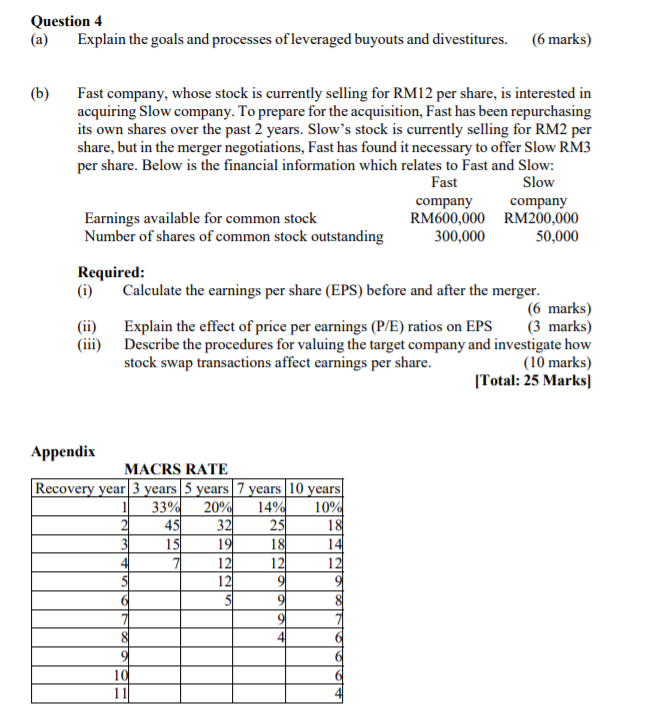

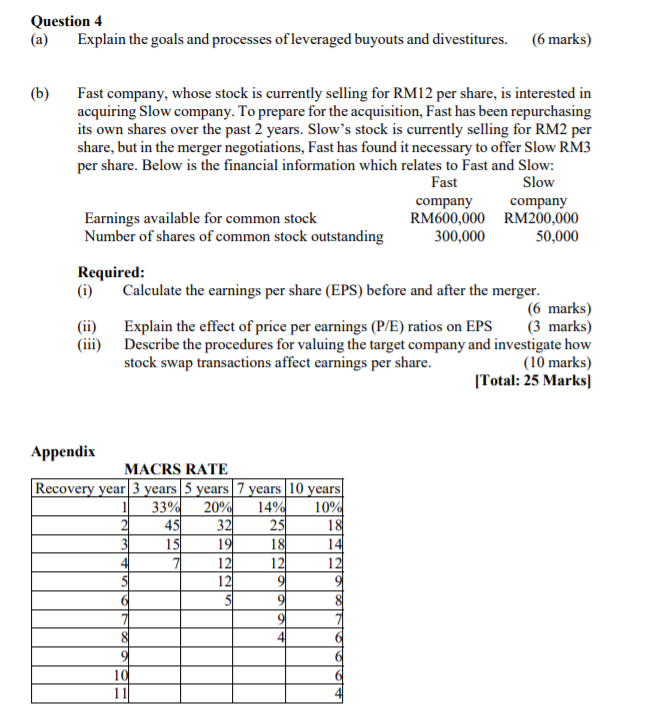

Question 4 (a) Explain the goals and processes of leveraged buyouts and divestitures. (6 marks) (b) Fast company, whose stock is currently selling for RM12 per share, is interested in acquiring Slow company. To prepare for the acquisition, Fast has been repurchasing its own shares over the past 2 years. Slow's stock is currently selling for RM2 per share, but in the merger negotiations, Fast has found it necessary to offer Slow RM3 per share. Below is the financial information which relates to Fast and Slow: Fast Slow company company Earnings available for common stock RM600,000 RM200,000 Number of shares of common stock outstanding 300,000 50,000 Required: Calculate the earnings per share (EPS) before and after the merger. (6 marks) (ii) Explain the effect of price per earnings (P/E) ratios on EPS (3 marks) (iii) Describe the procedures for valuing the target company and investigate how stock swap transactions affect earnings per share. (10 marks) [Total: 25 Marks (1) Appendix MACRS RATE Recovery year 3 years 5 years 7 years 10 years 11 33% 20% 14% 10% 21 451 32 251 18 31 151 19 18 141 12 12 12 12 9 9 ol 7 81 6 10 11 Question 4 (a) Explain the goals and processes of leveraged buyouts and divestitures. (6 marks) (b) Fast company, whose stock is currently selling for RM12 per share, is interested in acquiring Slow company. To prepare for the acquisition, Fast has been repurchasing its own shares over the past 2 years. Slow's stock is currently selling for RM2 per share, but in the merger negotiations, Fast has found it necessary to offer Slow RM3 per share. Below is the financial information which relates to Fast and Slow: Fast Slow company company Earnings available for common stock RM600,000 RM200,000 Number of shares of common stock outstanding 300,000 50,000 Required: Calculate the earnings per share (EPS) before and after the merger. (6 marks) (ii) Explain the effect of price per earnings (P/E) ratios on EPS (3 marks) (iii) Describe the procedures for valuing the target company and investigate how stock swap transactions affect earnings per share. (10 marks) [Total: 25 Marks (1) Appendix MACRS RATE Recovery year 3 years 5 years 7 years 10 years 11 33% 20% 14% 10% 21 451 32 251 18 31 151 19 18 141 12 12 12 12 9 9 ol 7 81 6 10 11