Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 A finance company offers car leases and you are advising a friend about whether to take out such a lease The lease has

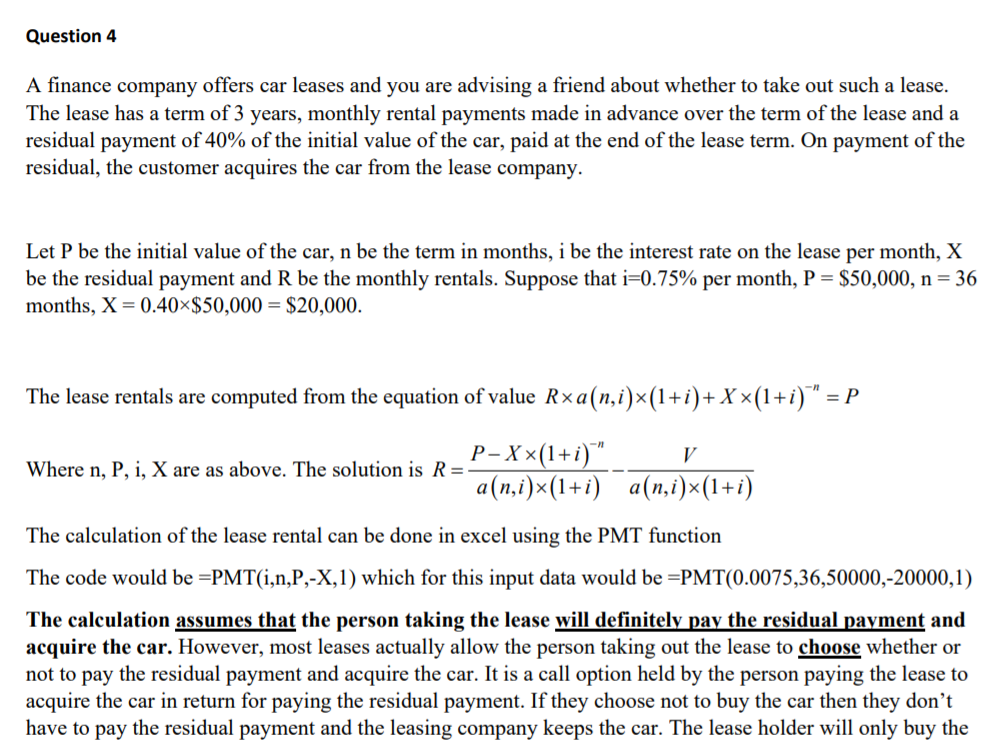

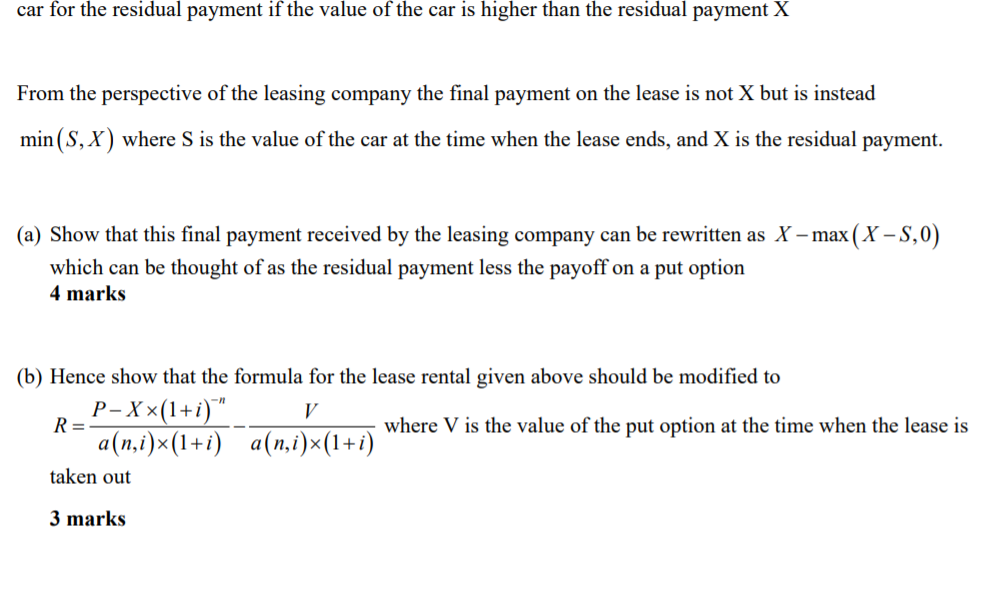

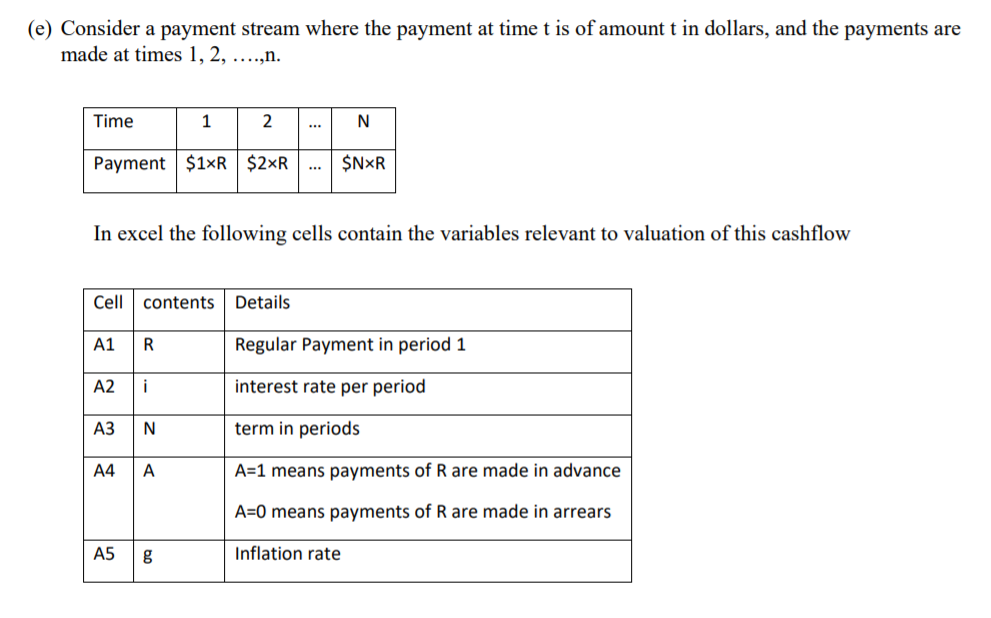

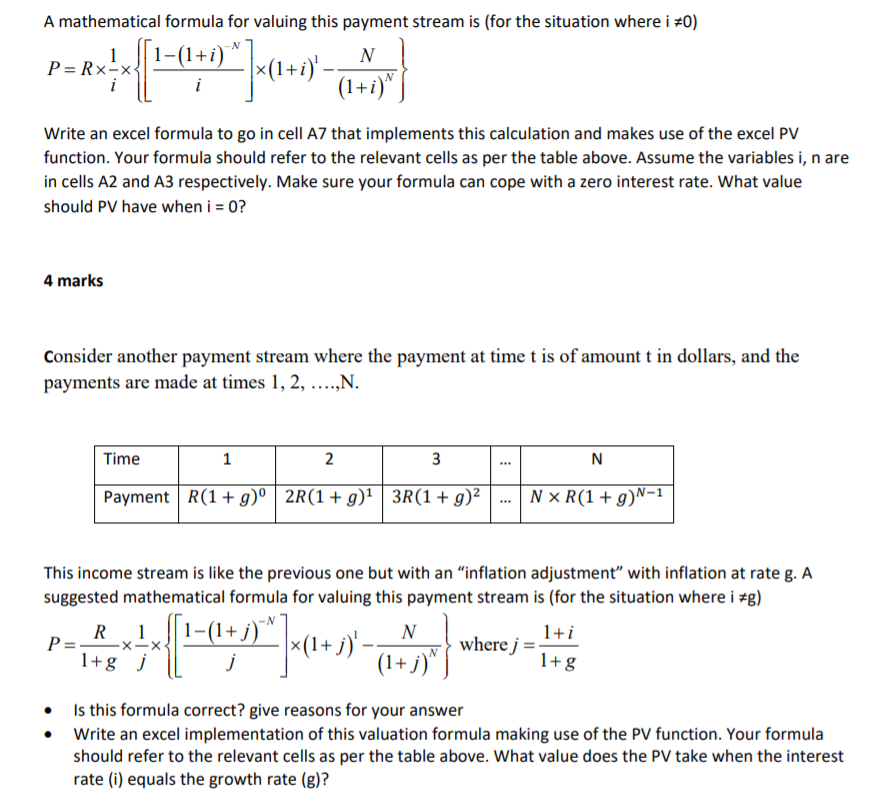

Question 4 A finance company offers car leases and you are advising a friend about whether to take out such a lease The lease has a term of 3 years, monthly rental payments made in advance over the term of the lease and a residual payment of 40% of the initial value of the car, paid at the end of the lease term. On payment of the residual, the customer acquires the car from the lease company. Let P be the initial value of the car, n be the term in months, i be the interest rate on the lease per month, X be the residual payment and R be the monthly rentals. Suppose that i-0.75% per month, P = $50,000, n-36 months, X 0.40x$50,000 $20,000. The lease rentals are computed from the equation of value R x a (n,i)(1 + i)-Xo (1 + i) Where n, P, i, X are as above. The solution is R The calculation of the lease rental can be done in excel using the PMT function The code would be -PMT(i,n,P,-X,1) which for this input data would be PMT(0.0075,36,50000,-20000,1) The calculation assumes that the person taking the lease will definitely pay the residual payment and acquire the car. However, most leases actually allow the person taking out the lease to choose whether or not to pay the residual payment and acquire the car. It is a call option held by the person paying the lease to acquire the car in return for paying the residual payment. If they choose not to buy the car then they don't have to pay the residual payment and the leasing company keeps the car. The lease holder will only buy the car for the residual payment if the value of the car is higher than the residual payment X From the perspective of the leasing company the final payment on the lease is not X but is instead min(S, X) where S is the value of the car at the time when the lease ends, and X is the residual payment. (a) Show that this final payment received by the leasing company can be rewritten as X-max (X-S,0) which can be thought of as the residual payment less the payoff on a put option 4 marks (b) Hence show that the formula for the lease rental given above should be modified to where V is the value of the put option at the time when the lease is