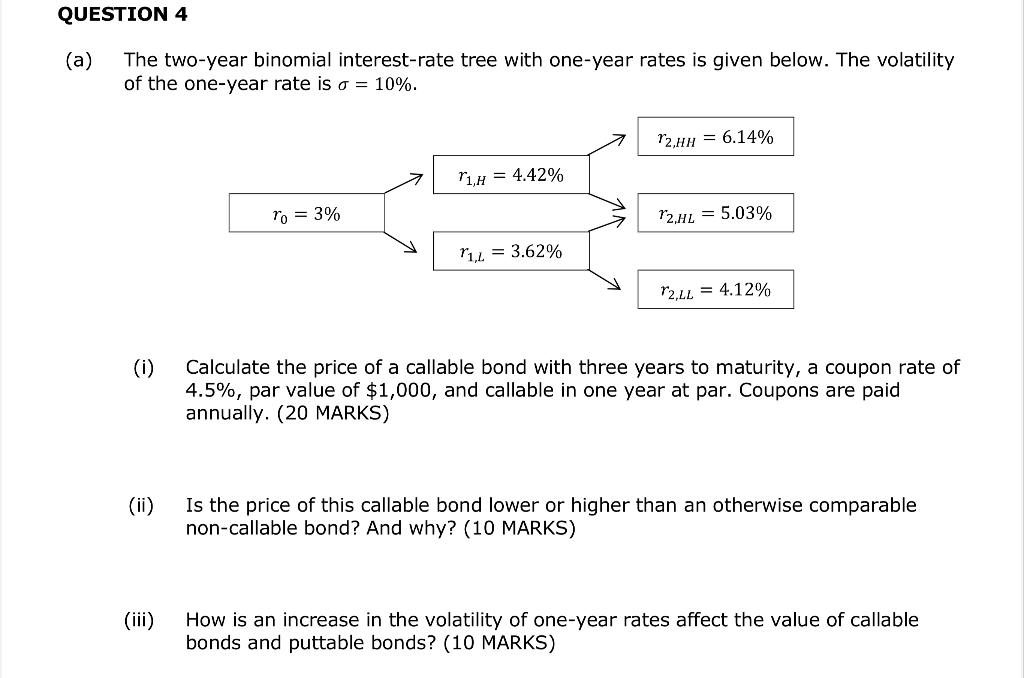

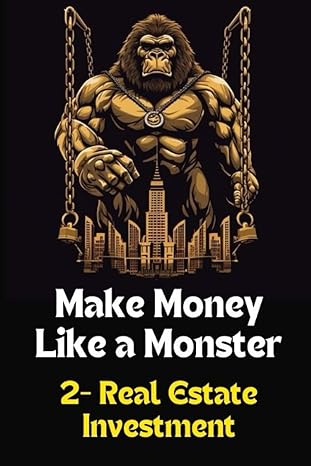

QUESTION 4 (a) The two-year binomial interest-rate tree with one-year rates is given below. The volatility of the one-year rate is a = 10%. T2,HH 6.14% T1,H = 4.42% To = 3% T2,HL= 5.03% T1,L = 3.62% 12,LL = 4.12% (i) Calculate the price of a callable bond with three years to maturity, a coupon rate of 4.5%, par value of $1,000, and callable in one year at par. Coupons are paid annually. (20 MARKS) Is the price of this callable bond lower or higher than an otherwise comparable non-callable bond? And why? (10 MARKS) (iii) How is an increase in the volatility of one-year rates affect the value of callable bonds and puttable bonds? (10 MARKS) (b) Since the end of 2008, central banks around the world have implemented several rounds of quantitative easing (QE) purchases. (i) Dr. Smart studies whether QE has an impact on Treasury yields by regressing the quarterly change of yields on the amount of QE purchases in the same quarter. Assess whether this regression is able to answer the research question. How does the literature measure the impact of QE on yields? (30 MARKS) How does the literature study the impact of QE on the macroeconomy? What are the findings? (30 MARKS) QUESTION 4 (a) The two-year binomial interest-rate tree with one-year rates is given below. The volatility of the one-year rate is a = 10%. T2,HH 6.14% T1,H = 4.42% To = 3% T2,HL= 5.03% T1,L = 3.62% 12,LL = 4.12% (i) Calculate the price of a callable bond with three years to maturity, a coupon rate of 4.5%, par value of $1,000, and callable in one year at par. Coupons are paid annually. (20 MARKS) Is the price of this callable bond lower or higher than an otherwise comparable non-callable bond? And why? (10 MARKS) (iii) How is an increase in the volatility of one-year rates affect the value of callable bonds and puttable bonds? (10 MARKS) (b) Since the end of 2008, central banks around the world have implemented several rounds of quantitative easing (QE) purchases. (i) Dr. Smart studies whether QE has an impact on Treasury yields by regressing the quarterly change of yields on the amount of QE purchases in the same quarter. Assess whether this regression is able to answer the research question. How does the literature measure the impact of QE on yields? (30 MARKS) How does the literature study the impact of QE on the macroeconomy? What are the findings? (30 MARKS)