Answered step by step

Verified Expert Solution

Question

1 Approved Answer

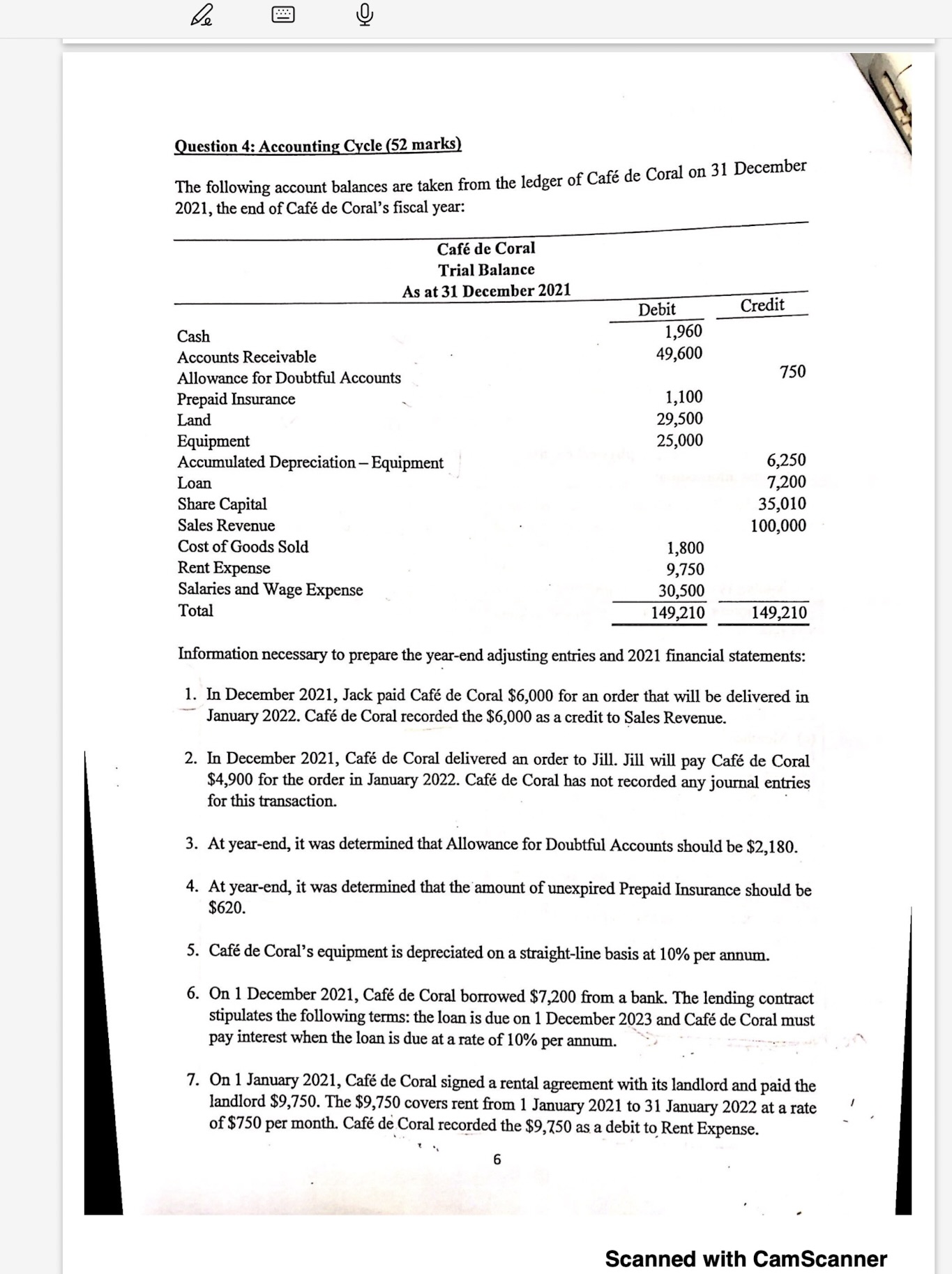

Question 4: Accounting Cycle (52 marks) The following account balances are taken from the ledger of Caf de Coral on 31 December 2021, the end

