Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (a) 'The historical cost convention looks backward but the going concern convention looks forwards. Required: Does the traditional financial accounting, using the historical

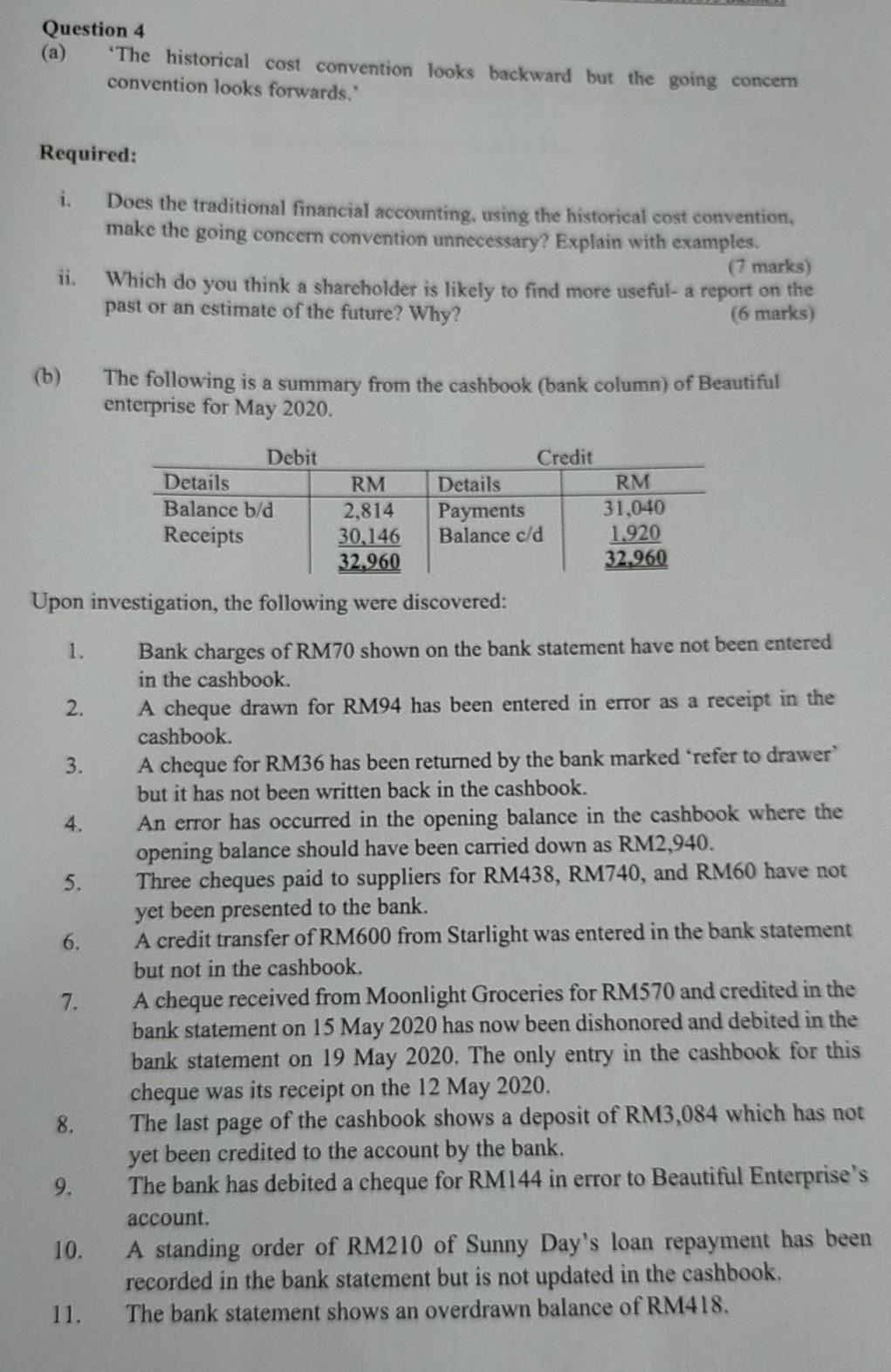

Question 4 (a) 'The historical cost convention looks backward but the going concern convention looks forwards." Required: Does the traditional financial accounting, using the historical cost convention. make the going concem convention unnecessary? Explain with examples. (7 marks) Which do you think a shareholder is likely to find more useful- a report on the past or an estimate of the future? Why? (6 marks) ii. (b) The following is a summary from the cashbook (bank column) of Beautiful enterprise for May 2020. Debit Details Balance b/d Receipts RM 2,814 30,146 32,960 Credit Details Payments Balance c/d RM 31,040 1.920 32.960 Upon investigation, the following were discovered: 1. 2. 3. 4. 5. 6. Bank charges of RM70 shown on the bank statement have not been entered in the cashbook. A cheque drawn for RM94 has been entered in error as a receipt in the cashbook. A cheque for RM36 has been returned by the bank marked 'refer to drawer but it has not been written back in the cashbook. An error has occurred in the opening balance in the cashbook where the opening balance should have been carried down as RM2,940. Three cheques paid to suppliers for RM438, RM740, and RM60 have not yet been presented to the bank. A credit transfer of RM600 from Starlight was entered in the bank statement but not in the cashbook. A cheque received from Moonlight Groceries for RM570 and credited in the bank statement on 15 May 2020 has now been dishonored and debited in the bank statement on 19 May 2020. The only entry in the cashbook for this cheque was its receipt on the 12 May 2020. The last page of the cashbook shows a deposit of RM3,084 which has not yet been credited to the account by the bank. The bank has debited a cheque for RM144 in error to Beautiful Enterprise's account. A standing order of RM210 of Sunny Day's loan repayment has been recorded in the bank statement but is not updated in the cashbook. The bank statement shows an overdrawn balance of RM418. 7. 8. 9. 10. 