Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #4 (5 points) The following common stocks are available for investment: COMMON STOCK (Ticker Symbol) Nanyang Business Systems (NBS) Yunnan Garden Supply, Inc. (YUWHO)

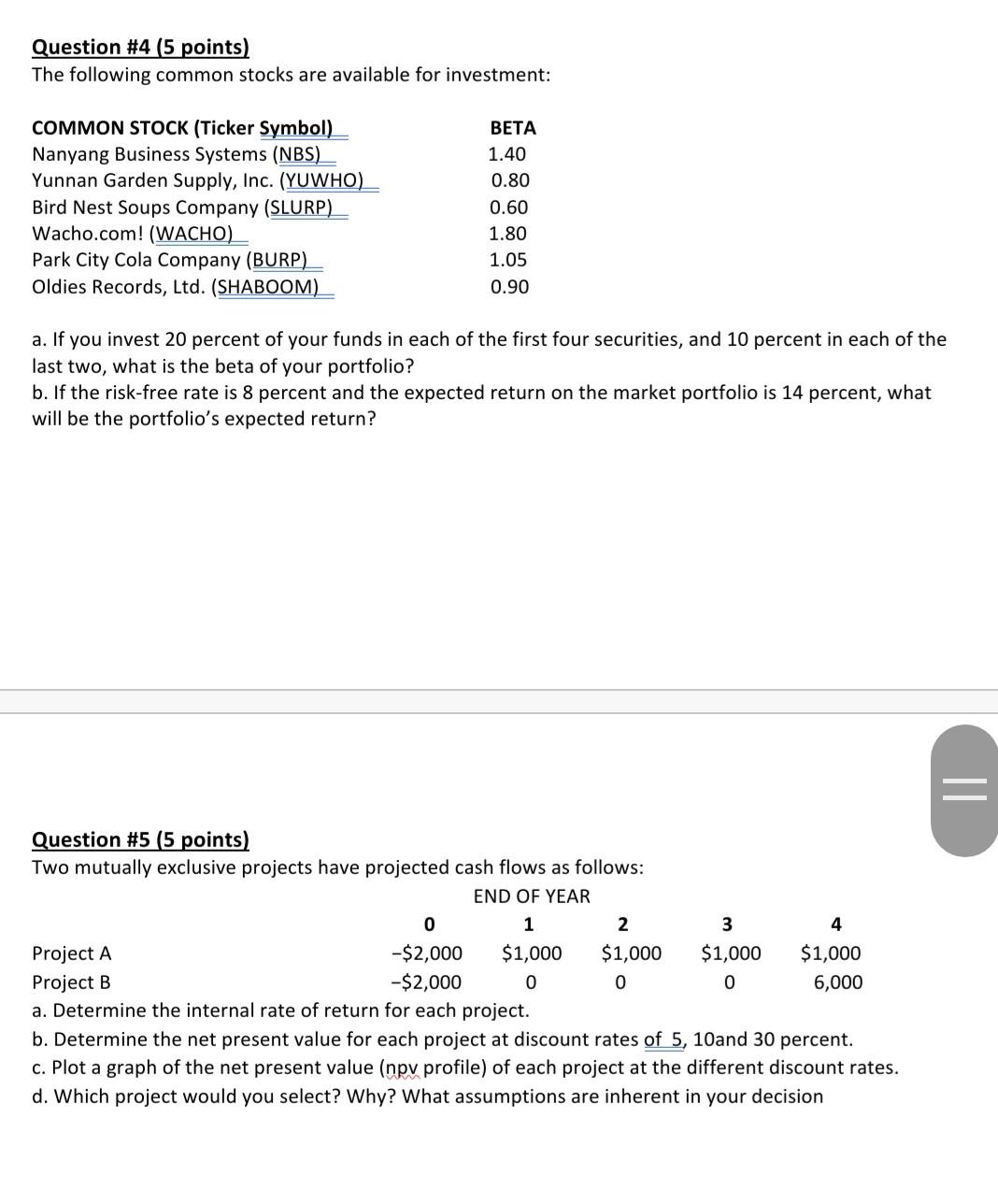

Question #4 (5 points) The following common stocks are available for investment: COMMON STOCK (Ticker Symbol) Nanyang Business Systems (NBS) Yunnan Garden Supply, Inc. (YUWHO) Bird Nest Soups Company (SLURP) Wacho.com! (WACHO) Park City Cola Company (BURP) Oldies Records, Ltd. (SHABOOM) BETA 1.40 0.80 0.60 1.80 1.05 0.90 a. If you invest 20 percent of your funds in each of the first four securities, and 10 percent in each of the last two, what is the beta of your portfolio? b. If the risk-free rate is 8 percent and the expected return on the market portfolio is 14 percent, what will be the portfolio's expected return? Question #5 (5 points) Two mutually exclusive projects have projected cash flows as follows: END OF YEAR 0 1 2 3 4 Project A -$2,000 $1,000 $1,000 $1,000 $1,000 Project B -$2,000 0 0 0 6,000 a. Determine the internal rate of return for each project. b. Determine the net present value for each project at discount rates of 5, 10and 30 percent. c. Plot a graph of the net present value (npv profile) of each project at the different discount rates. d. Which project would you select? Why? What assumptions are inherent in your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started