Question: QUESTION 4 A . Dren Industries is considering expanding into a new product line. Earnings per share are expected to be $ 5 in the

QUESTION

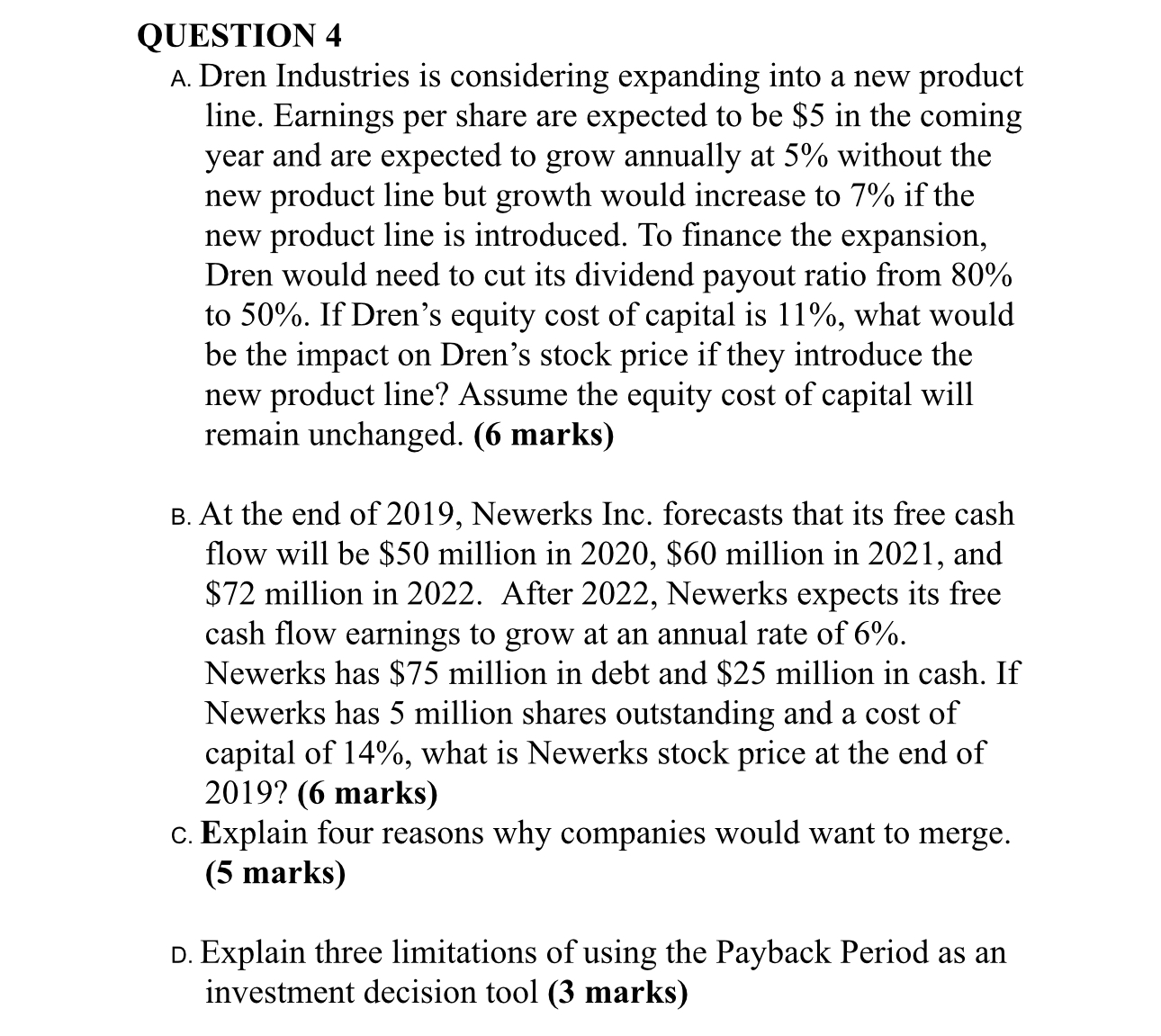

A Dren Industries is considering expanding into a new product line. Earnings per share are expected to be $ in the coming year and are expected to grow annually at without the new product line but growth would increase to if the new product line is introduced. To finance the expansion, Dren would need to cut its dividend payout ratio from to If Dren's equity cost of capital is what would be the impact on Dren's stock price if they introduce the new product line? Assume the equity cost of capital will remain unchanged. marks

B At the end of Newerks Inc. forecasts that its free cash flow will be $ million in $ million in and $ million in After Newerks expects its free cash flow earnings to grow at an annual rate of

Newerks has $ million in debt and $ million in cash. If Newerks has million shares outstanding and a cost of capital of what is Newerks stock price at the end of marks

c Explain four reasons why companies would want to merge. marks

D Explain three limitations of using the Payback Period as an investment decision tool marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock