Question

Question 4 a) Complete the following Table. The interest rate parity model is to be used to consider the impacts of changes in the economic

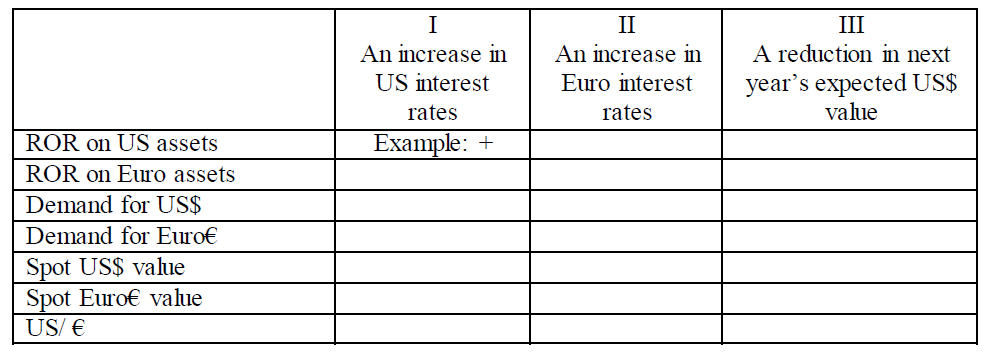

Question 4 a) Complete the following Table. The interest rate parity model is to be used to consider the impacts of changes in the economic conditions and investment returns (ROR). Use the following notation: + the variable increases - the variable decreases 0 the variable does not change A the variable change is ambiguous (i.e. it may rise, it may fall)

b) Consider the following data of interest rates and exchange rates in Malaysia and Singapore. Assuming risks are similar, show your calculation to justify if a foreign investor is to invest in the Malaysian or Singaporean financial market? iMalaysia = 3.5% per year iSingapore = 3.0% per year RM/US$2007 = 3.5 RM/US$2008 = 3.4 SG$/US$2007 = 1.5 SG$/US$2008 = 1.4 b) Using appropriate diagram and based on the interest rate parity condition, explain the effects of changes in the US interest rates on the spot US$/ exchange rate. c) Discuss about the practice of Yen Carry Trade in international investment.

ROR on US assets ROR on Euro assets Demand for US$ Demand for Euro Spot US$ value Spot Euro value US/ A reduction in next An increase in An increase in Euro interest year's expected US$ US interest value rates rates eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started