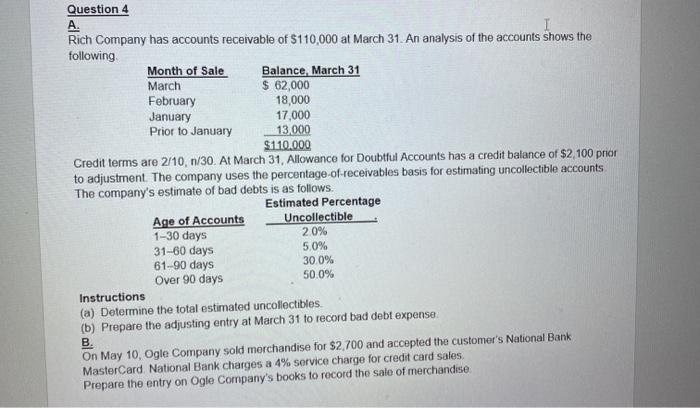

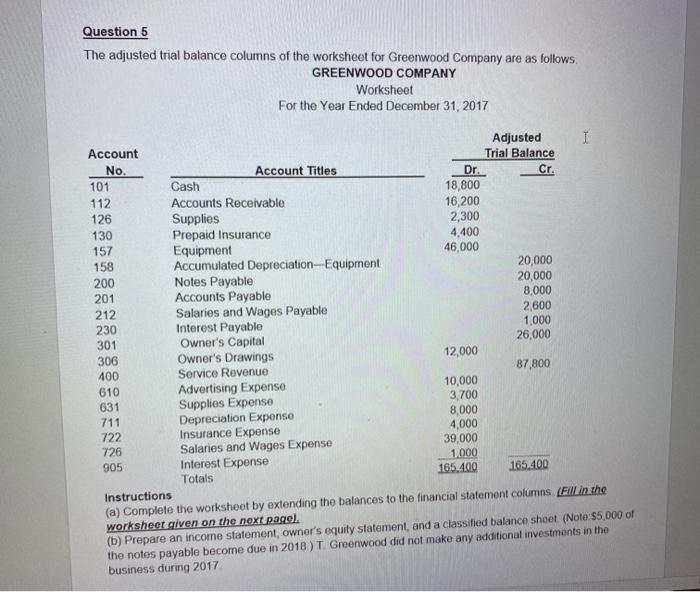

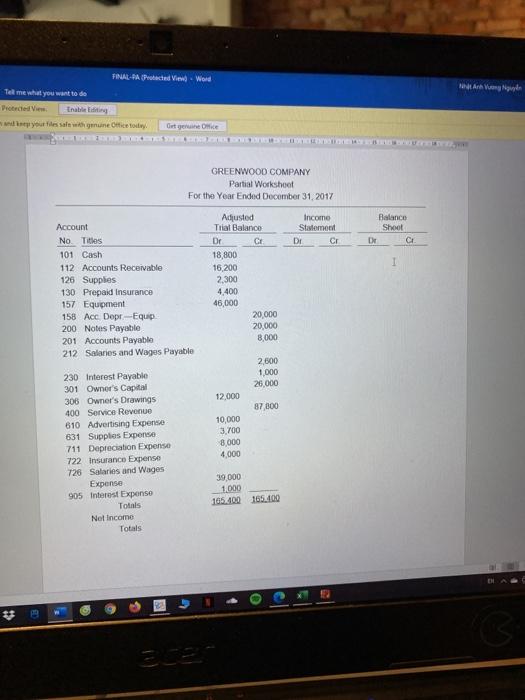

Question 4 A Rich Company has accounts receivable of $110,000 at March 31. An analysis of the accounts shows the following Month of Sale Balance, March 31 March $ 62,000 February 18,000 January 17,000 Prior to January 13,000 $110.000 Credit terms are 2/10,n/30. At March 31, Allowance for Doubtful Accounts has a credit balance of $2,100 prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts The company's estimate of bad debts is as follows. Estimated Percentage Age of Accounts Uncollectible 1-30 days 2.0% 31-60 days 5.0% 61-90 days 30.0% Over 90 days 50.0% Instructions (a) Determine the total estimated uncollectibles (b) Prepare the adjusting entry at March 31 to record bad debt expense: B On May 10, Ogle Company sold merchandise for $2,700 and accepted the customer's National Bank MasterCard National Bank charges a 4% service charge for credit card sales. Prepare the entry on Ogle Company's books to record the sale of merchandise Question 5 The adjusted trial balance columns of the worksheet for Greenwood Company are as follows. GREENWOOD COMPANY Worksheet For the Year Ended December 31, 2017 Cr. Adjusted I Account Trial Balance No. Account Titles Dr. 101 Cash 18,800 112 Accounts Receivable 16,200 126 Supplies 2,300 130 Prepaid Insurance 4.400 157 Equipment 46,000 158 Accumulated Depreciation Equipment 20,000 200 Notes Payable 20,000 201 Accounts Payable 8,000 212 Salaries and Wages Payable 2,600 230 Interest Payable 1,000 301 Owner's Capital 26,000 306 Owner's Drawings 12,000 400 Service Revenue 87 800 610 Advertising Expense 10,000 631 Supplies Expense 3,700 711 Depreciation Expense 8,000 4,000 722 Insurance Expense 39,000 726 Salaries and Wages Expense 1.000 905 Interest Expense 165.400 165.400 Totals Instructions (a) Complete the worksheet by extending the balances to the financial statement columns (Fill in the worksheet given on the next page) (b) Prepare an income statement, owner's equity statement, and a classified balance shoot (Note:$5,000 of the notes payable become due in 2018.) T. Greenwood did not make any additional investments in the business during 2017 Nht Anh luu y khi nhn FINAL-PA Practed Vie Word Tell me what you want to de Proteed View Enabled your des sale with gune Office Gut gewe TERRE GREENWOOD COMPANY Partial Workshoot For the Year Ended December 31, 2017 Income Statement DI Cr Balance Shoot De CA 1 Account No Titles 101 Cash 112 Accounts Receivable 126 Supplies 130 Prepaid Insurance 157 Equipment 158 Acc Dept. Equip 200 Notas Payable 201 Accounts Payable 212 Salaries and Wages Payable Adjusted Trial Balance Dr CE 18,800 16,200 2.300 4,400 46,000 20,000 20,000 8,000 2,600 1,000 26.000 12,000 87 000 230 Interest Payable 301 Owner's Capital 306 Owner's Drawings 400 Service Revenue 610 Advertising Expense 631 Supplies Expense 711 Depreciation Expense 722 Insurance Expenso 726 Salaries and Wages Expense 905 Interest Expense Totals Net Income Totals 10,000 3.700 8.000 4.000 39,000 1.000 1052400 165_400