taken out 3 marks This is lower than the amount charged by the leasing company so the error in the formula benefits the leasing company. (c) Suppose you wanted to estimate the value of the put option on the car and you try to use the Black Scholes formula for a put option. How would you obtain the values of the parameters needed for valuing the option using the black-scholes formula? How would you obtain or estimate the values of the initial value of the car, the exercise price, the term to maturity, the risk free rate of interest, the dividend yield, the volatility? Which of these parameters are difficult to estimate and why? 6 marks (d) What is different about an asset such as a second hand car compared to a financial asset such as shares, gold, exchange rates etc? Is the pattern of change in value over time the same for cars as for these other assets? Would you expect the variability of the price of a 2nd hand car to be the same as that of a new car or would you expect it to be higher? Why? 4 marks (e) Consider a payment stream where the payment at time t is of amount t in dollars, and the payments are made at times 1,2, ...,n Time 12...N Payment $1xR $2xR.SNxR In excel the following cells contain the variables relevant to valuation of this cashflow Cell contents Details A1 R Regular Payment in period 1 A2i interest rate per period A3 | N term in periods A-1 means payments of R are made in advance A4 A A-o means payments of R are made in arrears A5 Inflation rate A mathematical formula for valuing this payment stream is (for the situation where 0) P = Rx-X Write an excel formula to go in cell A7 that implements this calculation and makes use of the excel PV function. Your formula should refer to the relevant cells as per the table above. Assume the variables i, n are in cells A2 and A3 respectively. Make sure your formula can cope with a zero interest rate. What value should PV have when i = 0? 4 marks Consider another payment stream where the payment at time t is of amount t in dollars, and the payments are made at times 1, 2, ....,N Time Payment R(1g) 2R(1g)1 3R(1 g)N x R(1g)N-1 This income stream is like the previous one but with an "inflation adjustment" with inflation at rate g. A suggested mathematical formula for valuing this payment stream is (for the situation where i g) Is this formula correct? give reasons for your answer . Write an excel implementation of this valuation formula making use of the PV function. Your formula