11. Required: i. Show the adjustments that need to be made in the cashbook for May 2020. (7 marks) Prepare a bank reconciliation statement as at 31 May 2020. (5 marks) [Total: 25 Marks] ii. Question 4 (a) 'The historical cost convention looks backward but the going concern convention looks forwards." Required: Does the traditional financial accounting, using the historical cost convention. make the going concem convention unnecessary? Explain with examples. (7 marks) Which do you think a shareholder is likely to find more useful- a report on the past or an estimate of the future? Why? (6 marks) ii. (b) The following is a summary from the cashbook (bank column) of Beautiful enterprise for May 2020. Debit Details Balance b/d Receipts RM 2,814 30,146 32,960 Credit Details Payments Balance c/d RM 31,040 1.920 32.960 Upon investigation, the following were discovered: 1. 2. 3. 4. 5. 6. Bank charges of RM70 shown on the bank statement have not been entered in the cashbook. A cheque drawn for RM94 has been entered in error as a receipt in the cashbook. A cheque for RM36 has been returned by the bank marked 'refer to drawer but it has not been written back in the cashbook. An error has occurred in the opening balance in the cashbook where the opening balance should have been carried down as RM2,940. Three cheques paid to suppliers for RM438, RM740, and RM60 have not yet been presented to the bank. A credit transfer of RM600 from Starlight was entered in the bank statement but not in the cashbook. A cheque received from Moonlight Groceries for RM570 and credited in the bank statement on 15 May 2020 has now been dishonored and debited in the bank statement on 19 May 2020. The only entry in the cashbook for this cheque was its receipt on the 12 May 2020. The last page of the cashbook shows a deposit of RM3,084 which has not yet been credited to the account by the bank. The bank has debited a cheque for RM144 in error to Beautiful Enterprise's account. A standing order of RM210 of Sunny Day's loan repayment has been recorded in the bank statement but is not updated in the cashbook. The bank statement shows an overdrawn balance of RM418. 7. 8. 9. 10. 11. Required: i. Show the adjustments that need to be made in the cashbook for May 2020. (7 marks) Prepare a bank reconciliation statement as at 31 May 2020. (5 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started