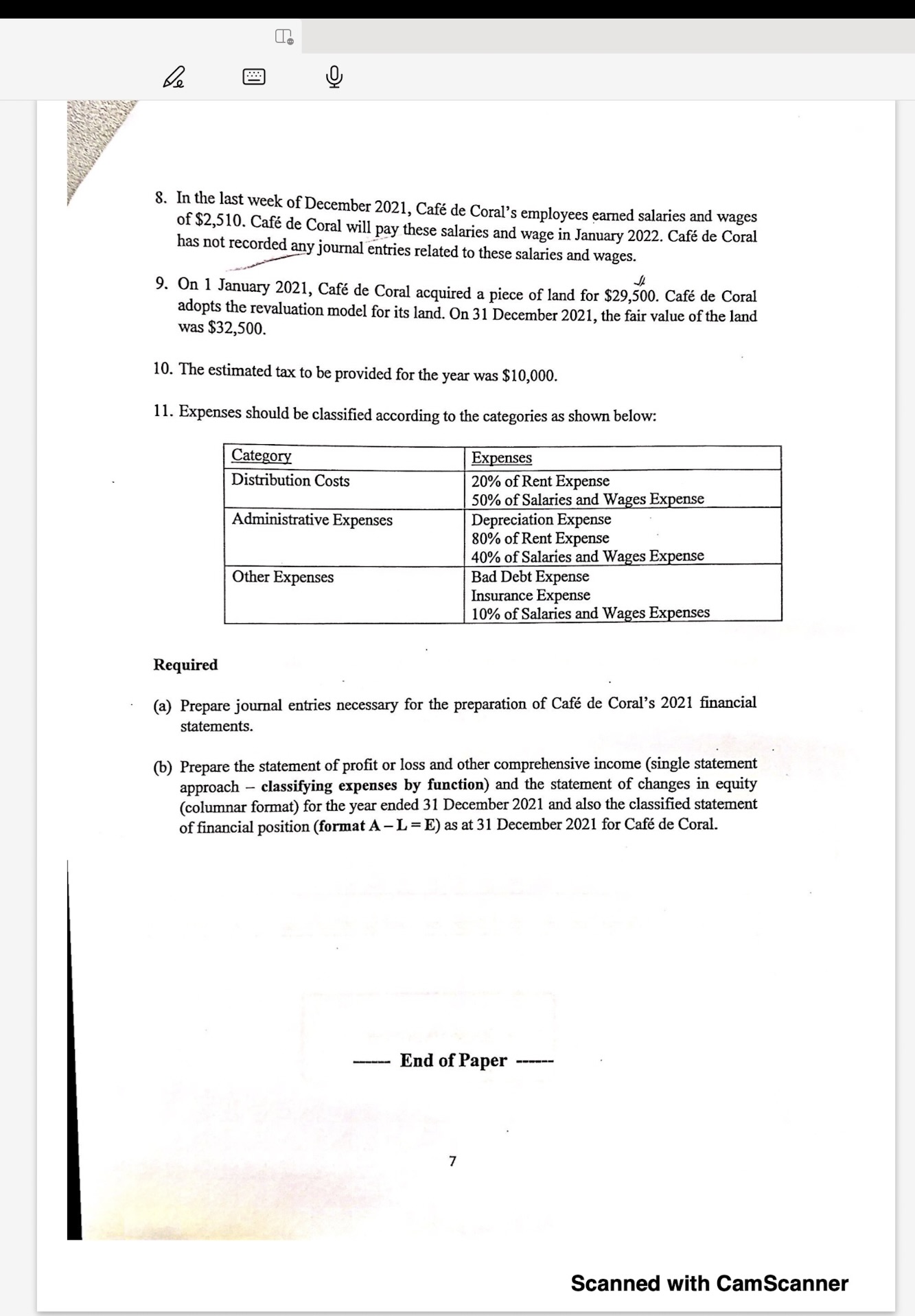

Question 4: Accounting Cycle (52 marks) The following account balances are taken from the ledger of Caf de Coral on 31 December 2021, the end of Caf de Coral's fiscal year: Information necessary to prepare the year-end adjusting entries and 2021 financial statements: 1. In December 2021, Jack paid Caf de Coral $6,000 for an order that will be delivered in January 2022. Caf de Coral recorded the $6,000 as a credit to Sales Revenue. 2. In December 2021, Caf de Coral delivered an order to Jill. Jill will pay Caf de Coral $4,900 for the order in January 2022. Caf de Coral has not recorded any journal entries for this transaction. 3. At year-end, it was determined that Allowance for Doubtful Accounts should be $2,180. 4. At year-end, it was determined that the amount of unexpired Prepaid Insurance should be $620. 5. Caf de Coral's equipment is depreciated on a straight-line basis at 10% per annum. 6. On 1 December 2021, Caf de Coral borrowed $7,200 from a bank. The lending contract stipulates the following terms: the loan is due on 1 December 2023 and Caf de Coral must pay interest when the loan is due at a rate of 10% per annum. 7. On 1 January 2021, Caf de Coral signed a rental agreement with its landlord and paid the landlord $9,750. The $9,750 covers rent from 1 January 2021 to 31 January 2022 at a rate of $750 per month. Caf de Coral recorded the $9,750 as a debit to Rent Expense. 6 8. In the last week of December 2021, Caf de Coral's employees eamed salaries and wages of $2,510. Caf de Coral will pay these salaries and wage in January 2022. Caf de Coral has not recorded any journal entries related to these salaries and wages. 9. On 1 January 2021, Caf de Coral acquired a piece of land for $29,500. Caf de Coral adopts the revaluation model for its land. On 31 December 2021, the fair value of the land was $32,500. 10. The estimated tax to be provided for the year was $10,000. 11. Expenses should be classified according to the categories as shown below: Required (a) Prepare journal entries necessary for the preparation of Caf de Coral's 2021 financial statements. (b) Prepare the statement of profit or loss and other comprehensive income (single statement approach - classifying expenses by function) and the statement of changes in equity (columnar format) for the year ended 31 December 2021 and also the classified statement of financial position (format AL=E ) as at 31 December 2021 for Caf de Coral