should refer to the relevant cells as per the table above. What value does the PV take when the interest rate (i) equals the growth rate (g)? Question 4 A finance company offers car leases and you are advising a friend about whether to take out such a lease The lease has a term of 3 years, monthly rental payments made in advance over the term of the lease and a residual payment of 40% of the initial value of the car, paid at the end of the lease term. On payment of the residual, the customer acquires the car from the lease company. Let P be the initial value of the car, n be the term in months, i be the interest rate on the lease per month, X be the residual payment and R be the monthly rentals. Suppose that i-0.75% per month, P = $50,000, n-36 months, X 0.40x$50,000 $20,000. The lease rentals are computed from the equation of value R x a (n,i)(1 + i)-Xo (1 + i) Where n, P, i, X are as above. The solution is R The calculation of the lease rental can be done in excel using the PMT function The code would be -PMT(i,n,P,-X,1) which for this input data would be PMT(0.0075,36,50000,-20000,1) The calculation assumes that the person taking the lease will definitely pay the residual payment and acquire the car. However, most leases actually allow the person taking out the lease to choose whether or not to pay the residual payment and acquire the car. It is a call option held by the person paying the lease to acquire the car in return for paying the residual payment. If they choose not to buy the car then they don't have to pay the residual payment and the leasing company keeps the car. The lease holder will only buy the car for the residual payment if the value of the car is higher than the residual payment X From the perspective of the leasing company the final payment on the lease is not X but is instead min(S, X) where S is the value of the car at the time when the lease ends, and X is the residual payment. (a) Show that this final payment received by the leasing company can be rewritten as X-max (X-S,0) which can be thought of as the residual payment less the payoff on a put option 4 marks (b) Hence show that the formula for the lease rental given above should be modified to where V is the value of the put option at the time when the lease is taken out 3 marks This is lower than the amount charged by the leasing company so the error in the formula benefits the leasing company. (c) Suppose you wanted to estimate the value of the put option