short one put option with strike price 45; long 3 put options with strike price 55; lend $1; and short x put options with strike price 60. Portfolio 2: Long one call option with strike price 45; short 3 call options with strike price 55; lend $1; and long y call options with strike price 60. Portfolio 3: Long 2 calls and short 2 puts with strike price 60; long 1 call and short 1 put with strike price 45; lend $2; and short z calls and long z puts with strike price 55. Given this information: i. Find x, y and z. (6 marks) ii. Consider which of the three portfolios make arbitrage profits. Specifically, provide a table for each portfolio showing the strategy, initial cash flows and cash flows at expiration. In doing this, ensure you consider portfolio performance when the exercise price is less than $45 (St $60). Make sure you specify which portfolio(s) would make arbitrage profits, and why. (15 marks)