Question 4: Accounting Cycle (52 marks) The following account balances are taken from the ledger of Caf de Coral on 31 December 2021, the end of Caf de Coral's fiscal year: Information necessary to prepare the year-end adjusting entries and 2021 financial statements: 1. In December 2021, Jack paid Caf de Coral $6,000 for an order that will be delivered in January 2022. Caf de Coral recorded the $6,000 as a credit to Sales Revenue. 2. In December 2021, Caf de Coral delivered an order to Jill. Jill will pay Caf de Coral $4,900 for the order in January 2022. Caf de Coral has not recorded any journal entries for this transaction. 3. At year-end, it was determined that Allowance for Doubtful Accounts should be $2,180. 4. At year-end, it was determined that the amount of unexpired Prepaid Insurance should be $620. 5. Caf de Coral's equipment is depreciated on a straight-line basis at 10% per annum. 6. On 1 December 2021, Caf de Coral borrowed $7,200 from a bank. The lending contract stipulates the following terms: the loan is due on 1 December 2023 and Caf de Coral must pay interest when the loan is due at a rate of 10% per annum. 7. On 1 January 2021, Caf de Coral signed a rental agreement with its landlord and paid the landlord $9,750. The $9,750 covers rent from 1 January 2021 to 31 January 2022 at a rate of $750 per month. Caf de Coral recorded the $9,750 as a debit to Rent Expense. 6 8. In the last week of December 2021, Caf de Coral's employees eamed salaries and wages of $2,510. Caf de Coral will pay these salaries and wage in January 2022. Caf de Coral has not recorded any journal entries related to these salaries and wages. 9. On 1 January 2021, Caf de Coral acquired a piece of land for $29,500. Caf de Coral adopts the revaluation model for its land. On 31 December 2021, the fair value of the land was $32,500. 10. The estimated tax to be provided for the year was $10,000. 11. Expenses should be classified according to the categories as shown below: Required (a) Prepare journal entries necessary for the preparation of Caf de Coral's 2021 financial statements. (b) Prepare the statement of profit or loss and other comprehensive income (single statement approach - classifying expenses by function) and the statement of changes in equity (columnar format) for the year ended 31 December 2021 and also the classified statement of financial position (format AL=E ) as at 31 December 2021 for Caf de Coral Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started