on the car and you try to use the Black Scholes formula for a put option. How would you obtain the values of the parameters needed for valuing the option using the black-scholes formula? How would you obtain or estimate the values of the initial value of the car, the exercise price, the term to maturity, the risk free rate of interest, the dividend yield, the volatility? Which of these parameters are difficult to estimate and why? 6 marks (d) What is different about an asset such as a second hand car compared to a financial asset such as shares, gold, exchange rates etc? Is the pattern of change in value over time the same for cars as for these other assets? Would you expect the variability of the price of a 2nd hand car to be the same as that of a new car or would you expect it to be higher? Why? 4 marks (e) Consider a payment stream where the payment at time t is of amount t in dollars, and the payments are made at times 1,2, ...,n Time 12...N Payment $1xR $2xR.SNxR In excel the following cells contain the variables relevant to valuation of this cashflow Cell contents Details A1 R Regular Payment in period 1 A2i interest rate per period A3 | N term in periods A-1 means payments of R are made in advance A4 A A-o means payments of R are made in arrears A5 Inflation rate A mathematical formula for valuing this payment stream is (for the situation where 0) P = Rx-X Write an excel formula to go in cell A7 that implements this calculation and makes use of the excel PV function. Your formula should refer to the relevant cells as per the table above. Assume the variables i, n are in cells A2 and A3 respectively. Make sure your formula can cope with a zero interest rate. What value should PV have when i = 0? 4 marks Consider another payment stream where the payment at time t is of amount t in dollars, and the payments are made at times 1, 2, ....,N Time Payment R(1g) 2R(1g)1 3R(1 g)N x R(1g)N-1 This income stream is like the previous one but with an "inflation adjustment" with inflation at rate g. A suggested mathematical formula for valuing this payment stream is (for the situation where i g) Is this formula correct? give reasons for your answer . Write an excel implementation of this valuation formula making use of the PV function. Your formula should refer to the relevant cells as per the table above. What value does the PV take when the interest rate (i) equals the growth rate (g)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started