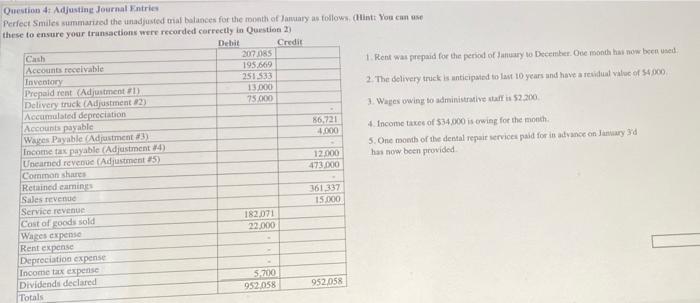

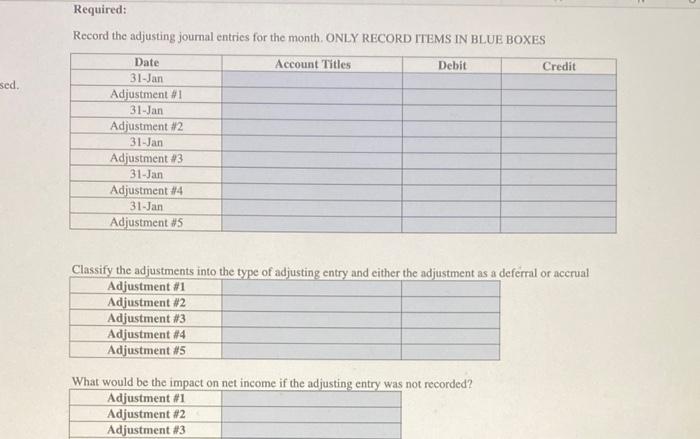

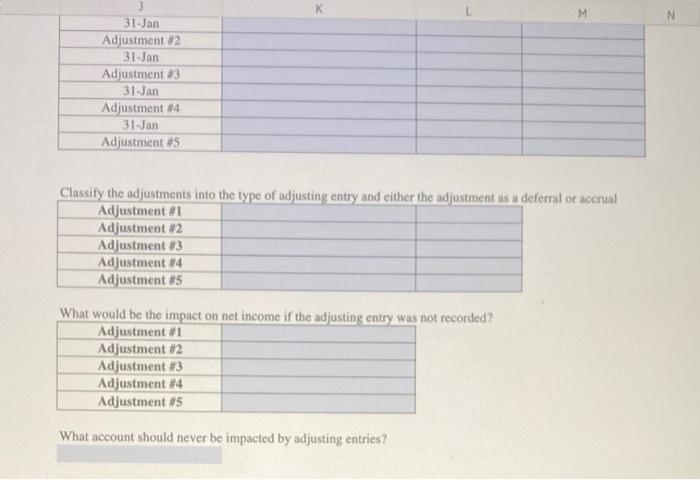

Question 4: Adjusting Journal Entries Perfect Smiles summarized the unadjusted trial balances for the month of January as follows (Hint: You can use these to ensure your transactions were recorded correctly in Question 2) Debit Credit Cash 207.0S Accounts receivable 195.669 1. Rent was prepaid for the period of try to December. One month has now been used Inventory 251333 Prepaid rent (Adjustment #1) 13.000 2. The delivery trick is anticipated to last 10 years and have a residual value of 54000 Delivery truck (Adjustment 22) 75.000 Accumulated depreciation 3. Wapes owing to administrative staff is $2.200 Accounts payable 86.721 4 Income times of $34.000 is owing for the month Wapes Payable (Adjustment #3) 4.000 Income tax payable (Adjustment 4) 5. One month of the dental repair service paid for in advance on January 3d Uneamed revenue (Adjustment 15) 12.000 has now been provided Common share 473.000 Retained camin Sales revenue 361,337 Service revenue 15.000 Cost of goods sold 182.071 Wares expenso 22.000 Rent expense Depreciation expense Income tax expense Dividends declared 5.700 Totals 952.058 952058 Required: Record the adjusting journal entries for the month. ONLY RECORD ITEMS IN BLUE BOXES Account Titles Debit Credit Sed. Date 31-Jan Adjustment 31-Jan Adjustment 2 31-Jan Adjustment #3 31-Jan Adjustment 14 31-Jan Adjustment #5 Classify the adjustments into the type of adjusting entry and either the adjustment as a deferral or accrual Adjustment #1 Adjustment #2 Adjustment #3 Adjustment #4 Adjustment #5 What would be the impact on net income if the adjusting entry was not recorded? Adjustment #1 Adjustment #2 Adjustment #3 M N 31-Jan Adjustment 2 31-Jan Adjustment #3 31-Jan Adjustment #4 31.Jan Adjustment #5 Classify the adjustments into the type of adjusting entry and either the adjustment as a deferral or accrual Adjustment #1 Adjustment #2 Adjustment #3 Adjustment 14 Adjustment #5 What would be the impact on net income if the adjusting entry was not recorded? Adjustment Adjustment #2 Adjustment 13 Adjustment #4 Adjustment #5 What account should never be impacted by adjusting entries