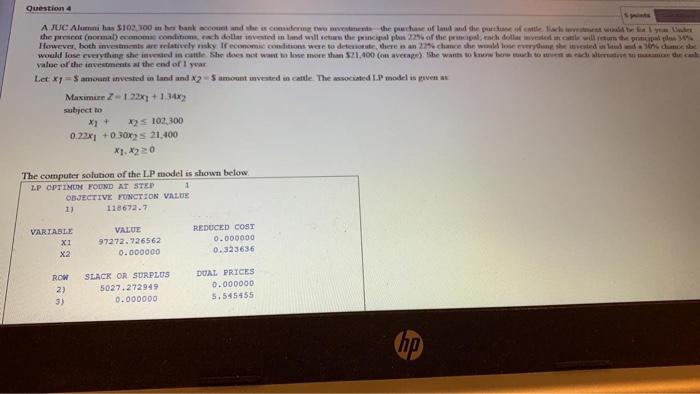

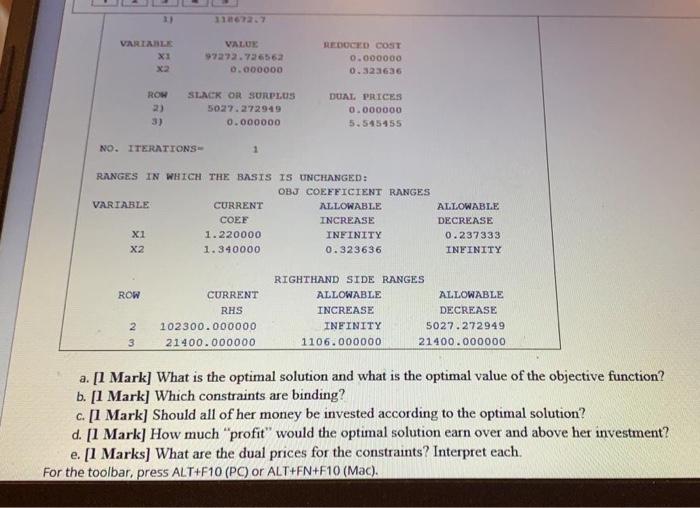

Question 4 A JUC Alumni has $102.00 bank account and the scendere the channel de pe loc the present formalcemos con della vested in land will the incipal plane 225 of the principal, each dollar investim te prale. However, both investments are relatively risky recommon conditions were detener, there an 29 chame she was very showevestedsbe would lose everything she invested in cattle She does not want to more than $21.400 (on average she wants to how much to dismo de cal value of the investments at the end of 1 year Let xy = amount invested in land and 2 Samount wested in cattle. The associated LP model is piena Maxime Z-122x+134X2 subject to X] + 2102,300 0.231 +0 30x2 21.400 XX220 The computer solution of the LP model is shown below LP OPTIMO FOUND AT STER 1 OBJECTIVE FUNCTION VALUE 1) 118672.7 VARIABLE x2 x2 VALUE 97272.726562 0.000000 REDUCED COST 0.000000 0.323636 ROW 2) 3) SLACK OR SURPLUS 5027.272949 0.000000 DUAL PRICES 0.000000 5.545155 hp 1) 111672.7 VARIABLE X2 VALUE 7272.726562 0.000000 REDUCED COST 0.000000 0.323636 ROW SLACK OR SURPLUS 5027.272949 0.000000 DUAL PRICES 0.000000 5.545455 3) NO. ITERATIONS 1 RANGES IN WHICH THE BASIS IS UNCHANGED: OBJ COEFFICIENT RANGES VARIABLE CURRENT ALLOWABLE ALLOWABLE COEF INCREASE DECREASE X1 1.220000 INFINITY 0.237333 X2 1.340000 0.323636 INFINITY ROW CURRENT RHS 102300.000000 21400.000000 RIGHTHAND SIDE RANGES ALLOWABLE ALLOWABLE INCREASE DECREASE INFINITY 5027.272949 1106.000000 21400.000000 2 3 a. [1 Mark] What is the optimal solution and what is the optimal value of the objective function? b. [1 Mark) Which constraints are binding? c. [1 Mark] Should all of her money be invested according to the optimal solution? d. [1 Mark) How much "profit" would the optimal solution earn over and above her investment? e. [1 Marks] What are the dual prices for the constraints? Interpret each For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Question 4 A JUC Alumni has $102.00 bank account and the scendere the channel de pe loc the present formalcemos con della vested in land will the incipal plane 225 of the principal, each dollar investim te prale. However, both investments are relatively risky recommon conditions were detener, there an 29 chame she was very showevestedsbe would lose everything she invested in cattle She does not want to more than $21.400 (on average she wants to how much to dismo de cal value of the investments at the end of 1 year Let xy = amount invested in land and 2 Samount wested in cattle. The associated LP model is piena Maxime Z-122x+134X2 subject to X] + 2102,300 0.231 +0 30x2 21.400 XX220 The computer solution of the LP model is shown below LP OPTIMO FOUND AT STER 1 OBJECTIVE FUNCTION VALUE 1) 118672.7 VARIABLE x2 x2 VALUE 97272.726562 0.000000 REDUCED COST 0.000000 0.323636 ROW 2) 3) SLACK OR SURPLUS 5027.272949 0.000000 DUAL PRICES 0.000000 5.545155 hp 1) 111672.7 VARIABLE X2 VALUE 7272.726562 0.000000 REDUCED COST 0.000000 0.323636 ROW SLACK OR SURPLUS 5027.272949 0.000000 DUAL PRICES 0.000000 5.545455 3) NO. ITERATIONS 1 RANGES IN WHICH THE BASIS IS UNCHANGED: OBJ COEFFICIENT RANGES VARIABLE CURRENT ALLOWABLE ALLOWABLE COEF INCREASE DECREASE X1 1.220000 INFINITY 0.237333 X2 1.340000 0.323636 INFINITY ROW CURRENT RHS 102300.000000 21400.000000 RIGHTHAND SIDE RANGES ALLOWABLE ALLOWABLE INCREASE DECREASE INFINITY 5027.272949 1106.000000 21400.000000 2 3 a. [1 Mark] What is the optimal solution and what is the optimal value of the objective function? b. [1 Mark) Which constraints are binding? c. [1 Mark] Should all of her money be invested according to the optimal solution? d. [1 Mark) How much "profit" would the optimal solution earn over and above her investment? e. [1 Marks] What are the dual prices for the constraints? Interpret each For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)